What is Keynesian economics?

Keynesian economics is the economic theory that states demand is the driver of economic growth. This economic theory also states that fiscal aid helps recover an economy from a recession. Certain Keynesian economic principles stand in stark contrast to the Classical theory of economics.

The theory was given by John Maynard Keynes in the 1930s and published in Keynes’ “General Theory of Employment, Interest and Money” in 1936. The Keynesian theory stated that government spending was an essential factor in increasing demand and maintaining full employment.

What are the theories under Keynesian economics?

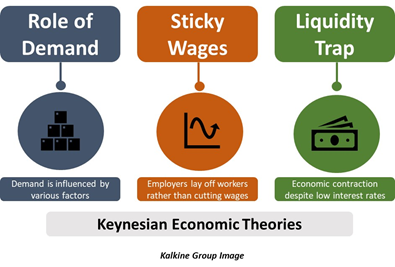

- Aggregate demand is affected by a host of factors: Aggregate demand is affected by various factors public and private factors. Monetary and fiscal policy both affect the level of aggregate demand in the economy. Any decision taken by the monetary authority or the government greatly affects the economy’s level of demand. Say’s Law proposes that supply generates its own demand. However, Keynesian economics suggests that demand is the driver of supply and overall growth in the economy.

- Sticky Wages: According to the theory of sticky wages, employers would prefer laying off workers over decreasing the existing workers’ wages. This happens because even in the absence of labour unions, workers would still resist wages cuts. Even if the employers were to reduce wages, it would lead to economic depression as demand would fall and people would become more cautious about their spending. Keynes advocated that the labour markers do not function independently from the savings market. Therefore, prices and wages respond slowly to changes in supply and demand.

- Liquidity Trap: Liquidity trap refers to an economic scenario where there is a contraction in the economy despite very low interest rates. This contrasts with the relationship between interest rates and investment given in Classical economics.

How is Keynesian economics different from Classical economics?

Classical economics states that the economy self-regulates in case of a disequilibrium. Any deviations from the market equilibrium would be adjusted on its own without any government regulation. However, Keynesian economics propagates that government intervention must maintain equilibrium or come out of an economic downturn. Keynesian economics highlights the importance of monetary and fiscal policy, while Classical economics does not mention any government intervention.

Another crucial difference is that Classical economics suggests that governments should always incur less debt, while Keynesian economics advises that governments should practice deficit financing during a recession. Classical economics states that government spending can be harmful as it leads to crowding out of the private investment. However, it has been later established that this happens when the economy is not in a recession. Government borrowing competes with private investment leading to higher interest rates. Thus, Keynesian economics is of the view that deficit spending during a recession does not crowd out private investment.

What are the policy measures advocated by Keynesian economics?

According to Keynes, adopting a countercyclical approach can help economies stabilise. This means that governments must move in a direction opposite to the business cycles. The theory also states that governments should recover from economic downturns in the short run itself, instead of waiting for the economy to recover over time.

Keynes wrote the famous line, “In the long run, we are all dead”. The short run knowledge of the economy would be far better than the long run prediction made by any government. Thus, it makes sense for governments to focus on short run policies and maintain short run equilibrium.

Keynes’ multiplier effect states that government spending would increase the GDP by a greater amount than the increase in government spending. This multiplier effect established a reason for governments to go for fiscal support when the economy requires it.

What have been the criticisms of Keynesian economics?

The initial stages of Keynesian economics propagated that monetary policy was ineffective and did not play any role in boosting economic growth. However, the positive effects of monetary policy are well established and have been integrated into the new Keynesian framework.

Another criticism is that the advantage of the fiscal benefits to the GDP cannot be measured. Thus, it becomes difficult to fine-tune the fiscal policy to suit the economic scenario better. Also, the Keynesian belief of increased spending leading to economic growth may lead to the government investing in projects with a vested interest. It could also lead to increased corruption in the economy.

The theory of rational expectations suggests that people understand that tax cuts are only temporary. Thus, they prefer to save up the income left behind to pay for future increases in taxes. This is the Ricardian Equivalence theory. Thus, fiscal policy may be rendered ineffective due to this.

Supply-side economics has also shown contrast to Keynesian beliefs. During the stagflation in the 1970s, the Phillips curve failed, bringing out the importance of supply-side economics.

Please wait processing your request...

Please wait processing your request...