What is a junior mortgage?

A junior mortgage is a form of mortgage that is subordinate to a first or senior mortgage. It is also known as a junior lien or a second mortgage, but it may also be a third or fourth mortgage in ordinal terms. In the event of a default, the first mortgage will be paid off first.

It is an additional loan taken on top of the primary loan on a property, for which the property itself acts as a collateral. Individuals may opt for a junior mortgage even when they are yet to pay off their first mortgage.

Summary

- A junior mortgage is backed by a lien and is subordinate to another mortgage on the property.

- Junior mortgages are mainly used for debt repayment and home renovations.

- Lower interest rates, larger loan amounts, and future tax benefits are all advantages of second mortgages.

Frequently Asked Questions (FAQs)

What is the concept of a junior mortgage?

A junior mortgage is any form of loan obtained after the senior mortgage has been approved and is backed by the home's value as collateral.

In the case of default, the initial mortgage will retain all proceeds from the property's liquidation until the borrower fully pays it. Since it receives repayments only after the first mortgage is paid off, the interest rate on a junior mortgage is usually higher, and the amount borrowed is lower than on a first mortgage.

Junior mortgages may be used in several ways, including home equity loans and piggy-back mortgages, which enable borrowers to avoid paying expensive private mortgage insurance with less than a 20% down payment. Home equity loans are commonly used to access a home's equity to pay off other debts or make new purchases.

Source: © Bigldesign | Megapixl.com

Junior mortgages may be a viable alternative compared to unsecured loans, credit cards, or other high interest debt. However, since mortgage interest is tax-deductible, the interest rates on junior mortgages are often lower than they seem when the tax benefits are factored in.

Junior mortgages, on the other hand, are not necessarily made in the same way as senior mortgages are. When comparing interest rates, penalties, and repayment terms between lenders, borrowers are well served. After all, if a borrower defaults, his or her home will permanently belong to the bank.

How does junior mortgage work?

Junior mortgages are like conventional mortgages in nature. For instance, these mortgages are typically repaid over a decided period. Though some lenders may offer fixed rates on all these loans while others provide variable rates.

Most banks can charge points and other fees for obtaining a junior mortgage, like first mortgages (title fees, solicitor fees, paperwork fees, and insurance, for instance), and these costs differ across banks.

The lender can charge a fee if the borrower prepays the loan under some circumstances. Since a property backs the loan, the lender has complete control over the foreclosure process.

Source: © Webking | Megapixl.com

What are the various forms of junior mortgages available?

A "piggy-back loan," also known as an 80-10-10 loan, is a junior mortgage that works in tandem with the primary mortgage to allow homeowners to avoid paying mortgage insurance by merging a junior mortgage for 10% of the house's cost with a primary mortgage for 80% of the house’s cost.

A home equity loan, or HEL, is a form of junior mortgage that offers a lump sum payment that the borrower will repay over time at a fixed rate.

A home equity line of credit, or HELOC, is an open-ended, adjustable-rate junior mortgage that can be drawn on when required and repaid over time.

What is the procedure for obtaining a junior mortgage?

While there are some distinctions, obtaining a junior mortgage is equivalent to getting a primary mortgage.

A real estate agent and an inspection are not needed. However, since the house's current value is a significant factor in deciding how much can be lent, a home valuation is required.

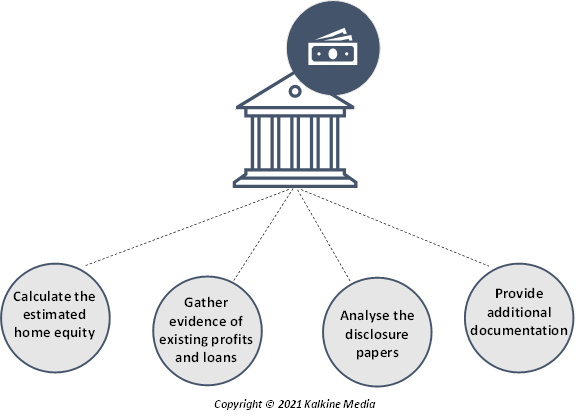

Here is a rundown of the measures involved in obtaining a junior mortgage:

- Calculate your estimated home equity and how much you can borrow.

- Gather evidence of existing profits and loans.

- Junior mortgage lenders are compared.

- Apply for a junior mortgage.

- Take a look at the disclosure papers. Check that the terms are as expected and that the borrower can afford the payments on the junior mortgage.

- Provide additional documentation which is required for underwriting.

What are the qualifications for a junior mortgage?

The qualifications for a junior mortgage vary depending on the type of junior lien the borrower is looking for and the lender he or she chooses.

However, one qualifying condition remains constant: borrowers must have ample home equity to borrow against to qualify for a stand-alone junior mortgage. For a junior mortgage, the maximum amount that borrower is lent is 85% of the borrower's equity.

For a junior mortgage, a credit score of 620 is usually needed. Lenders can require a higher score, especially if the borrower attempts to borrow a large sum of money. A better credit score will also assist in obtaining a lower rate.

What are the benefits of taking a junior mortgage?

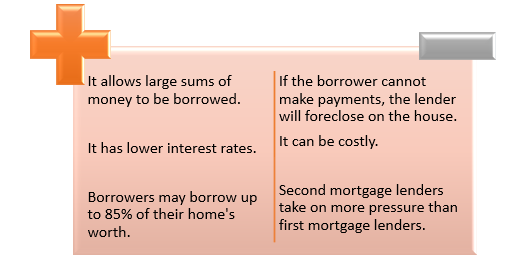

Since the house backs the loan, junior mortgages allow large sums of money to be borrowed. Borrowers may borrow up to 85% of their home's worth, depending on the lender. Both home loans, including first and second mortgages, will be included in that limit.

Junior mortgages have lower interest rates than other forms of debt. Again, obtaining a loan against a home benefits the borrower by lowering the lender's risk. Junior mortgages have lower interest rates than unsecured personal loans like credit cards because they are less risky.

Borrowers will be entitled to claim a mortgage interest deduction on interest accrued on a junior mortgage in some situations.

What are the risks of a junior mortgage?

One of the most significant drawbacks of a junior mortgage is that homeowners must place their homes on the line. If the borrower cannot make payments, the lender will foreclose on the house, putting the borrower and their families in financial distress.

Purchase loans, like junior mortgages, can be costly. Appraisals, credit assessments, origination fees, and other fees must all be paid by the borrower.

Junior mortgage rates are usually lower than credit card rates, but they are also marginally higher than the rate on the first loan. Second mortgage lenders take on more pressure than first mortgage lenders.

Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...