What are Liquid Assets?

Liquid assets can be defined as the cash that is readily available in the company’s funds or cash equivalents and other assets that could be easily converted to cash quickly. Liquid assets are considered ‘current cash’ in the company records while accounting. Liquid assets determine the net worth of a business organisation and do the same at the individual level. Thus, in short, liquid assets could be quickly sold and converted into cash without impacting their original value in one line.

Usually, the liquid assets are found to be sold in a huge financial market with lots of sellers and buyers. The more the buyers, easy it is for the asset to get sold.

Summary

- Liquid assets can be defined as the cash that is readily available in the company funds.

- Liquid assets play a significant role in determining the net worth of an individual or a company.

- Liquid assets are significant as they are the primary source of cash to any individual or company for paying their debtsand other financial liabilities.

- Other than cash, the cash equivalents could be considered liquid assets.

Frequently Asked Questions (FAQs)

How can Liquid Assets be explained?

Liquid assets play a significant role in determining the net worth of an individual or a company. It develops awareness about the amount of cash one has in its hand that can be used during an emergency. Net worth is calculated by subtracting the debts and liabilities from the total value of the liquid assets.

The typical examples of liquid assets are:

- Cash

- Cash equivalents such as savings account, checking account and money marketaccount

- Marketable securities such as stocks and government bonds

Image source: © Arturszczybylo | Megapixl.com

Out of the examples mentioned above, only cash is considered as the most superior form of a liquid asset as it’s the ultimate goal of every other liquid asset. Every other form of liquid cash apart from cash itself is viewed as cash as it can be readily converted to cash.

Several parameters determine the nature of an asset, whether or not it is liquid. Such as:

- The asset should be established.

- Huge liquid market with various buyers ready to purchase.

- Cash conversion capacity within less than a year.

- Inventories

Any other asset the owner is confident to convert into cash can be considered liquid assets. Liquid assets are significant as they are the primary source of cash to any individual or company for paying their debts and other financial liabilities.

How to analyse Liquid Assets?

Liquid assets are an essential aspect in business as it gives an impression of the company’s ability to pay the debts. A company with a greater amount of liquid debts undeniably attracts more investors. As a result, every business organisation follows several strategies to maintain its liquid asset balance sheet.

Why are Liquid Assets significant?

Liquid assets are the ultimate factor that determines the success of a business. Liquid assets determine the net worth of a company or an individual and ensure that it can pay for its liabilities and debts and continue its operational activities. Liquid assets are the only backup that an individual or a company have during an emergency, such as an economic downfall during the COVID 19 pandemic or a recession. Having more liquid asset also increases the credibility and money-making ability of a company which attracts investors for buying shares.

Therefore, it is quite evident that whether it is a company or an individual, liquid assets are essential and the ultimate goal of everyone.

Which investments can be considered liquid assets?

Other than cash, the cash equivalents could be considered liquid assets. Cash equivalents could be described as assets that could be readily converted into cash very quickly. The assets that come under the cash equivalent category are:

- Marketable securities

Marketable securities and stocks are considered liquid assets for their ability to be easily convertible into cash. Companies and individuals utilise Stocks and market securities during the time of a financial emergency.

- Short-term government bonds

Government bonds are issued by the national government that pays periodic interest payments. These are short term investments and can be converted into cash anytime.

- Mutual funds

A mutual fund is a platform for several investors wherein they invest money in a company. The company further invests that money in various investment opportunities to gain profit, which is then divided among the investors. These are short-term investment plan which could be easily converted to cash whenever needed.

Image source: © Designer491 | Megapixl.com

- Treasury bills

Government bonds or debt securities with a maturity of less than a year are considered treasury bills. T-bills are used to cover short-term discrepancies in receipts and expenditures.

- Commercial papers

Commercial paper is a type of unsecured, short-term debt that is frequently issued by businesses. Commercial paper is most commonly used to fund wages, accounts payable, inventories, and other short-term obligations.

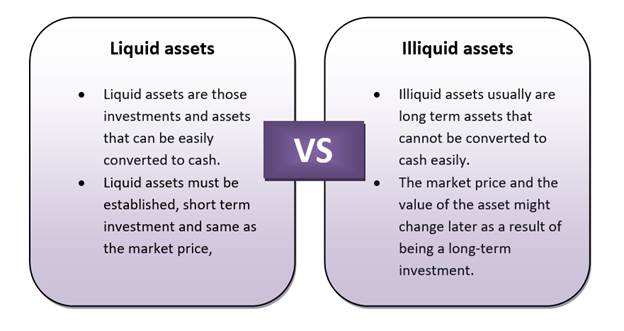

What is the difference between Liquid Assets and Illiquid Assets?

Liquid assets- Liquid assets are those investments and assets that can easily convert to cash.

The features of liquid assets are:

- Must be established.

- Short term investments.

- Not much change in the market price of the asset.

Image source: Copyright © 2021 Kalkine Media

Illiquid assets – Illiquid assets refer to a stock, bond, or other assets that cannot be quickly sold or exchanged for cash without suffering a significant loss in value. Illiquid assets offer bigger bid-ask spreads, more volatility, and thus a higher risk for investors.

Please wait processing your request...

Please wait processing your request...