Final Investment Decision (FID)

Final Investment Decision is a stage during the life cycle of a project where a company decides to move forward or withhold the project. The management decides on the future development of the project.

Large projects are mostly executed by a group of partners rather than a single owner because of the huge capital involvement, as it could be beyond the capacity of a sole owner. The participation of multiple partners also divides the risk associated with the failure of the project.

Understanding FID in detail:

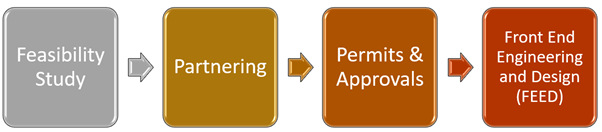

Companies usually take several years to reach the FID stage. It is the most crucial stage for developing a project that comes after a long-travelled road, starting from the Feasibility study phase to the pre–Front End Engineering and Design (FEED) phase and then the Front End Engineering and Design phase arrive at the FID stage finally. The step marks a significant place before commencement of the engineering, procurement, and construction (EPC) stage. During FID, the project owners begin actual execution and construction of the project.

Since large projects require huge capital investment, the owners plan strategically in advance to efficiently execute the project, minimising the risk involved in the project. The owners also keep an eye on optimising the project cost so that the completion can bring profitable returns on the investment for the partners and shareholders.

Roadmap to FID:

The roadmap to FID starts with various phased steps beginning from the Feasibility Study. Let us first understand some basic things related to it.

Source: Copyright © 2021 Kalkine Media Pty Ltd.

Feasibility Study:

This is the foremost basic and primary step towards the development of a project. At this stage, the project idea is validated for its economic viability.

Rough estimations about the project cost and funding sources are identified. The owner company draws a roadmap for the project development.

The company contemplates the best possible ways to eliminate the project development cost without compromising its quality. Assessment is made on how to obtain regulatory permits, local and regional challenges are outlined, including political, climatic, funding, workforce, expertise and other challenges.

Partnering:

Post completion of the Feasibility Study, if more than one company is developing the project, it forms a legally binding agreement in a JV or MoU form. The companies formalise the venture's basic structure, their partnership percentage, responsibilities, and the scope of their work.

The partnership enables the division of capital expenditure between the companies. It also increases technology access across the partners, enhancing the technical expertise and distributes the economic risks among the partners.

Permits/Approvals:

The companies file regulatory approvals and take permits before entering the FID stage. There are numerous types of permits and approvals that might be required before the commencement of a project, like environmental approval, permits from local bodies and other regulatory approvals before the beginning of actual construction work.

The prior permissions allow the partners not to indulge in any legal obligations and charges.

Front End Engineering and Design (FEED):

The next step towards the planning of the project cycle is FEED. This stage marks the next stage after taking necessary approvals, illustrating the basic design of the project.

FEED outlines the financial and technical aspects which are undertaken during the feasibility study. This step outlines the rough estimates of the overall project cost.

Extensive analysis of the potential challenges encountered during the project execution is taken into account and addressed by the partners. It is one of the most significant steps towards developing the project as the activities at this stage guarantee the success of the FID stage.

The best possible engineering and technical options are also nominated and shortlisted in this stage among the partners and contractors. Partners also ensure their eligibility for securing financial support from the fiscal institutions.

In general, if the feasibility study remains positive, overall load transfers to the FEED.

A positive FEED result doesn't mean that the FID will also become positive. Since each project is ranked based on various factors, including return on capital, risks associated with the project and financial options, many projects may have positive FEED result. Still, they might be highly risky, making them hard to forward into the FID stage.

FID is associated with financial options, which may affect the debt level of an organisation. So, sometimes a positive FEED project may also be kept on hold based on the executive committee's decision, formed by the JV or partnering institutions. The operator company heads the committee.

Next Steps after FID:

Source: Copyright © 2021 Kalkine Media Pty Ltd.

Post completion of the FEED, the project enters into the FID stage, and if the partners wish to invest in the project, it enters the EPC stage.

FID is the most crucial stage where partners spend most of their money hiring vendors for subcontracting. During the EPC phase, fundamental engineering planning and construction occur, followed by procurement and purchase of essential services and solutions.

In the final step, construction and installation take place, including civil, electrical and mechanical installations.

Effect of Demand on FIDs:

Weaker market demand for a product may lead to delay in the FIDs. The most recent example can be easily correlated with the 2020 pandemic situation.

Last year, the oil industry faced the darkest phase in its history. The demand for the commodity was nearly non-existing due to the previous supply gluts.

Oil and gas companies were focusing on short-term contracts dodging long-term contracts. Most of the companies, including Royal Dutch Shell Plc, Chevron Corporation and ExxonMobil, downsized their CAPEX in the past year and delayed the final investment decision on various mega-scale projects. A similar scenario with LNG players had also been observed.

The delay in FIDs may lead to a reassessment of the project as per the latest conditions. This further involves more time and more money which may erode the economic benefits of the projects.

Please wait processing your request...

Please wait processing your request...