What are High–Yield Bonds?

High-Yield bonds are those bonds where the issuer pays higher interest rates because these bonds have lower credit ratings than the investment-grade bonds (a rating that shows that a municipal/corporate bond is at low risk of default).

Since they are unstable, high-yield bonds are also known as junk bonds or speculative-grade bonds. Bonds with a high yield usually mature in seven to ten years. There are, however, exceptions. Junk bonds have a higher likelihood of defaulting.

Source: g0d4ather, Shutterstock.com

Summary

- High-yield bonds have a credit rating of less than Baa3 from Moody's or BBB- from Standard and Poor's (S&P) and Fitch.

- Improvements in the issuer's financial results and creditworthiness will transform high-yield bonds into investment-grade bonds.

- To lure investors, non-investment grade debt issuers offer higher interest rates and design investor-friendly bond agreement.

Frequently Asked Questions (FAQs)

What are the two different categories of High-Yield Bonds?

High-Yield Bonds can be classified into two categories:

Source: Copyright © 2021 Kalkine Media

- Fallen Angels: A fallen angel is a bond that had higher ratings before being downgraded to junk bond status due to the issuing company's low credit quality. In the first half of 2016, there were 26 fallen angels around the world. Half of the 26 fallen angels belonged to the United States.

- Rising Stars: A rising star is a bond that is on the verge of being upgraded to investment-grade status. Since, these bonds have improved their financials and reduced the risk of default, there are higher chances that in future they may not be seen as Junk Bonds. Identifying a rising star bond can be highly beneficial if done at the correct time, depending on prevailing market conditions.

What is the future of the High-Yield Bond market and status?

There was no significant growth of the non-investment-grade market until the 1970s. The demand for high yield, on the other hand, has exploded since the early 2000s. The sector saw its first boom in the 1980s when businesses began to use High-Yield Bonds as a funding vehicle for mergers and leveraged buyouts. The most popular example is the US$31 billion leveraged buyouts of RJR Nabisco by private equity sponsor Kohlberg Kravis & Roberts in the year 1989.

In the US, the overall corporate (investment grade) bond market is approximately US$8.1 trillion, with high yield bonds comprising 15% of the market. Besides, as per last year figures, in the US, the estimated value of the High-Yield Bond market was US$1.2 trillion. Given the present scenario, with both investors as well as the companies preferring this as their investment option, it does not seem that the growth in the non-investment-grade market will slow down in the foreseeable future.

Who usually issues High-Yield bonds in the market?

It is believed that high yield bonds are mostly issued by companies or entities who want to raise money for growth, cash flow purposes, or to refinance the existing loans or debts. Few examples can be – Fallen Angels, leveraged buyouts, insurance companies, mutual funds, pension funds, collateralized debt obligations, Exchange-Traded Funds, etc.

Typically, during an economic slowdown, financially depressed companies issue Bonds to raise money.

What are the advantages and disadvantages of High –Yield Bonds?

Advantages:

- Higher Yields: As opposed to investment-grade bonds, high-yield bonds will add at least 150 to 300 basis points to an investor's portfolio.

- Higher Expected Returns: For most long holding periods, high-yield bonds outperform their investment-grade counterparts.

- Consistent Income: If a company does not default, the income that these bonds provide will be regular.

Disadvantages:

- Default Risk: There is always a high risk of default associated with junk bonds. The best way to deal with it is through diversification. It is important to note that High-Yield bond ETFs and mutual funds are considered better options for investment by retail investors.

- Higher Volatility: High-yield bond yields have historically been even more volatile than investment-grade bonds. High-yield bonds lost 26.17% of their value in a single year in 2008. A diversified portfolio of investment-grade bonds never lost more than 3% over a twelve-month period between 1980 and 2020.

- Worth of High-Yield bond may decline during a recession: It is usually seen that during a recession, investors mainly invest in gold and investment-grade bonds. At such times, risk-averse investors abstain from investing in junk bonds because these bonds become even much riskier when the economy is not in good health.

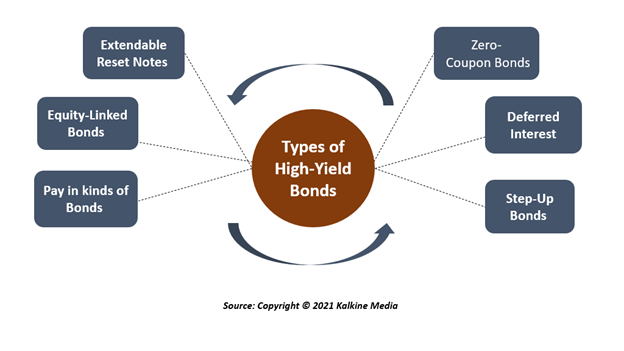

What are the different types of High-Yield Bonds?

Zero-Coupon Bonds: Zero Coupon bonds also known as accrual bonds refers to those bonds which offer a deep discount and makes no periodic interest payments. Besides, these bonds are suitable for long-term investment plans.

Step-Up Bonds: A Step-up bond is a type of security that possess a coupon rate that increases with time. Other than other benefits, investors investing in these bonds get the benefit of fixed-income securities. These Bonds are managed by the Securities and Exchange Commission (SEC).

Deferred Interest: Deferred Interest bond refers to the bond that pays the interest as a single payment rather than in monthly or periodic installments. Example can be toggle notes and Zero-coupon bonds. Investors looking for a higher rate of interest can opt for these bonds.

Pay in Kinds of Bonds: Pay in Kinds of Bonds is a debt structure wherein the borrowers are permitted to pay interest with additional debt instead of cash. Pay in Kinds of Bonds offer higher yields, because the risk of default by the issuers of these bonds is also high compared to other bonds.

Equity Linked Bonds: Equity Linked Bond is a type of debt instrument with unfixed payments, where the final payout is based on an equity market benchmark. These securities usually mature within twelve months, pay higher yields, and are primarily issued to raise money.

Extendable Reset Bonds: These are the type of bonds that give the bondholders and the issuers the right to extend the initial maturity of a debt security to a later date. Investors tend to benefit from these bonds when interest rates witness a downfall.

What are the Characteristics of High-Yield Bonds?

The two constant characteristics of Junk Bonds include – Coupon (the rate of interest which the private entities pay to the bondholder or investor every year) and Maturity -- when the full principal amount of the bond issued is due to investors and indicative of interest payment dates.

Other features include if, where, and at what price the borrower can call a bond, financial performance, disclosure covenants, and even equity warrants. It is to be noted that equity warrants often are attached to those junk bonds which are more vulnerable to risks. In such a situation, each bond carries a specific number of warrants to purchase equity in the company later.

What is the future of the High-Yield Bond market?

There was no significant growth of the non-investment-grade market until 1970s. The demand for high yield, on the other hand, has exploded since the early 2000s. The sector saw its first boom in the 1980s, when businesses began to use High-Yield Bonds as a funding vehicle for mergers and leveraged buyouts. The most popular example is the US$31 billion leveraged buyouts of RJR Nabisco by private equity sponsor Kohlberg Kravis & Roberts in the year 1989.

In the US, the overall corporate (investment grade) bond market is approximately US$8.1 trillion, with high yield bonds comprising 15% of the market. Besides, as per last year figures, in the US, the estimated value of the High-Yield Bond market was US$ 1.2 trillion. Given the present scenario, with both investors as well as the companies preferring this as their investment option, it does not seem that the growth in the non-investment-grade market will slow down in the foreseeable future.

Rating agencies involved in the credit rating of Junk Bonds

Rating agencies, such as Moody’s, S&P and Fitch, are responsible for providing credit ratings to the bonds based on their vulnerability to risks and quality.

Please wait processing your request...

Please wait processing your request...