What is imperfect competition?

Imperfect competition is a competitive market setup that includes multiple sellers engaged in selling heterogenous goods. Imperfectly competitive markets are a more accurate depiction of the markets in the real world than a perfectly competitive setup.

The sellers in an imperfect market have the liberty to influence prices and are thus price makers. The sellers in this market are often protected by barriers to entry.

What are the types of imperfect markets?

Imperfect competition can be observed in various forms, including:

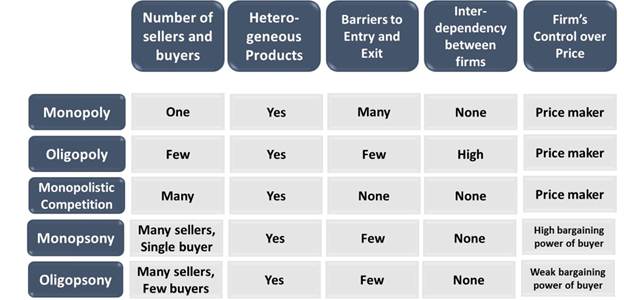

- Monopoly: Monopoly is a single producer market, wherein the producer has entire power as it is a price maker. The producer has control over the output, price, and the quality of the product in the market. There are no substitutes in the market, leaving the consumers with only one choice.

Besides, there are many barriers to entry of new firms. Thus, the firm continues to hold its monopoly position. Public utilities are generally a monopoly set up as they have a single provider with no substitutes. Since these are government regulated, the prices are not too high to crowd out certain sections of individuals.

- Oligopoly: The number of players in this set up is more than one, however it is less than the number of sellers in a monopolistic competition. Here there are few barriers to entry and exit. A few producers have control over the market while other firms are small and are price takers.

Thus, there exists a high level of interdependency between firms. This can also lead to firms coordinating in some instances to obtain higher profits. This is most frequently seen in the form of cartels.

- Monopolistic competition: Just like perfect competition, monopolistic competition also comprises of many buyers and sellers. However, both lie on the opposite end of the competitive market spectrum. Products are heterogenous and producers have greater control over the prices of their products as compared to perfect competition.

- Monopsony: In monopsony there are many sellers but a single buyer. Thus, buyer has greater bargaining power as compared to other market setups. Thus, buyers may ask for lower prices than what sellers want to sell for.

- Oligopsony: In oligopsony, many sellers serve a few buyers. Thus, buyers have slightly more bargaining power than in other market setups excluding monopsony.

What are the characteristics of imperfect competition?

The following characteristics define a market with imperfect competition:

- Number of buyers and sellers: The number of buyers and sellers vary largely, depending on the type of imperfect markets. Under monopolistic competition, firms are usually small in size and each firm is insignificant with respect to any changes in the entire market. Thus, no single firm can affect the sales of another firm. Each firm functions independently of the other.

However, in a monopoly there is only one firm and, in an oligopoly, firms are highly interdependent.

- Heterogeneous Products: Products provided by different sellers may be similar. However, they are differentiated. This means that there are different variations offered in the same type of product across the market. This allows customers to have a variety of goods to choose from, even when the goods perform similar tasks.

These variations in the products may come because of the differences in the quality of the product across sellers. For instance, ice creams are offered by different companies selling dairy. Thus, consumers may prefer one brand over the other for their quality or for their range of flavours. However, the product itself serves the same purpose irrespective of which company it belongs to.

- Free Entry and Exit of Firms: The free entry and exist exists in monopolistic competition under the imperfect market set up. Free entry and exit of firms allow them to produce close substitutes and consequently leads to a greater supply of goods in the market.

However, this is not the same for all types of imperfect markets. For instance, in monopoly there are barriers to entry and exit.

- Imperfect Knowledge About the Market: Both sellers and buyers do not possess perfect knowledge about the market. Under monopolistic competition firms use advertisement to make consumers aware about their products. Thus, advertisements play an important role. However, same is not true for monopoly.

- Price Makers: Firm in imperfect markets are price makers. Each firm can decide the price for their products. Thus, producers may charge a price that is higher than the marginal price. This is especially true for a monopoly.

Kalkine Group Image

How did the theory of imperfect vs perfect competition come to light?

The theory of perfect competition was given by French mathematician Augustin Cournot in 1838. The theory helped theorise the economic relationships that existed in the market.

The theory, however, was too ideal a representation to fit into the real-world scenario. This model of perfect competition was a hypothetical one and was an oversimplification of real-world scenarios. It did not include other aspects like barriers to entry, imperfect knowledge in markets and heterogeneity of products.

Despite these shortcomings, the model of perfect competition was widely accepted and is still popular in theory. Theoretical economics still includes the topic of perfect competition as an integral part. Markets like oligopoly, monopolistic competition, monopsony, monopoly, etc are all extensions and variations to the model of perfect competition.

Importantly, the theory of imperfect competition was most prominently popularised by Joan Robinson in 1983 in her book “The Economics of Imperfect Competition”. In this book, Robinson gave the model where each firm enjoyed some monopoly power. This was later extended into the idea of monopolistic competition.

Please wait processing your request...

Please wait processing your request...