Who is a Financial Advisor?

Financial advisors are the professionals who provide financial consultation and guidance to the clients. The financial advisors, based on the understanding of their client’s requirements, provide specific solutions and advice. They earn money by either charging commission on investment or separately charge a consultation fee.

The financial advice can be a general advice or a personalized advice depending on professional’s expertise and licence obtained. In general advice, professionals offer overall generic solutions pertaining to interests of a class/group. The onus of financial decision ultimately lies with the individual basis his own opinion and expectation setting. While, in personalized advice, the advice is tailored to meet the monetary objectives and risk appetite of customers.

The advice can relate to areas such as investment in different asset classes, tax planning, financial coaching, wealth advice, risk management, insurance decisions, retirement, and estate planning. They cater to financial needs of both individuals as well as companies. The financial advisors can provide the services independently, or they can work for the financial firms.

Services of financial advisors are targeted towards increasing the wealth of clients or reducing financial risk, or both. This is done by guiding on investment in alternate return-enhancing or income-generating assets or devising strategies though which cost, and debt can be easily managed.

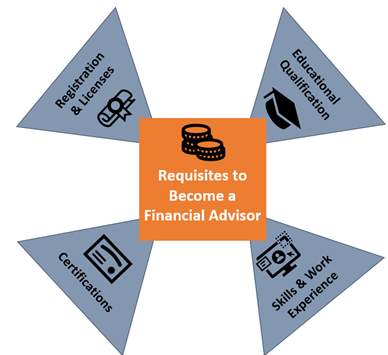

What are the Basic Requisites to Become a Financial Advisor?

A financial advisor must comply to regulations and licensing requirements. The right mix of education, expertise in financial domain, well-experienced team, along with license and certification can go a long way to shape the advisor’s performance and clients’ choice.

Kalkine Image

Let us look at the key elements which are essential to become financial advisors:

- Educational Qualifications

Firms providing financial services often require a degree in finance, accounting, mathematics, business, statistics, or economics from an accredited educational institution. Higher education is not generally required but could be substantially helpful in enhancing the proficiency of advisors.

Educational qualifications play a key role in shaping the advisor’s ability to research market and financial information.

- Registration and Licenses

There does not exist an independent license for becoming a financial advisor catering to all areas of financial consulting services. However, depending upon different fields such as stock investment, risk management, tax planning, etc., the individuals/firms require different types of licenses from designated regulatory authorities under specific Acts.

In the United States, one needs to pass several tests administered by the Financial Industry Regulatory Authority (FINRA) for getting licenses in the respective area of investment. The licenses may include Series 6, Series 7, Series 63, Series 65, Series 66 licenses.

In Australia, one requires an Australian Financial Services (AFS) license for providing various financial consultation and monetary advice related services. There also exists Registered Investment Advisor (RIA) who are registered either with the Securities and Exchange Commission (SEC) or with the Government and regulatory agencies.

In New Zealand, there exists two specific Acts pertaining to regulatory regime for financial advisors: Financial Advisers Act 2008 and Financial Service Providers (Registration and Disputes) Act 2008.

- Certification

Lack of a standalone license for financial advisor may generate credibility issues among prospective clients, who may doubt the expertise of the advisor in the field. No one is ready to shell out and waste their resources and money, especially when they are going for a financial investment. Thus, professional certification gives a competitive edge to an individual over many other financial advisors.

The individuals can get a designation of Certified Financial PlannerTM (CFP), which is awarded by the American Institute of Certified Financial Planner Board of Standards. The requirements for CFP certification include:

- Completed CFP Board-registered education program and Passing CFP test

- Graduate Degree from an accredited institution

- At least three years of experience in relevant financial planning services

- Skills and Work Experience

Financial advice demands not only providing assistance in creation of plans but also offering consultations to the client. Hence, interpersonal communication skills assume immense importance while dealing with a client. Furthermore, strong aptitude is also critical, especially for those working in the areas of devising financial plans and strategies. The delivery of top notch services can further be enhanced through significant work experience in the same field.

What are the Different Types of Financial Advisors?

Depending upon the area in which the services are offered, financial advisors typically fall in one of the following categories:

- Stockbroker- The representative who trades stocks and securities on behalf of the investors is called stockbroker. Stockbrokers can work independently or be associated with a stockbroking firm. The brokers charge a commission for the transaction.

- Investment Advisor- Registered with regulatory bodies, investment managers, apart from picking securities, offers comprehensive guidance. They work to meet the long-term objectives of the clients through asset allocation.

- Tax Planner- Tax Planner takes into account varying tax-related factors for devising a plan which seeks to enhance tax efficiency by dodging avoidable taxes. For instance, they may highlight the tax-friendly investment options, which could help in saving some extent of tax deductions.

- Risk Management Advisor- Risk Management consultants assess the varying risks inherent to a business and can help in mitigating the chances of losses. Both the individuals and the companies are exposed to different types of risks that can affect their returns, such as market risk, business risk and legal risk. The risk management consultants, depending on the nature of the investment and macro-scenario, formulates risk-management strategies.

- Estate Planner- Estate planning involves advance arrangement for managing and disposing of a person’s wealth before their death or incapacitation. Estate planners help in devising plans which could reduce both the legal as well as financial struggles, the person’s loved ones may face in case of the person’s demise.

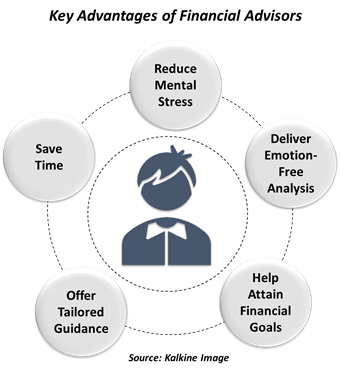

What Are the Pros and Cons of Hiring Financial Advisors?

Pros

- The expert advice provides an advantage in additional areas which can be oblivious to the investors.

- The advisors are more aware of changes in legislation and policies which can hurt the investment objectives.

- Their past experiences can help avoid common pitfalls.

- Financial planning and investments are well aligned.

- Hiring a financial consultant saves time and energy.

Cons

- Additional cost burden in the form of substantial commissions and the fee charged by the financial advisors.

- A financial advisor may have a contradictory interest which may not serve in favour of the client.

- Poor-quality or inexperienced advisors can affect the overall financial planning goals.

Please wait processing your request...

Please wait processing your request...