What is meant by Goods and Services tax?

Goods and Services tax or GST is a tax that customers must pay upon the consumption of goods and services like clothes, food, everyday items, etc. It is an indirect tax that is levied on businesses providing these goods and services but is paid by the customers. An indirect tax is a tax that is levied on one party, but the burden of the tax ultimately falls on another party.

Businesses include the GST amount into the price of the product they are selling. Thus, the GST amount is paid by the consumers as it is passed down to them by the manufacturers.

How does GST work?

Most countries have a unified system of applying GST. However, there may be complexities attached to the application of GST. In Australia, the GST rate is 10%. Thus, a single rate applies to the entire country. A GST tax integrates various other taxes that are levied on businesses and on the goods and services purchased in an economy.

Unified GST means that the central tax and state-level taxes are merged into one. Thus, every item is taxed individually at the same rate across the entire country.

How can businesses register for GST?

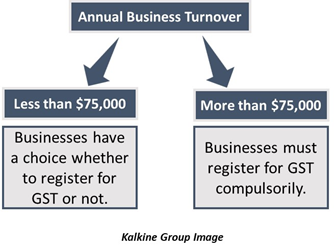

Businesses must register for a GST once they fulfil certain criteria. In Australia, businesses must have an annual turnover of $75,000 or more to be able to register for GST. However, if a business has an annual turnover less than $75,000 then the owner has the choice to opt out of registering for GST.

Businesses have a period of 21 days to register once they reach the turnover limit. However, taxi drivers and ride-sharing drivers must register for a GST irrespective of their turnover. The turnover limit for non-for-profit organisations is higher at $150,000.

Businesses must register for a GST through the Australian Business Register which is the central registry of Australian business information. Businesses can also register with the ATO or the Business Portal.

How is GST implemented in Australia?

GST application may vary from country to country. Many countries have faced issues with the application of GST as it is not a straightforward tax applied in an ad-valorem manner.

When businesses make a taxable sale of more than $82.50(including GST), then the businesses must send a tax invoice to their customers. This enables the customers to avail GST credit.

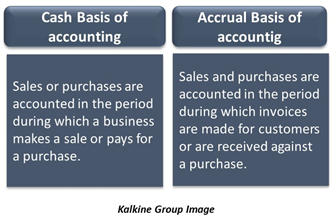

There are two methods of accounting GST, these include: the cash basis or the accrual basis. Only businesses with a turnover of less than $2 million can choose which accounting method to adopt. However, other businesses must choose accrual basis.

Under the cash basis, sales or purchases are accounted in the period in which a business makes a sale or pays for a purchase. This method allows the tax to be better aligned with the cash flow. Under the accrual basis, the sales and purchases are accounted in the period during which invoices are made for customers or are received against a purchase.

What is GST credit or input credit?

Buyers can claim GST credit for the goods and services bought by them for their business. This is also called an input credit. Customers are eligible for a GST credit only if they have a business in operation. It allows them to reduce on dual GST application as the products they purchase as inputs from other businesses would be taxed as final goods later.

The purchase against which GST credit is granted must be solely used for business and not for making input-taxed supplies. The credit can only be availed if the price of the input includes GST. A corresponding tax invoice must be available with the buyer against which credit would be given. Another important prerequisite is that the supplier of the product must have registered for GST.

It is important to note that GST credit is given only for those products which are to be used as inputs. Thus, if a customer were to purchase few goods for private use and the rest as inputs for his business, then credit can only be availed for the latter.

GST credit can only be applied to those purchases against which GST is levied. For instance, credit can not be given against the wages paid to employees as there is no GST on wages.

What are the advantages of GST?

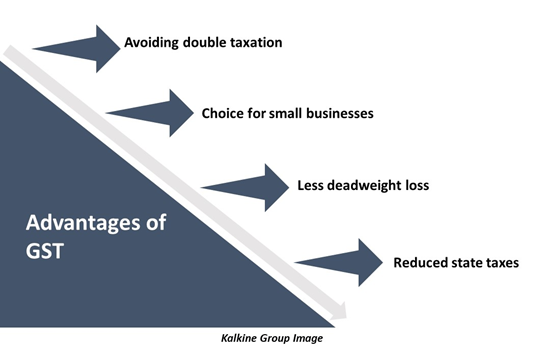

- Avoiding double taxation: GST helps avoid the cascading effect of taxes which refers to the multiple levels of taxation that a good might go through. With GST goods can be taxed once and for all.

- Choice for small businesses: Small business have an option on whether to opt for GST or not. This gives them more leverage in conducting business and the tax burden on them is reduced.

- Less deadweight loss: Most taxes add less revenue to the government that the amount of money they pull out of the system. However, under the GST reform, which was modelled on the VAT system, taxation is done on spending rather than income. Thus, it is less inefficient and less distortionary.

- Reduced state taxes: This was the main intent which led to the adoption of GST in Australia. GST allows the eradication of various state level charges, the burden of which fell on the sellers. It also reduces tax avoidance which occurs in the cash economy.

What are the disadvantages of GST?

Once a business is registered for GST, they must complete a business activity statement (BAS) every quarter. BAS is a form that requires data on all the sales, expenses as well as the GST collected and spent by the business. Thus, implementing GST with the proper formula and calculating the right amount might be a lengthy process.

In addition to this, GST requires business to have digital system integrated in their functioning. Thus, applying GST means having full fledged digital account of all transactions in the business. This is especially important for businesses that are small and would have to make the shift to GST in the near future.

Please wait processing your request...

Please wait processing your request...