Generally Accepted Accounting Principles (GAAP)

GAAP stands for Generally Accepted Accounting Principles, which is an accounting principle that provides a set of rules, standards and procedures issued by the Financial Accounting Standards Board to control financial reporting and corporate accounting. The Generally Accepted Accounting Principles are mainly used by public companies in the United States.

Summary

- The Generally Accepted Accounting Principles provides a designed set of rules, concepts, methods, standards, procedure used for corporate accounting and financial reporting.

- The Generally Accepted Accounting Principles are adopted and used by the public organizations in the United States.

- The Generally Accepted Accounting Principles ensures the consistency and transparency of the financial reports and statements of an organization.

Source: Copyright © 2021 Kalkine Media

Understanding Generally Accepted Accounting Principles

The Generally Accepted Accounting Principles refers to the concepts, set of rules, methods standards, procedure used for corporate accounting and financial reporting. GAAP ensures the consistency and transparency of the financial reports and statements of an organisation. GAAP provides the general rules and guidelines to govern accounting. It is also known as US GAAP that is developed by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB) to apply in governmental and non-profit accounting.

GAAP used by any company to organise and summarise their financial transactions and information in the form of accounting records.

Frequently Asked Questions (FAQs)

What are the different principals of Generally Accepted Accounting Principles?

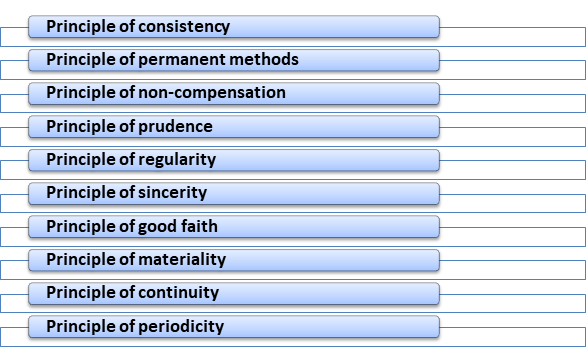

Generally Accepted Accounting Principles are generally based on 10 principles:

Source: Copyright © 2021 Kalkine Media

- Principle of consistency

According to principle of consistency, if an organisation starts to use an accounting principle or method, it must follow it in future consistently. Principle of consistency ensures that the adopted standards have to be followed consistently in financial reporting of an organisation in future accounting periods.

- Principle of permanent methods

Principle of permanent methods is closely related to the Principle of Consistency. It states that consistent and same procedures are used in accounting and financial reporting of an organisation that allows comparison of data.

- Principle of non-compensation

According to principle of non-compensation, an organization should not offset its debts with its assets. An organization’s performance has to report all aspects including positive and negative.

- Principle of prudence

According to principle of prudence, an organisation’s reporting of financial data has to be factual, reasonable, and not speculative.

- Principle of regularity

According to principle of regularity, accountants of an organisation strictly adhere to the GAAP.

- Principle of sincerity

According to the principal of sincerity, accountants of an organisation is performing and reporting with the honesty and accuracy.

- Principle of good faith

Principle of good faith is close related with the principle of good faith, and states that any third person who is involved in financial reporting is need to in good faith and honest.

- Principle of materiality

According to principal of materiality, an organisation’s financial position should be clearly disclosed in its financial reports.

- Principle of continuity

According to the principal of continuity, an organisation runs and prepares its financial reports with the assumption of its business continuity in future.

- Principle of periodicity

According to the principle of periodicity, an organisation should present its financial reports periodically, such as quarterly or annually.

What is the significance of GAAP?

- GAAP provides concepts, set of rules, methods standards, and procedure that helps in maintaining the financial reports with transparency and consistency.

- It helps investors by providing comparable and transparent financial reports about an organisation’s financial position.

- GAAP make government and non-profit entities more accountable.

- These principles make an organisation’s financial statements consistent, provide financial reports periodically, such as quarterly or annually.

What are the key assumptions of GAAP?

Generally Accepted Accounting Principles are based on various assumptions:

- These principles are based on the assumption that every business has its separate entity. Based on that, the figures shown in the financial reports of an organisation are only related to that particular organisation and no other entity can claim to its revenues.

- According to second assumption of GAAP, a business should follow the concept of going concern with the assumption foreseeable future.

- The third assumption of GAAP is that an organisation’s financial statements are recorded in the stable currency.

- These principles are based on an accurate time period showed in financial reporting. For instance, as organisation accounting period from 1 January 1- 31 December, all the transactions during that time period are showed in the financial report of that year.

What is the difference between International Financial Reporting Standards and GAAP?

The International Financial Reporting Standards (IFRS) refers to the set of rules issued by the International Accounting Standards Board (IASB) that helps to make the financial statements more consistent, transparent, and comparable. It is an alternative to the GAAP. Private companies have option how to make their financial reports by using different methods and principals and the International Financial Reporting Standards (IFRS) is mainly used by private companies. On the other hand, the Generally Accepted Accounting Principles are adopted and used by the public organizations in the United States.

The differences are:

- GAAP has more concrete methods, rules, guidelines and principles in the comparison of the International Financial Reporting Standards (IFRS).

- According to the IFRS, assets and liabilities required to be separated, and in the GAAP this is the only suggested method of financial reporting.

- GAAP recorded intangible assets at fair value, whereas the International Financial Reporting Standards considers intangible assets only if they have some future benefits.

- In GAAP, companies have to give a Statement of Comprehensive Income on the other side the International Financial Reporting Standards, does not.

- In GAAP, an organisation has to record extraordinary items in a separate income column whereas in the International Financial Reporting Standards, extraordinary items can be recorded in the income statement.

- In GAAP, inventory does not write down reversals, whereas in the International Financial Reporting Standards, in some cases inventory can write down reversals.

Please wait processing your request...

Please wait processing your request...