What is Forward Rate Agreement?

Forward rate agreements (FRA) are over-the-counter (OTC) agreements amongst parties who decide the rate of interest payable on a future date. It allows individuals or firms to exchange a guaranteed future interest rate for an estimated current payment. Parties involved also conclude the termination date and notional value. FRAs are generally settled in cash. Payment is for the net difference in the contracted interest rate and floating market interest rate. It is not the notional amount that is exchanged but the interest differential based on the notional value of FRA.

Summary

- Forward Rate Agreements are interest rate linear derivatives by nature, traded over the counter.

- It is a type of Interest rate hedging instrument that allows individuals or firms to exchange a guaranteed future interest rate for an estimated current payment.

- Long positioned participants or Buyers, benefit when rates increase while shorting parties or sellers gain on lowered interest rates.

Frequently Asked Questions (FAQs)-

Who participates in a FRA?

It is best for investors or firms who want to lock in an interest rate. Parties interested lock in interest rates payable in the future use this agreement. Investors not wanting exposure to interest rate volatility are interested in FRA.

Buyers of a forward rate agreement try to protect themselves from any future upside movements in interest rates. Sellers, of FRA, enter a contract to ensure safety from future downfalls in interest rates. FRA is structured to meet the precise requirements of participants as they are OTC agreements.

What are the Features of Forward Rate Agreements (FRAs)?

- Forward Rate Agreements are interest rate linear derivatives by nature.

- It is an over-the-counter type of short-term hedging instrument.

- It is a future settlement contract for interest differential based on a notional principal.

- The principal amount notional without any commitment on any counterparties.

- Prices are in the form of two-way quotes where the buyer quotes a higher rate and the seller a lower rate.

- The reference rate is based on a benchmark floating interest rate like LIBOR, MIBOR.

- Long positioned participant benefits when rates increase while shorting party gains on lowered interest rates.

Example

- An Indian Bank and an Australian listed company may create and sign a FRA, where the Indian bank agrees to pay a stable interest of 8% and receive a floating rate of interest based on LIBOR plus a margin of 2% on the principal amount of AUD1000 million.

- Another instance can be when, two firms contract to borrow USD1 million after 90 days for 120 days, at 10%. Here, the settlement date will be post 90 days when the amount will be borrowed/lent for 120 days. The borrowing party is usually the buyer while a lending organisation is a seller.

FRAs are quoted in terms of months to settlement date and interest term. In the above case, the settlement date is after 3 months, and the interest period is of 4 months. Thus, FRA will be valid up to a total of 3+4 = 7 months or 210 days. This FRA will be quoted as 3×7 FRA in the FRA market.

How is the settlement amount & benefit from FRA computed?

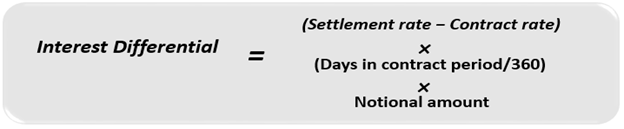

In FRA, the amount to be swapped on the payment date is called the settlement amount. It is computed using the steps described below.

- Step 1 - Computing interest rate differential

By comparing the FRA rate and the settlement rate, an interest rate differential is derived. It is worked out as follows:

Source: Copyright © 2021 Kalkine Media

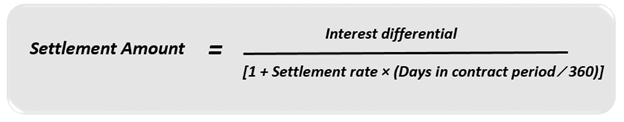

- Step 2 - Computing Settlement Amount

The settlement amount is paid upfront at the date of contact, but fluctuating rates depend on interbank rates like LIBOR and are paid at end of the term. Thus, the above-computed interest differential needs to be discounted, using the settlement rate. The settlement amount is therefore the present value computed as:

Source: Copyright © 2021 Kalkine Media

If the settlement rate is higher than the contract rate, then the FRA seller pays the settlement amount to the buyer and vice versa. If both rates are equal, there is no need to make any payment.

Consider a 2×5 FRA on a notional principal of USD2 million. The FRA rate is 10%. So, the settlement date will be after 2 months or 60 days and it will be based on a 90-day benchmark interest rate, say, LIBOR.

If, on the settlement date, the actual 90-day LIBOR is 12%. The buyer will be able to borrow at a rate of 10% under the FRA, gaining 2%. So, the borrower will save-

= 2,000,000 * 2% *90/360 = USD 10,000

How are FRAs used by contacting parties?

A FRA is used by contracting parties for:

- Hedging future movements of interest payments on loans and debt receipts by fixing an interest rate.

- Sometimes is also used for trading purposes based on expectations of future interest rate trends.

- It can be used in arbitrage by individuals trying to benefit from the price difference between FRAs and any other interest rate contract.

- It is a short-term fixed-interest financing option in exchange for fluctuating interest debts.

Source: https://www.iotafinance.com/en/Article-Forward-rate-agreements-FRAs.html

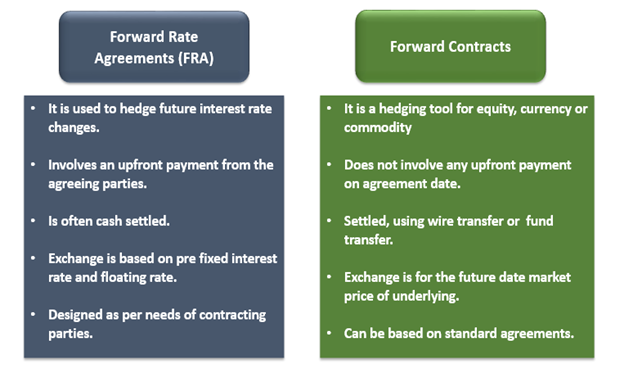

How are FRAs different from Forward Contracts?

Source: Copyright © 2021 Kalkine Media

What are the Benefits & Drawbacks of using Forwarding Rate Agreement?

Forward rate agreements benefit parties as they-

- Enable risk reduction of future adverse movements in interest rates.

- Currency fluctuation risk can also be avoided using a Forward Rate Agreement as it is designed according to user needs.

- Forward Rate Agreements are derivatives and can be shown as Off-Balance Sheet items thus not impacting Balance Sheet Ratios.

- Settlement is cash-based and not via assets or other fund balances.

On the other hand,

- FRA being Over-the-counter instruments carry, a higher Counterparty Risk.

- They are notional agreements, and therefore don’t involve any exchange of principal at the expiry date.

- They are similar to futures customized by contracting parties, hence entail drawbacks of futures contracts.

- It is a bit complex to derive its value as they are Derivatives, thus not for retail investors.

Please wait processing your request...

Please wait processing your request...