What is an import duty?

Import duty is a tax imposed on goods purchased from another country. It is a form of trade barrier introduced to restrict international trade. Import duties are levied to generate revenue for the government and protect domestic sellers in the economy. Sometimes governments may also use import duties to raise the price of goods from the rival nation so that its demand declines. When specific items enter the country, import duty is collected. Numerous international organisations, agreements, and treaties have a direct impact on import duties. The taxation on imports may be done by imposing customs duty or an import tariff.

Summary

- Import duty is a tax imposed on goods purchased from another country.

- There is a net welfare loss in the economy when imports are taxed.

- Other forms of trade barriers include tariffs, import licences, import quotas etc.

Frequently Asked Questions

Why is an import duty imposed?

There are various reasons why a government imposes an import duty. First, levying a tax on imports is a means for the government to raise revenue for itself. Especially in cases where there is a product with relatively inelastic demand, the quantity demanded does not decline with the rise in price caused by the imposition of import duty. As a result, the government can earn considerable revenue from it.

There are various good with negative externalities. Import duty could be a decision by the government to control its purchase and consumption to protect from the negative externalities.

Import duties are also imposed to protect domestic producers. The imposition of a tariff will increase the price, and thus by the law of demand, the quantity demanded of the imported good will decline.

When governments want to improve their trade surplus, they may either increase exports or reduce imports. In such situations, a tax on imports is of use.

What is the impact of an import duty?

When an import duty is imposed, its effect can be seen from three aspects- impact on Consumer surplus, impact on producer surplus and impact on government revenue. The aggregate impact of these three factors helps determine the net gain or loss of benefit to the economy caused by the tariff imposed.

Image source: Copyright © 2021 Kalkine Media

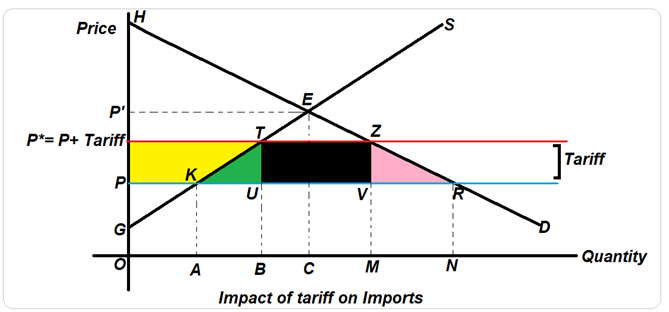

In the diagram given, we can understand the impact of these factors. The graph above explains the market mechanism of country X for commodity J. In a situation of no trade with other countries, quantity demanded and supplied is equal at output level OC and price level OP’.

If, instead, the country decides to import the good J then the pricing will differ. In a situation of no tax on imports, the price will be OP. At this price level, the domestic suppliers are willing to supply only OA units while the demand at price OP is equal to ON. So the excess demand of AN is fed by importing. However, tax-free imports is not a very realistic scenario.

When the country imposes a tariff, the price will increase and will be at level OP* such that OP*=OP+tariff. At this higher price, the domestic demand is at OM, and domestic supply is at output level OB. So the excess demand is equal to BM which will be equal to the quantity imported.

Impact on Consumer Surplus

Consumer surplus is the difference between what the consumer is willing to pay and what he/ she actually pays. It is the area enclosed below the demand curve and above the price line. HEP gives the consumer surplus in case of no imports.

When the country starts importing, and there is no tariff, consumer surplus will be given by HRP. When a tariff is imposed, consumer surplus falls, and then consumer surplus will be HZP* The increase in price due to the imposition of import duty will lead to the loss in consumer surplus by PRZP*

Impact on producer surplus

Producer surplus is the difference between the price at which a firm is willing to sell and the price that it actually receives. Producer surplus is shown by the area enclosed between the area above the supply curve and below the price line. In case of no exports, producer surplus will be equal to the area EGP.'

If imports were to be without any tax or tariff, the producer surplus would be equal to the area GKP. However, when prices rise, it is beneficial for the suppliers as their surplus will improve. At the new price, P* producer surplus will be GTP* implying again in producer surplus equivalent to the area of PKTP*

Impact on the government

For a tariff of PP* on imports of BM, the government will generate revenue equal to the area of UVZT.

Impact on nation’s welfare

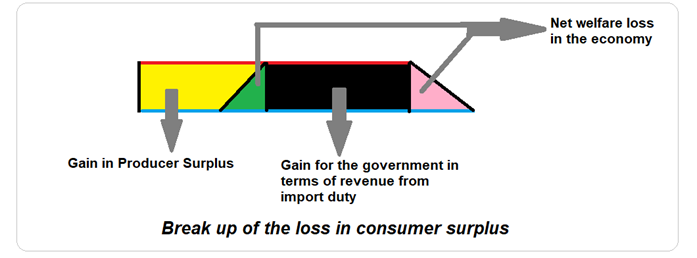

When an import duty is imposed, the consumer losses a significant chunk of his/her surplus. However, the consumer's loss becomes the gain for producers and the government. However, there is still some loss of surplus that does not get covered up as any entity’s benefit. Total welfare lost is given by the area of PRZP*.

Welfare lost= Area of PRZP*= area of PKTP* + area of KUT + area of UVZT + area of VRZ

Benefit gained= area of PKTP*+ area of UVZT

As a result, there is a net loss in welfare in the economy because losses exceed benefits. The welfare loss is given by the area of KTU plus the area of ZVR.

Image source: Copyright © 2021 Kalkine Media

What are the ill effects of trade barriers?

Trade barriers are costs imposed on trade to raise the cost of the traded product. Other forms of trade barriers include tariffs, import licences, import quotas etc. In general, trade barriers are said to decrease economic efficiency. If countries keep imposing trade barriers on each other it leads to trade war. According to comparative advantage, the opportunity cost of producing a commodity that the country does not specialise in is very high. Since all countries are not endowed with all the resources, not just final goods but even raw materials may be imported by a nation. When raw materials are not domestically procured, the cost of production is already high; if further imports are taxed, the final product will be very expensive for consumers. Thus we see that producers, consumers and the economy, in general, has to tackle the increased cost due to the trade barrier.

Please wait processing your request...

Please wait processing your request...