What is the Impact cost?

Before diving deep into the Impact cost, we must first understand the concept of liquidity as it is the sole factor to decide the Impact cost for a buyer or seller while executing an order (buy or sell).

Liquidity refers to the ease with which any market participant, either buyer or a seller, is able to execute his/her order in a free marketplace without affecting the current market price of the stock at the time of initiating a transaction.

Watch: What Is Market Liquidity?

In other words, liquidity defines the extent to which an asset can be transacted and quickly converted into cash without much of a negotiation. This is only possible when there are a large number of buyers and sellers present in the same market at the same time. To sum it up, the higher number of buyers and sellers means higher liquidity and lower number of buyers and sellers means poor liquidity.

What liquidity means in the context of the stock market?

In the context of the stock market, it means how easily a large quantity of shares or any other underlying asset can be transacted without incurring a high cost. Now high cost here does not mean transaction charges such as depository charges, brokerage, turnover charges, taxes etc. Here the cost is referred to the one which is incurred due to lack of liquidity, i.e. the Impact cost.

So what exactly is Impact cost?

Impact cost is the cost which the buyer or a seller incurs due to the existing liquidity condition of the market while executing their respective order. It represents the cost of executing the predefined quantity of shares with respect to the availability of buyers and sellers at that given point of time.

Impact cost is an efficient and realistic measure to gauge the liquidity in the market at any specific point of time. In a highly liquid market, it is closer to the true cost of execution faced by traders in comparison to the bid-ask spread.

Let's look at an example to understand the impact cost better.

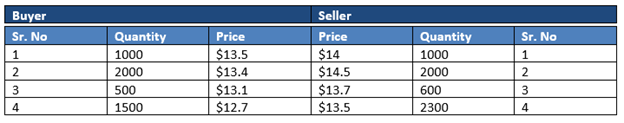

Let’s assume there are 4 buyers and 4 sellers for XYZ stock present at the same time in the same market and are willing to buy XYZ (buyer) or sell the existing holding of XYZ (seller) at their respective prices. The highest price a buyer is willing to pay is $13.5 (bid), and the lowest price the seller is willing to offer is $14 (ask).

If a buyer wants to buy 100 shares of XYZ, it would be matched against the lowest available sell order at $14, i.e. he would get 100 shares at $14 per share. If a seller wants to sell 100 shares of XYZ, it would be matched against the highest available buy order at $13.5, i.e. the shares would be sold at $13.5 per share.

Hence if a person buys 100 shares and sells them immediately, he is losing due to the bid-ask spread (the difference between the lowest bid and highest offer). This bid-ask spread is considered as the transaction cost, which is charged by the market for the privilege of trading.

The bid-ask spread may change with the change in the size of the transaction therefore in the above example the bid-ask spread of $0.5 is valid for an order size from 1 share to 1000 shares. However, for a quantity which is larger than 1000 shares, the Impact cost would be quite different from the impact cost for the order below 1000 shares.

Now if the buyer decides to buy and sell a relatively larger quantity of 3000 shares, then his/her buy order will hit the flowing sell orders. It would be matched against the lowest available sell orders at $14 and $14.5, i.e. he would get 1000 shares at $14 per share and remaining 2000 shares at $14.5 per share.

Similarly, while selling the 3000 quantity of shares, his order would match the lowest available buy orders, 1000 shares at $13.5 per share and remaining 2000 shares at $13.4 per share. This clearly states the transaction cost of a larger quantity would be higher as remaining orders are being executed at relatively higher prices for buying and lower prices for selling.

The ideal transaction cost is the average of the best bid and offer price, in the above example, it is ($13.5+$14)/2, i.e. $13.75. In a highly liquid market, it would be possible to transact a large number of shares on both buy and sell side at current prices which are very close to the ideal price of $13.75 per share (as the case with the transaction of 100 shares). But generally, less than $13.75 per share may be received while selling and more than $13.75 per share may be paid while buying shares due to large quantity (as the case with the transaction of 3000 shares). This increase in the transaction cost is experienced vis-à-vis the ideal transaction cost, when shares or any other underlying assets are being bought or sold, is called impact cost which varies with the quantity of shares been transacted.

Continuing with the above example the ideal transaction cost of initial buying and selling 100 shares was $13.75 but due to a relatively larger order in the next transaction of 3000 shares, our impact cost had gone up due to lack of liquidity. How? let us see.

The weighted average selling price for 3000 shares is $13.43 (1000 shares being sold at $13.5 and the remaining 2000 shares sold at $13.4) which is 8.53% worse than the ideal transaction price of $13.75. In simple words, while selling 3000 shares, the seller received $13.43 per share instead of ideal $13.75. Hence, we can say "The impact cost faced in selling 3000 shares is 8.53% than the ideal transaction price".

Please wait processing your request...

Please wait processing your request...