How to define Index Futures?

Index futures are financial contracts in which an investor buys or sells a stock market index at a predetermined rate to be settled in the future. The selling and buying between two traders entering the contract occur in zero time (present-day), where the exchange price gets determined. The actual exchange of stocks takes place on a future date. In the future contract, the date of transaction (maturity period), exchange price (strike price), and quantity, and type of stocks are mentioned in the contract.

Example: An investor predicts that ABC stock will show an upward trend by 500 points in the coming days. Based on personal predictions, an investor buys 100 ABC stock’s future at the strike price of $8000 each. At the date of maturity, the stock price reaches $8,500. At the maturity date, that investor purchases the stocks at $8000 each and sells them in the market for $8,500 each. Therefore, the investor makes a profit of $50,000 (100 x 500). Similarly, if the price of stocks falls to $7,500, then an investor will lose $50,000 as he is bound to buy the ABC stock at the price of $8,000.

The above example provides insight into the basic trading nature and aim of the index future. However, in the stock market, the transaction does not take place on the maturity date. The accounts of the investors (who entered the contract) are settled daily. i.e. a difference in the value is paid or deducted from the accounts daily.

Summary

- A market index projects the movement of prices among the stocks listed in the index.

- Index future contracts give the right to the investor to sell or buy a stock at a predetermined price on a future date.

- Index futures are used for hedging, speculation and arbitrage.

FREQUENTLY ASKED QUESTIONS (FAQs)

What are the most important terms in Index futures?

Maturity/expiration date: The date on which the contract will be fulfilled by both parties entering the contract.

Strike price: The price which is predetermined while entering the contract is called the strike price.

Spot Price: The price of the stock while entering the contract is at zero time. In few cases, the strike price and stock price can be the same.

Long position: The position is undertaken when the investor predicts an increase in the future price and makes an obligation to buy the stock at the maturity date.

Short position: The position is undertaken when investors predict that the stock prices will show a fall in the future. The investor makes an obligation to sell the share on a future date.

Mark-to-market basis: In the index future, the settlement is done daily, and this process is known as a mark-to-market basis.

Initial margin: While entering in future contract, the investor is not required to make a full payment but should deposit a fraction of the contract amount in their respective accounts.

Maintenance Margins: Since the settlement is done daily, the investor must maintain a minimum balance in their accounts. If deductions are made daily from the account, then an investor should deposit funds to cover the future losses.

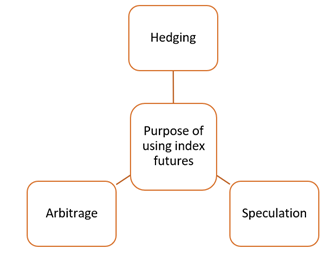

What is the Purpose of Index Futures?

There can be different reasons for entering into a futures contract, such as:

- Hedging:Hedging stands for reducing the impact of price change on the market portfolio. Suppose the portfolio is affected by the change in the index movement. In that case, investors (organisations or individuals) can hold a long or short position in the future market and offset the impact.

- Arbitrage:The arbitrageurs attempt to profit from the inefficiencies of the future market by making trade in two markets simultaneously. The price difference in the two markets results in the income for arbitrageurs.

- Speculators:They buy or sell the futures contract with the anticipation of a change in the prices of indexes in the future. The difference in the strike price and maturity prices is the profit or loss earned by the speculators.

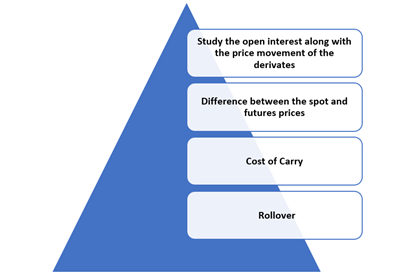

What are the things to consider while investing in a futures contract?

Source: Copyright © 2021 Kalkine Media Pty Ltd

Study the open interest, and the price movement of the derivates: These two components give an insight into the trend of the derivatives market. A bullish trend can be predicted when open interest increases along with a significant rise in the prices of the derivatives. A bearish trend is predicted when the open interest is rising, but the results prices are either falling or stagnant. Furthermore, if the price is rising, but the open interest is stagnant, then it indicates that no investment should be made in the particular derivative.

Difference between the spot and futures prices: If the gap between the spot and futures prices is positive, it projects the bullish market trend. In contrast, if the gap is negative, then a bearish market trend can be predicted.

Cost of Carry: A bullish trend should be anticipated when the cost of carry is high at the maturity date. Similarly, a negative cost of carry projects a bearish market. Moreover, to generate a better insight, the cost of carry should be compared with the open interest.

Rollover: Increased cost of carrying accompanied by the high rollover, the stocks can show an upward trend. The downside trend should be estimated when a rollover is high, but the cost of carrying is decreasing.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What are the Advantages and disadvantages of trading in index futures?

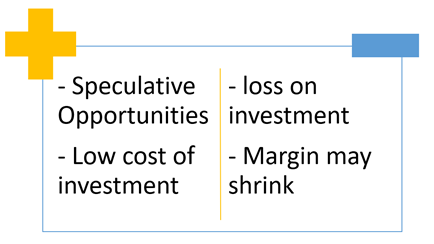

Advantages

Investment in the index futures allows the investor an opportunity to speculate. Chiefly, a long position in index futures does not involve full payment. Also, the difference exists in terms of the stock purchase and future contract purchase. To illustrate: while buying 100 shares ABC index of $200, an investor has to pay $20,000. On the other hand, while buying ABC Index’s future (Having 100 shares), an investor has to pay only the contract's price and maintain a margin.

Disadvantage

If the market goes in the opposite direction than predicted, it results in a complete loss of investment.

Furthermore, the index future involves maintaining a margin. In case of the failure of keeping the margin, the investor can operational issues.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Please wait processing your request...

Please wait processing your request...