What are LEPOs?

The term LEPO stands for low exercise price options and is a call option having an exercise/ strike price of one cent. It is a European style call option and is very much like a futures contract.

Since it is an European style call option, the holder of LEPOs will exercise it on the date of maturity, therefore the traders operate on margins, that is, traders have to pay or receive margins in accordance with the change in price.

Being long in LEPOs gives the investor the right but not the obligation to purchase a specific amount of security on a specific future date. A premium must be paid to obtain a long position on the contract. This is paid in addition to the strike price.

On ASX, one LEPO contract generally includes 100 shares and the exercise prices is AU$10 per contract.

What is index LEPOs?

In index LEPO contracts, the underlying asset is an index. The index value is determined by the prices of the major listed companies, and the listed companies are assessed as per their market capitalisation and performance.

Summary

- LEPOs stand for the low exercise price options and an have exercise (strike) price of one cent.

- It is a European style call option and is almost like future contract.

- The holder of LEPOs will exercise it on the date of maturity, therefore the traders operate on the margins.

- One LEPO contract generally includes 100 shares, and the exercise prices is AU$10 per contract.

- In index LEPO contracts, the underlying asset is an index.

Frequently Asked questions (FAQs)

What does it mean to be long in LEPO?

Purchase of LEPO is like a stock purchase as they are so deep in the money. LEPO extends the advantage of paying only the margin rather than the stock value. The rest of the balance is paid when LEPO is exercised.

Since LEPO is an option, the buyer of LEPO gains the right but not the obligation to exercise it.

What does it mean to be short in LEPO?

When an investor holds a short position in LEPO, then he/she has the obligation to sell a specified number of shares on a specific date, in exchange for a premium, if the buyer chooses to exercise the option. Therefore, like other call and put options, the seller of LEPO must deliver the underlying asset when the holder exercises the LEPO.

What is the difference between LEPO and shares trading?

The exposure of LEPOs is like the ownership of shares, however, dividends are not received directly as in the case of shares. The dividend value is factored in LEPOs price. It is especially advantageous for investors who are unable to take advantage of the franked dividends.

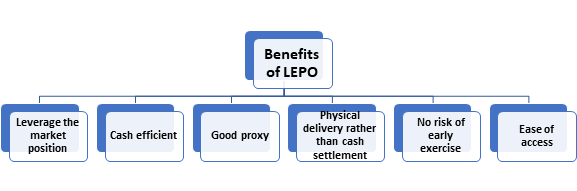

What are the benefits of LEPOs?

- Leverage the market position – The position of the investor in the share market is leveraged as the investor only must pay the margin of the total share value. The share price movement leads to loss or gains in the investor’s position which is marked on daily basis, through the mark to market process. when the position is closed, the profit or losses are crystalised. LEPO has the potential to increase the risk and return of an investor’s portfolio.

- Cash efficient – Since LEPOs are leveraged, they are cash efficient. With the same exposure to the share market, the investor has to pay less. It can be observed as an alternative to funds borrowing for investment

- Good proxy – The premium price movement of LEPO is similar to the underlying assets’ price movement. Therefore, LEPOs are a better alternative as they are adjusted for dividends.

- Physical delivery rather than cash settlement – When a LEPO is exercised by the holder, the cash settlement is not done, instead physical delivery of assets takes place.

- Risk of early exercise is not present – LEPOs are European options, therefore, they cannot be exercised before the date of expiry. Therefore, the risk of early exercise is not present. It can be utilised by those investors who want to lock in a strong position without risk.

- Ease of access – If an investor has an account in the exchange-traded options account, then the investor can trade in LEPOs as well.

Source: Copyright © 2021 Kalkine Media

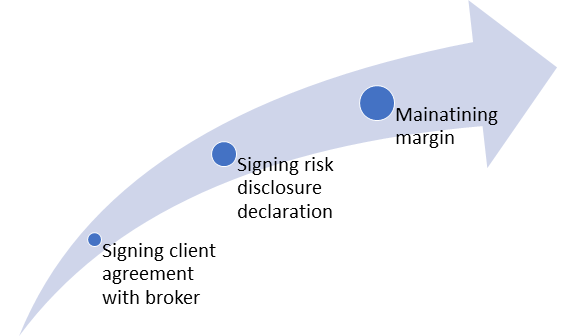

What is the documentation process for LEPOs?

- A client agreement must be signed with the broker so that broker can perform LEPO transactions.

- Risk disclosure declaration is signed which will be obtained from the broker.

- Lastly, to cover the risk margin obligations, collateral must be maintained which should be discussed with the broker.

Source: Copyright © 2021 Kalkine Media

What factors to consider while investing in LEPOs?

- Cost – Only a small margin is paid by the investor while investing in LEPOs. However, the brokerage fee is applicable, and the investor must consider the same while calculating risk and return.

- Margins – Throughout the life of LEPO contract, margins are paid by both seller and buyer.

- Adjustment in the underlying assets – In case of the bonus issues, right issues or reconstruction events, the value of underlying assets may change. The adjustments in the LEPOs contract are like the adjustment in the options contracts.

- Dividend – The LEPO’s buyer does not receive any dividend till the LEPO is exercised.

- Closing out – The contract can be closed by either selling or buying the LEPO contract.

What is specified in a LEPO contract?

The underlying assets – security code of shares (in case of Index LEPO, the index name is mentioned)

- Contract size – 100 shares per contract

- Tick size – 1 cent

- Exercise date – the date of maturity

- Exercise price – 1 cent per share

- Trading hours

- Settlement type – physical delivery of shares

- Expiry date – Generally, Thursday preceding last Friday of the month.

What risks are associated with LEPO trading?

Market risks: The value of LEPO is affected by different factors such as the change in the value of the underlying asset. The relationship between LEPO and the underlying asset’s value can be positive, negative or zero.

Leverage related impact: A minor market movement can significantly impact the value of the contract. Therefore, an investor should acknowledge that LEPOs can generate huge losses and gains as well.

Unlimited losses – If an investor is short in the LEPO contract and on the date of expiry does not have ownership of the underlying assets, then he/she will face unlimited losses.

Margin calls – If the market moves against the prediction of the LEPO holder, then investor must pay extra funds to maintain their position. In case, the margin amount is not maintained then, the position will be closed, and losses will be borne by the investors.

Interference of regulatory authorities - The regulatory authorities have the power to interference in the trading to protect the interest of investors. The interference may affect the investor’s position, as regulatory bodies might cancel the contracts as well.

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...