What is inheritance tax?

An inheritance tax is a tax imposed on the people who receive a bequest from a family member who has passed away. The tax is imposed on the inheritance left behind by the deceased, including all assets and property. The tax is also sometimes referred to as “estate tax” or “death tax”. However, an estate tax may not always be the same as an inheritance tax.

Certain countries do not recognize inheritance tax but do charge some amount of tax or levy that is applied to the sums of money and other assets passed from a deceased person to the dependents or other nominees.

In certain instances, the superannuation benefits passed onto the family member of a deceased individual are taxed depending on the conditions of the beneficiary. Such a superannuation benefit also includes tax-free components. The percentage of inheritance tax charged can run as high as 40% and even 55% in certain countries.

Summary

- Inheritance tax is imposed on the people receiving a bequest from a family member who has passed away.

- The tax is imposed on the individuals and not on the estate itself that is left behind.

- Most developed nations impose an inheritance tax but not all countries recognise the tax.

- The value of the inheritance tax can go as high as 55%, with the taxed amount going directly to the government before the bequest can reach the beneficiary.

Frequently Asked Questions (FAQs)

How does an inheritance tax work?

An inheritance tax changes depending on how close the deceased was to the beneficiary. The tax advantages may be higher depending on how the bequest is formulated. Usually, children of the deceased pay the lowest amount of inheritance tax while spouses may be completely exempt from paying the tax.

Additionally, small inheritances may not be taxed at all due to a certain threshold value that must be crossed before the tax can be imposed. In the US, not all states charge an inheritance tax. Only 6 states impose the tax, namely, Maryland, Nebraska, Kentucky, New Jersey, Pennsylvania, and Iowa. However, if the beneficiary stays in either of the states but the benefactor was from another state, then the inheritance tax will not be applicable.

Which countries do not have an inheritance tax?

Australia does not impose an inheritance tax on the assets and money passed down to beneficiaries by the deceased. However, there are certain taxes that are usually charged in such assets which are imposed in the country. These include interest earned and capital gains tax, etc. Thus, the beneficiary is not exempt from the usual structure of taxes that must be paid on an asset.

This was not always the case in Australia as the country had an inheritance tax structure in place up until 1979. The system was abolished when Queensland Premier Sir Joh Bjelke-Peterson removed all inheritance and gift taxes to attract migrants from other states. Consequently, the Federal Government also removed the tax nationally.

While debate is still ongoing on whether inheritance taxes are necessary or not, most experts are of the view that it is not a politically friendly policy to reintroduce. But in the absence of such a tax, a large amount of assets and bequests lay in the hands of relatively lesser proportion of the population.

How is superannuation taxed under the inheritance tax structure?

The superannuation balance is passed down to the beneficiaries once the benefactor passes away. Factors such as dependency of a beneficiary, their age, and the methods in which the funds are passed on, i.e., lumpsum or stream, determine how much tax is levied.

In Australia, superannuation benefits may also have certain tax-free components which can include after-tax contributions and government co-contributions. The part of the funds which are taxed include employer contributions and salary sacrifice contributions.

The Australian Taxation Office has mandated that superannuation death benefits should generally be tax-free if it is paid as a lumpsum amount. However, if paid as an income stream, it may be taxed with certain exceptions.

Is it possible to avoid inheritance tax?

It is not entirely possible to avoid inheritance tax once the benefactor has passed away. However, the possibility still exists that the beneficiary receives the bequest in small amounts while the benefactor is still alive. In most countries, small amounts of gifts are not charged. There is a threshold limit beyond which any gift given is taxed. This threshold might be even higher for married couples.

Another option is for the benefactor to set up a revocable trust. This trust would hold all the assets and money that the holder wants to give away to his/her family or other beneficiaries. (SOURCE: revocable trust allows last minute changes and cancellations depending on what the holder of the trust desires. The funds transferred into a revocable trust are only passed onto the beneficiaries once the originator of the fund passes away.

How is an estate tax different from an inheritance tax?

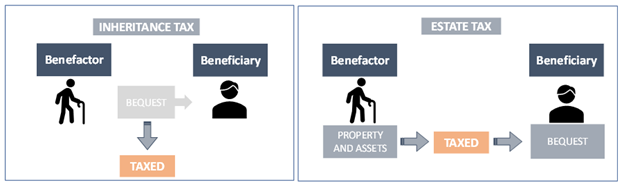

The estate tax is imposed on the entire assets of a deceased individual while an inheritance tax is imposed on assets inherited by someone. Estate tax is based on the right of a deceased to transfer his assets upon his death.

Source: Copyright ©2021 Kalkine Media

The amount of estate tax depends in the total value of the deceased person’s entire estate. On the contrary, inheritance tax is imposed only on the value of a specific gift. In case the inheritance tax is also imposed on the total value of the benefactor’s property and assets, then it is the same as an estate tax.

Please wait processing your request...

Please wait processing your request...