Source: © Rjmiz | Megapixl.com

What is a merger?

A merger is a business strategy that involves combining two or more companies into a single legal organisation. In terms of operations, scope and size, the organisations that agree to join are usually comparable.

A merger may lead to the dissolution of several entities, decreasing competition, reducing the expenses such as advertising etc.

There are different motives for corporations to participate in mergers. They are frequently used to broaden a company's reach, acquire market share, or enter new markets. All of this is done to boost the value of the company's shareholders.

Summary

- A merger is the consensual integration of two businesses into a single legal organisation on roughly equal footing.

- Some similar-product companies may merge to lessen competition and avoid duplication, resulting in lower consumer prices.

- Mergers allow businesses to expand their reach, enter new markets, or acquire market share.

Frequently Asked Questions (FAQs)

Why do companies merge?

- Following the merger, the companies will have more significant resources to secure, and their activities will scale up.

- Companies merge for various reasons, including the benefit of their stockholders. Following the merger, existing shareholders of the original companies acquire shares in the new firm.

- Companies may also agree to merge to enter new markets or diversify their service and product offerings, resulting in increased profitability.

- When corporations desire to buy assets that would take too long to develop domestically, they may merge.

- A merger between corporations will lessen competition between them, lowering the cost of advertising for items. Furthermore, the price reduction will benefit customers and, as a result, sales will improve.

- Mergers may lead to improved financial resource usage and planning.

Source: © Studio-54-foto | Megapixl.com

How does a merger operate in modern trade?

A merger is the consensual integration of two businesses into a single legal organisation on roughly equal footing.

The companies involved in the merger are comparable in terms of customers, size, and operations scale, the term "merger of equals" is occasionally used.

Mergers are most typically used in modern strategic planning to save operating costs, gain market share, raise revenues, expand into new regions, enhance profits, and unite shared products, all of which should benefit the firms' shareholders.

Following a merger, the new company's shares are allocated to the original companies' shareholders.

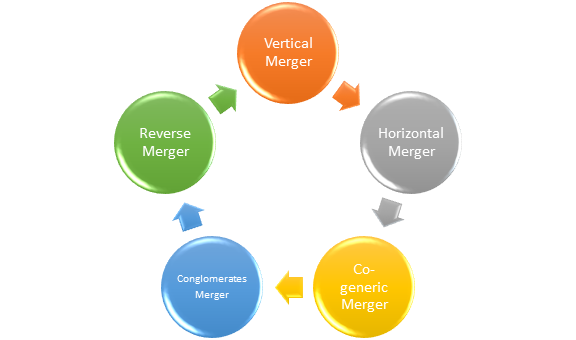

What are the different forms of business mergers?

Vertical Merger

When two companies with a seller-buyer connection unite to form a new organisation, this is a vertical merger. It is the merger of two businesses that operate in the same industry but at distinct stages of distribution and manufacturing. It can be upstream or downstream, i.e., if the firm acquires its suppliers, it is an upstream merger, and if the firm receives its distribution entities, it is a downstream merger.

Horizontal Merger

A horizontal merger occurs when the merging companies are in the same industry or trade-in similar business areas. Its goals include:

- Lowering competition.

- Expanding market share.

- Achieving economies of scale.

- Investing in research and development.

Co-generic Merger

A co-generic merger occurs when two companies that have decided to unite belong to the same or similar industry. The product lines of both companies are distinct, that is, they do not provide identical products but somewhat comparable ones. The purchased firm and the target company have similar distribution networks.

Merger of Conglomerates

It is a sort of business integration in which the merging organisations have neither vertical nor horizontal ties. Essentially, two or more companies merge under a single flagship company that operates in multiple business lines.

Reverse Merger

In this sort of merger, a publicly traded firm is acquired by a privately held corporation, giving the private firm the option to go public without going through the lengthy and complicated process of becoming listed on the stock exchange. The unlisted firm buys the majority of the shares in the listed firm in this merger.

Source: © Copyright Kalkine Media

What are the benefits of a business merger?

- During the merger, the new business gains a competitive advantage by earning a higher market share.

- Companies can obtain economies of scale by purchasing raw materials in bulk, lowering costs.

- Some similar-product companies may merge to lessen competition and avoid duplication, resulting in lower consumer prices.

- The new company will gain a monopoly and boost its service and product prices.

- Mergers can keep a company from going bankrupt while also preserving a large number of employees.

- Suppose a company wishes to expand its business in a specific geographic area. In that case, it can merge with another similar firm in the location to get the company up and running rapidly.

- Mergers can keep a company from going bankrupt while also preserving a large number of employees.

What are the drawbacks of a company merger?

- There may be minor rivalry and a larger market share in merger. As a result, the new company will gain a monopoly and boost its service and product prices.

- Different cultures may exist in merging firms, resulting in a communication gap and affecting employee performance.

- In an aggressive merger, a firm may go to great lengths to eliminate the other business's failing assets, resulting in job losses.

- Synergies may be challenging to achieve in circumstances where the companies have little in common. A giant corporation may also struggle to motivate staff and maintain the same level of management. As a result, the new business may be unable to attain economies of scale.

Source: Kalkine Media

What are some examples of mergers in modern trade?

Here are some examples of successful mergers in the modern trading business.

The Walt Disney Company and Pixar Entertainment combined in 2007 for a $7.4 billion deal.

The marriage of Android and tech behemoth Google in 2007 is another example of a successful vertical merger. Without question, the Google-Android merger was a huge success; as of 2018, Android-powered about 88 % of all new mobile phones purchased. Without Google's integration with Android, they would not have achieved such a significant market share and made history.

Please wait processing your request...

Please wait processing your request...