What is the k percent rule?

Famous economist, Milton Friedman proposed the term k percent rule. The k percent rule was introduced with the theory that the money supply should be increased by the central banks at a constant rate on an annual basis. The k percent rule proposes that the central banks should consider increasing the money supply regardless of where the economy is, and the rate of increase should be equal to the growth rate of real GDP on annual basis.

For example, the money supply growth rate in the United States should range between 2 to 4% as per the average growth rate of the US GDP.

Image source: © Vkoletic | Megapixl.com

Summary

- Famous economist, Milton Friedman proposed the term k percent rule.

- The k percent rule was introduced with the theory that the money supply should be increased by the central banks at a constant rate on an annual basis.

- The rule proposes that central banks should consider increasing the money supply, with the rate of increase being equal to the growth rate of real GDP on annual basis.

Frequently Asked Questions (FAQs)

Who was Milton Friedman?

Milton Friedman who proposed the k percent rule is a renowned economist and recipient of a Nobel prize in the economics and recognized as he founded Monetarism. Monetarism is a branch of economics which focuses on money supply growth. It also comprises of the policies which play a crucial role in controlling and handling inflation. Friedman shared the belief that monetary policies play a critical role and contribute significantly towards handling economic fluctuations. Earlier, it was considered dangerous to fine tune the economy by employing different monetary policies under specific economic conditions because the insight regarding the respective effects was limited and no knowledge was present in the field (relationship between monetary policies and economic development).

From the long - term perspective, the economic stability can be brought in by central banks and financial institutions ensuring the money supply growth happens at a specific rate on annual basis and the different economic states should not be given much consideration. It has been seen as the ideal way to ensure economic stability.

Friedman shared the opinion that the money supply should be increased at the rate of 3 to 5 percent on annual basis.

The Federal Reserve Board of America acknowledges the benefits associated with the k percent rule. Majority of the monetary policies of the high-end economies is based on the k percent rule, irrespective of the economy’s current state. In case, an economy is weak, then the Federal reserves might ignore the k percent rule, and increase the money supply significantly and control the fluctuation in the economy. On other hand, when the economy is strong, then banking institutions and federal reserves might not increase the money supply as suggested by the k percent rule and authorities might constraint the supply.

What is the working of the k percent rule?

Central banks and the financial institutions are constructed to keep stability in the economy and ensure that the growth rate does not increase too slowly or too quickly. When the economy is cyclically weak, then central banks increase the supply of money, and the rate of growth is higher than the rate suggested by the k percent rule. It indicates that the money supply in the economy has increased, and the increase rate is higher than the rate of growth of the economy.

On the contrary, the money supply is constrained by the central banks when the economy is performing well. An increase in the money supply in a strong economy results in inflation and slowing down of economic activities. Thus, central banks utilize the k percent rule to protect the economy from hyperinflation or deflation.

What is the significance of the k percent rule?

Friedman believed the central banks are the source of cyclic fluctuation in comparison to the source of stability. He stated that when the money supply increases at a reasonable rate then it helps in avoiding extreme deflationary pressures and substantial inflation. This allows the economy to perform efficiently during the business fluctuations.

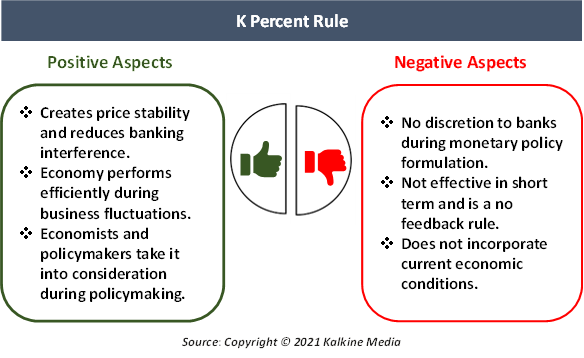

Friedman reported that k percent helps in creating price level stability and avoid the interference of banking institutions to frame a new monetary policy. He argued that the k percent rule empowers the banks to ensure stability on the price level and helps them in making decisions.

Economists and the policymakers take into consideration the k percent rule while framing economic policies, however, they make adjustment in the policy as per the current economic situation with the aim to increase effectiveness of the policies framed. Moreover, the k percent rule gathered a lot of criticism from economists as it does not provide any discretion to the banks while the monetary policies are formulated.

K percent rule limits the interference of the central bank; therefore, many policymakers generally modify the k percent rule and the rule is used as a base for developing new rules which will be further utilised for framing the monetary policies.

K percent rule is not effective in short term and is a no feedback rule. The rule does not allow modification in the policies introduced and does not take into consideration the prevailing economic situation.

What are monetary policies?

Monetary policy is a macroeconomic policy which involves money supply management and interest rate management. It is the demand side policy which is laid down by the central bank. Monetary policy is used to promote growth and stability. Moreover, it involves maintaining low unemployment. Monetary policies are implemented through open market operations, credit control policies and bank rate policies.

The employment of these instruments results in a change in the money circulation and in effect, the interest rate changes. The monetary policies are of two types, contractionary and expansionary. When the money supply is increased then the interest rate decreases, this is known as expansionary. Contractionary policies are those where the money supply is controlled and the interest rate increases.

Please wait processing your request...

Please wait processing your request...