What are funds from operations?

Funds from operations (FFO) can simply be defined by a process that is assessed by the Australian Real Estate Investment Trust (A-REIT) to analyse the cash flow from operational activities. It is generally used by the real estate companies to view their operational performance.

The funds from operations are purely based on the cash that comes due to the operational activities. It does not include profit earned from financial investments or revenue earned through some other methods.

Summary

- Funds from operations is an activity to analyse the cash flow from operational activities.

- The purpose of FFO is to assess the operational performance of a company.

- Funds from operations does not include any profit earned from financial investments.

Frequently Asked Questions (FAQ)

How can we explain the funds from the operations process?

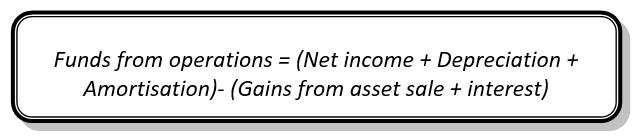

Funds from operations are generally utilised by organisations that are closely related to the Australia Real Estate Investment Trust (A-REIT). It accounts for a detailed record of the fund that is generated through operational activities. Funds from operations can be calculated by subtracting the profit earned from investments or selling assets from the sum of depreciation, amortisation, and losses on sales of assets to earning.

Funds from operations is often mistakenly understood by people as cash flow. Initially, both cash flow and fund flow might appear the same. However, the major difference between cash flow and the funds from operations is that cash flow records all the details of the financial transactions happening within an organisation, whereas fund from operations only records the fund that is generated through operational activities. The purpose of FFO is to understand the operational performance of a company.

Image source: © VectorMine | Megapixl.com

How to calculate funds from operations?

Follow the below-mentioned steps to calculate funds from operations:

- Figure out the net income of the company that has been stated at the bottom of its income statement.

- Depreciations and amortisations, which the company generally spends on the tangible or intangible assets for some period of time. They are merely considered for accounting; hence, they are added back to the net income to determine the actual amount of income.

- Do note that funds from operations do not include any profit earned from financial investments. Therefore, you must subtract any type of profit earned outside the operational activities from the net income.

- Also, subtract any type of interest earned as it is not a part of operational income.

Here goes the formula of funds from operations:

Image source: Copyright © 2021 Kalkine Media

Things to keep in mind while calculating the funds from operations:

- FFO does include depreciation and amortisation.

- FFO does not include profit gained from investments.

- FFO does not include transactions due to the sale of land or property.

For example, let us assume that real estate company A has earned a net income of AU$15 million along with AU$3 million depreciation, AU$2 million amortisation, AU$1 million profit on sales of assets and AU$1 million profit from other investing activities. Therefore, the FFO of company A will be = (15+3+2) - (1+1) = AU$18 million.

What is adjusted funds from operations?

Nowadays, the analysts are calculating adjusted funds from operations wherein certain recurring expenditures show up in the books of Australian Real Estate Investment Trust (A-REIT) companies. For instance, we can assume the expenses of any property related damage or renovation cost are known as recurring expenses. Such type of expenses fall under the categories of capital expenditures and are therefore deducted from FFO to obtain the adjusted funds from operations.

What is the significance of FFO in the real estate industry?

The funds from operations method are predominately utilised in the real estate industry in order to judge its operational performance. The operational performance in real estate highly depends upon the macroeconomics aspects; hence, the cash accounting method fails to work in this industry. Therefore, FFO is the only significant method to measure the operational performance of real estate companies accurately.

Image source: © Starblue | Megapixl.com

What does FFO indicate?

Funds from operations can be briefly described as the cash generated by A-REIT companies from their operational activities. A real estate FFO could be used as an excellent way to set a performance benchmark for all the companies under A-REIT. FFO should not be mistaken for the A-REIT cash flow statement.

A cash flow statement records all the transactional activities taking place within a company, while funds from operations only record the transactional activities taking place through operations. The aim of FFO is to assess the performance of real estate companies.

Please wait processing your request...

Please wait processing your request...