What is a junk bond?

A junk bond is a bond that holds low credit ratings due to the poor track record of the issuer of the bond. The return on these bonds is usually higher than the return on other bonds which is why they are also called high-yield bonds. Due to the high level of risk involved in these bonds, they usually pay a high interest rate.

Most of the companies issuing these bonds either have a high debt profile or are newly founded businesses with no credit history. Even when a junk bond defaults, it may still hold some value.

Why are junk bonds high risk bonds?

Buyer of a bond is lending to the issuer, in exchange for monthly interest payments. On maturity, the issuer must repay the principal amount to the buyer.

This is where the default risk comes in. If the issuer does not return the principal payment, then the buyer can face a heavy loss, against the relatively lesser interest payments received by him. To incentivise a junk bond, higher interest rate is offered on it.

A junk bond’s credit rating deteriorates the longer it takes for the issuer to repay and can be extremely low if the issuer does not repay at all. Default risk increases as the company’s creditworthiness declines and thus, the bond’s credit rating declines as well.

Bonds with a credit rating of AAA are less likely to default, whereas bonds having a rating of BB or less are more likely to default. Therefore, junk bonds have a credit rating of BB or lower.

How is the creditworthiness of Junk bonds defined?

The credit rating of the company issuing a bond greatly impacts the bond’s credit rating. Through the process of credit analysis, it is possible to judge a company’s creditworthiness.

Businesses with strong financial performance and sound business strategy are likely to have a good credit score. To analyse these areas, the best parameters can be the company revenue as well as its asset value. These parameters can be used to do a relative analysis between businesses falling in the same industry.

Other parameters can also be used to judge the company’s performance and financial standing, including the current ratio and the debt-to-equity ratio. It is helpful to analyse these parameters before investing in a junk bond, despite the lucrative interest payments offered on it.

Junk bonds are also labelled as speculative bonds. Any bond falling in the credit rating of AAA to BA is considered an investment-grade bond and is considered to less speculative than a bond with a rating higher than or equal to BB.

Sometimes, investment-grade bonds may turn into speculative or junk bonds over time. These are referred to as “Fallen Angels”. On the contrary, sometimes low-grade bonds may become investment-grade bonds and are thus, called “Rising Angels”.

Why are Junk bonds important for an economy?

The behaviour of investors towards junk bonds says a lot about the health of the economy. As investors pay more attention to junk bonds, it means that they are becoming less risk averse, and are accepting riskier ventures. This means that the investors are optimistic about the economy and are thus, willing to take more risks.

On the contrary, a lack of interest in junk bonds can be an alarming signal towards a negative sentiment developing among investors. Fearing economic downfall, investors might hold themselves back from riskier investments. This means that investors become more risk averse during periods of economic downfall.

Pessimism about the economy could lead towards a bear market and a market contraction. While optimism about the economy could lead towards a bull market and a market expansion.

Why do investors still prefer Junk Bonds?

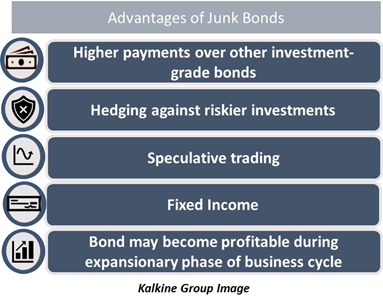

- Junk bonds can help investors gain higher payments than other investment-grade bonds due to the greater interest payments involved. This could be highly incentivising for investors looking to earn fixed interest payments that are relatively higher.

- Junk bonds can help offset the risky position of an investor. Investors can take a position opposite to the investment against which they want to hedge.

- They can be used for speculative trading. When the market is low, junk bonds can be bought with the intention of selling them off for a profit in the future when prices increase.

- Bondholders are paid before stockholders in case of bankruptcy. Thus, Junk bonds may provide fixed returns.

- Investors can hold onto junk bonds as they have longer maturities and expect the company to perform better in coming year. This could make the bond more profitable with time. Also, businesses can improve their performance during the expansionary phase of the business cycle.

Please wait processing your request...

Please wait processing your request...