What is KYC?

Know your customers of know you clients (KYC) refers to a due diligence process used by financial firms to assess the individual or organisation with whom the business is or will be conducted. KYC act as a protection for both investment firm and the clients.

It is a regulatory requirement that has to be fulfilled by a broker, real – estate investors, business investors, wealth management agencies, banking institutions and other investment related firms. The client’s assessment includes determining their risk tolerance, financial position and knowledge in the field of investment. It is a good practice that allows organisations to protect them from activities like money laundering, illicit financial activities and terrorism financing.

Summary

- Know your customers of know you clients (KYC) refers to a due diligence process used by financial firms to assess the individual or organisation with whom the business is or will be conducted.

- The due diligence procedure includes determining their risk tolerance, financial position and knowledge in the field of investment.

- KYC allows financial organisations to protect them from activities like money laundering, illicit financial activities and terrorism financing.

Frequently Asked Questions (FAQs)

What is the importance of KYC?

KYC procedure has to be adopted globally by the investment industries in order to protect all the stakeholders and protect the company from potential frauds. The KYC procedure is not limited while bringing a new customer on board but it is also conducted while renewing their existing customers. Keeping the data updated is crucial for serving the basic purpose of KYC.

Importance for Companies

KYC process allows companies to ascertain the customer’s income sources, capability to invest, present portfolios, and financial background, which results in a reduction of the financial risks. The financial checks are vital in ensuring that potential customers are not involved in any illegal activities which might affect the reputation of the business in future.

With KYC, trust is generated between client and company. Additionally, KYC is a regulatory requirement, and non-compliance with the regulatory requirement might affect the business operations and image in the industry.

Importance for customers

From the investor’s point of view, the importance of KYC procedure may not be evident, however protecting the interest of the general public is the priority of regulators. From an investor’s perspective going through the KYC procedure can be burdensome, but it creates a protective environment to undertake financial activities.

Moreover, the KYC process has become smooth and streamlined after shifting to digital platforms. The KYC technology is evolving and ensuring the protection of investor’s information.

KYC can inculcate trust and confidence amongst the investors that they are working with a trustworthy company and their funds will be safe.

What is the KYC process?

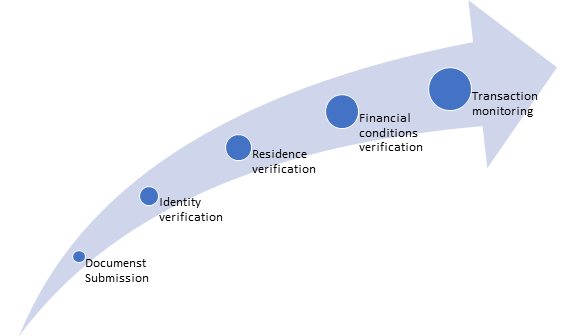

The KYC process can differ from country to country but the majority of the KYC process involves the following steps and the order can be different.

Source: Copyright © 2021 Kalkine Media

Step 1: Documents submission

A potential client or customers of the investment industry have to submit their documents for the purpose of identity and residence verification. The documents submission can be undertaken through digital platforms or physically.

Following documents can be submitted for identity verification - passport, identity card, driver’s licence or any document issued by the federal or state government.

Following documents can be submitted for residence verification – Bank statements, utility bills, rental agreement or employment documents.

Step 2: Verifying the identity

The document verification services are generally outsourced by investment firms as they can be a costly affair for the firm. In identity verification, those authorities are contacted who issues the submitted document.

Step 3: Verifying the residency

It includes verifying the citizenship of the client by confirming their address.

Step 4: Financial conditions verification

To reduce the risk of misrepresentation, the liabilities and assets claimed by the client are verified using their submitted documents and contacting the previous issuers, and financial institutions.

Step 5: Monitoring the transaction

By monitoring the financial transactions of the client, the company is able to ascertain the business of the client and whether it is connected with any illegal activities or not. It protects the interest of the institution.

By conducting the above-discussed KYC steps, companies are able to complete a due diligence check. (SOURCE: https://corporatefinanceinstitute.com/resources/knowledge/finance/know-your-client-kyc/)

What is the relationship between KYC and due diligence?

A strong KYC program includes undertaking customer’s due diligence. Due diligence includes identity verification and understanding their monetary transactions. While conducting due diligence, there is the probability of raising red flags:

- Determining the customer’s customers.

- Annual salary or sales.

- AML policies

- Reputation in the market.

- Third-party verification.

- Details of all the business customers maintain.

What is KYCC?

KYCC stands for the Know your customer’s customer. It addresses the limitation of KYC.

KYC comprises assessing the nature of potential customer’s business. However, the customer might be legitimate but the customer’s customer may be involved in criminal or illegal activities. It might result in fraud in future.

Moreover, KYC does not cover the funds hidden by politicians, businessman or individual in offshore tax heavens.

Therefore, KYCC is introduced which maintains higher transparency between the business mad the potential client.

What is KYC in Banking?

In banking institutions, to avoid money laundering, and terrorism financing, KYC has become a periodic and mandatory procedure while opening a new account in a bank and over time.

It is crucial to monitor the customer periodically because,

- The customer might change their businesses in future.

- Concerns are raised regarding the validity of the previously submitted information.

- Suddenly, a lot of suspicious transactions are taking place from the bank account.

- The customer might get in touch with a politically exposed person later.

- Unusual international; transactions are done.

In case the minimum KYC requirements are not met, then banking institutions can refute to continue with individual or business or does not open bank account.

Why KYC is important in banking institutions?

- It reduces the risk of error in transactions and internal counterfeiting.

- KYC helps in combating all illegal financial activities like corruption, money laundering or terrorist financing.

- Ensures that their customers are real and no risk is involved while undertaking business with them.

- Following KYC procedures is regulatory compliance, non – compliance led to facing heavy penalties from the regulatory bodies.

Please wait processing your request...

Please wait processing your request...