What Is Gapping?

Gapping happens when the value of a security or a commodity opens below or above the preceding day’s close accompanied by no transaction in between. In the security’s price chart, the discontinuity area is known as the gap. Gaps may appear in the price chart when the market fundamentals have changed rapidly due to any headlines when the market is closed. For example, an earnings call after-hours may result in gapping.

In the context of the banking industry, gapping stands for the spread or difference in the rate of lending or borrowing. This gap is used to calculate the change in the money held or money loaned over time.

Summary

- Gapping happens when the value of a security or a commodity, opens below or above the preceding day’s close accompanied by no transaction in between.

- In the security’s price chart, the discontinuity area is known as the gap.

- Gaps may appear in the price chart when the market fundamentals have changed rapidly due to any headlines when the market is closed.

- In the context of the banking industry, gapping stands for the spread or difference in the rate of lending or borrowing.

Frequently Asked Questions (FAQs)

What is meant by the stock market gap?

When there is a difference between the previous day closing price and the opening price of a stock, then it is termed as a gap or occurrences of a gap. The gap occurrences are not limited to the stock market, it can take place in other financial markets as well. In case of low market liquidity, a gap usually occurs, that is, the market does not have enough buyers and sellers to stop a sudden price change.

Moreover, the gap can also happen in the high trading market like the forex market. In a stock market, a gap is generally observed after the close of the trading day and the opening of trading the next day. Events like company related news or earning releases have an impact on the market sentiments and as result, a gap is observed on the stock price chart.

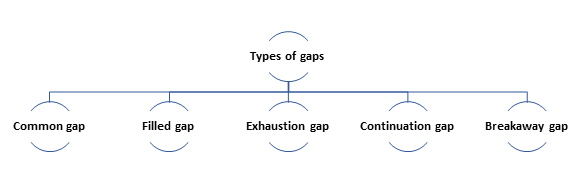

What are the types of gaps?

The gaps are dependent upon the market conditions. The most familiar types of gap are –

Common gap – These are the most commonly observed gaps in the stock market. In the stock market, they can be observed when a new trading day starts. In the forex market, they can be observed after a pause of weekend trading. Moreover, they can be seen during the reading hours, and occur due to strong selling or buying pressure.

Breakaway gap – This gap usually occurs when a trend reversal is around the corner, that is, it takes place at the bottom of a downtrend or the top of the uptrend. When major chart patterns are broken or high trading volume is present, then also breakaway gap happens.

Continuation gap – In the middle of a strong down or uptrend, continuation gap occurs in the direction of the trend. An occurrence of a continuation gap projects the existence of selling pressure in a downtrend and extensive buying pressure during upward trends.

Exhaustion gap – This gap occurs during a strong down or upward trend, however in the opposite direction of the trend. It projects the potential reversal in the underlying trend.

Filled gap – The market generally fills the common gaps.

Source: Copyright © 2021 Kalkine Media

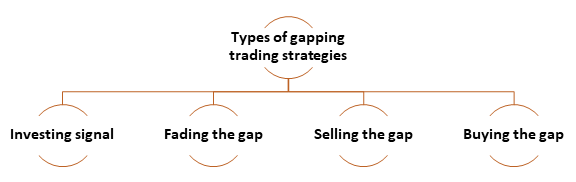

What are the gapping trading strategies?

Gaps can be used by traders to gain analytical insight into the market. For example, if an exhaustion gap occurs, then it indicates the potential reversal in the market and traders take actions or construct strategies accordingly.

Some traders can also utilise the gap and take a trading position during its occurrences. This phenomenon is known as playing with the gap.

Buying the gap – this strategy is also known as the gap and go strategy among the traders. The traders take a position in the market during the stock gaps and a stop - loss order is placed under the low gap bar. Or the traders can wait for the gap to be filled by price change and a limit order can be placed to purchase the stock when the prices are higher than the previous day close.

Selling the gap – In this strategy, the trader takes a short position during a gap down.

Fading the gap – Fading strategy is deployed to exploit the gapping. Since the majority of the gaps will be filled over a period, the traders take a trading position in the opposite direction and attempt to make a profit. A stop-loss order is also used and the profit target is generally set near the previous day close.

Investing signal – When a trader observes a runaway or breakaway gap, then it can be interpreted as a signal that advantage can be taken from the trend. Therefore, after locating any of these gaps, a trader may take a position in the market in the direction of the gap. Moreover, they can also hold the transaction until the exhaustion gap happens.

Source: Copyright © 2021 Kalkine Media

What is the relationship between gapping and stop-loss order?

In a long position, a trader can use stop loss order beneath their stop-loss price due to gapping.

A trader can reduce the risk associated with the gapping by not taking a position in the market directly when there are chances of news announcement of the company’s earnings. These two factors can impact the stock prices significantly. Moreover, risk can be minimised by reducing the position in stocks with high volatility.

The traders with a short position can be affected by the gapping risk and may have to bear risk more than expected. Therefore, it should be considered while using a stop loss.

Please wait processing your request...

Please wait processing your request...