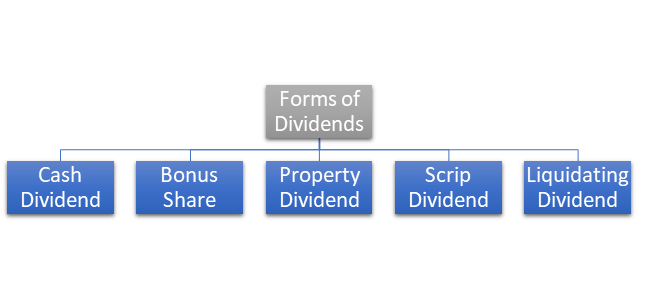

What are forms of dividend payments?

A company pays out a dividend from earnings as a return to shareholders. It is at the company's discretion whether dividends will be paid annually, monthly, or quarterly. It depends on the dividend policy. A company has various ways of paying out dividends. Dividends can be paid as a cash dividend, stock dividend, property dividend, scrip dividend, or liquidating dividends.

Summary

- Dividends are a part of earnings given to shareholders or owners as a return on their invested capital.

- Dividends can be paid as a cash dividend, stock dividend, property dividend, scrip dividend, or liquidating dividends.

- Monetary and non-monetary classifications of dividends exist, and the company's board may decide on the payment type based on a company's situation.

Frequently Asked Questions (FAQ)-

What are cash dividends?

Cash dividends are the most visible form of dividend payment. It utilises a company's cash for payout. The board of directors pass a resolution to pay a certain dividend amount in cash on the dividend declaration date. It is payable to those eligible investors who hold the company's stock on a specific date, often the record date. The record date is when dividends are assigned to the shareholders. On the payment date, the company issues cash to holders as dividend payments. It is by far the most popular form of dividend payout. The money shelled out is deposited in the bank accounts of shareholders. The shareholders are paid in cash as per their shareholding on a per-share basis. Only companies having positive earnings or cash flow can distribute cash dividends.

Source: © Adrian825 | Megapixl.com

What are stock dividends?

When a company issues additional shares to its existing shareholders for no extra consideration, it is called a stock dividend. A company often issues this type of dividend with low operating cash available but still wants to satisfy investors. Each equity shareholder in such a case will receive a certain number of additional shares based on original shareholding. For the company, the number of issued shares in its existing capital base will increase. Since there is an increase in the share capital, it will adjust its market price, EPS, DPS, and other metrics based on share capital accordingly. If shareholder desires cash returns, they can sell the stock in the secondary market for cash. It is termed earnings capitalisation. If the company issues below 25% of the existing number of outstanding shares, it is termed as a stock dividend or a stock split. Retained earnings are utilised for giving this type of dividend.

Source: Copyright © 2021 Kalkine Media

What are property dividends?

It is another form of non-monetary dividend paid to shareholders. Property dividends are recorded at the current market price of the asset issued as dividends. Often the market price of an asset is either above or below the book value; therefore, property dividends either incur profit or loss depending on the book value entered. The distributed asset could be anything like inventory, equipment, vehicle, or any other asset. The value must be restated at fair value on the date of issuing the dividend. Businesses issue property dividends to adjust or alter taxable or reported income.

What are scrip dividends?

A Scrip is, in essence, a promissory note that is issued instead of a dividend when a company doesn't have sufficient funds to issue dividends in future. The promissory note is for a later date payment to shareholders. A dividend of this type is accounted as a note payable in the books of account. It is like a charge created for future dividends in the accounting books. It provides surety for future dividends.

What are liquidating dividends?

It is the dividend payment made at the time of liquidation of the company. The board of the company pays it for returning the original capital to shareholders. It is paid when the company wraps up or intends to close the business entirely. It is a term used to describe the returned original capital contributed by the equity shareholders, but it is in dividends. For shareholders or interested investors, liquidating capital is an indication of the closedown of the company. It is a precursor decided by the board of directors before shutting down the business. A liquidating dividend is the same as a cash dividend in the books of account, but the funding is from the available capital for liquidation.

What are the advantages of paying dividends?

Shelling out dividends has various benefits for the shareholders and the company. Some of them are following.

- Investors are attracted to companies that pay regular dividends. Thus, any dividend holds the investors' interest in the company even if it is going through a comparatively rough phase. Investors like stability in dividends as it assures a reliable source of earnings. It is beneficial even when the market price of the share dips.

- It is good for investors who are looking to earn quickly and not wait for returns. Dividend payments ensure investors receive some money and do not have to wait for share appreciation.

- Stability in dividend payments portrays a positive image for any company. Investors prefer to have stable regular dividends. It provides a kind of predictability towards the company's earnings capacity.

- Investors keep receiving the benefits and do not need to sell their shares. Double benefits of share price appreciation along with a part of earnings is received. There is temporary cash availability with the shareholders.

- Primarily a business that has saturated or explored its capacities fully can attract investors by paying regular dividends. Reinvesting earnings may not generate any needed value for them. Instead, shareholder wealth maximisation is possible with dividend distribution.

Image Source: © Fewerton | Megapixl.com

What are the disadvantages of dividends?

While dividends are so beneficial, they also have a few disadvantages.

-

Regularity needs to be maintained. If a company wants to maintain investors' interest with dividends, regularity in dividends becomes essential. If in between companies are unable to pay dividends for some time, it may lose few old investors.

-

When the payout ratio is high, the retention ratio automatically decreases. Dividend payments decrease the cash available to businesses. Thus, not enough cash is left to fulfil unexpected obligations or expenses that can arise anytime.

-

Dividends limits a company's growth as earnings are paid out and not reinvested into the business.

-

Dividends also need a lot of resources for keeping track of payments and ensuring funds reach investors. Even if holders do not claim dividends, the obligation is on the company to make it either reach them or be used for regulatory approved purposes.

Please wait processing your request...

Please wait processing your request...