What is a facility?

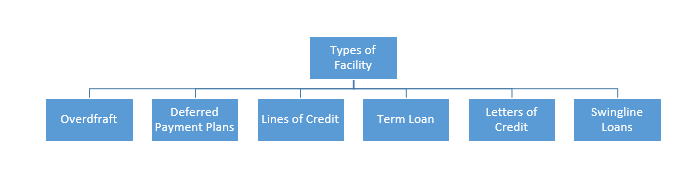

A facility is a formal financial assistance programme or a loan provided by a lending institution to support a business in need of operating cash. Overdraft services, deferred payment plans, lines of credit (LOC), term loans, letters of credit, and swingline loans are examples of facilities. A facility is simply another word for a loan that a corporation has taken out.

Summary

- A facility is a formal financial assistance programme provided by a lending institution to support a business in need of operating cash.

- Some commonly used facilities are Overdraft services, deferred payment plans, lines of credit (LOC), term loans, letters of credit, and Swingline loans.

Frequently Asked Questions (FAQs)

What is an Overdraft facility?

An overdraft facility is a financial instrument that allows firms to take money out of their account even if the balance is zero. An overdraft is a credit being extended above a predefined limit depending on the account holder's balance. Each borrower's limit may be different. Almost every financial institution, including banks and NBFCs, offers this service.

Overdraft is a form of short-term loan that must be repaid over a specified period as determined by the financial institution. The interest rate is decided by the lender and is fixed, it is not variable. The interest rate is calculated based on the amount of the overdraft. It is calculated daily and billed to the account at the end of each month. If not paid on time, the interest is added to the principal at the end of the month. Following the default the interest is computed on the new principal.

However, there are no prepayment penalties on repayment of the amount borrowed through an overdraft. The repayment is not stringent like the EMIs in the case of loans. Any amount can be paid at any interval, subject to interest rate revision. However, if the lender demands payback, it is obligatory to do so. Putting off repaying overdraft for too long impacts the borrowing entity's credit score. If an account does not already have an overdraft facility attached to it, then the cheque is dishonoured along with a dishonour fee in case of insufficient balance.

Copyright © 2021 Kalkine Media

What are deferred payment plans?

A deferred payment plan is a flexible payment option or agreement between a lender and a borrower in which the borrower delays their payments. When a borrower can't pay the credit right away, but the lender is ready to work with them, this is a joint arrangement. The borrower can keep using the money they've borrowed, but they could have to start paying interest on it. Some deferred payment arrangements call for a specific percentage of money to be paid out at certain intervals.

What is meant by Lines of Credit?

Small business owners can borrow money through an unsecured business line of credit, often known as a revolving line of credit or LOC, in a way that a standard company loan cannot. A lender does not approve the application and then deliver the money to in one single sum with a small business line of credit. Instead, the credit limit gives the lender the ability to borrow up to a particular amount of money. Interest is to be paid only when money is borrowed, and there are no prepayment penalties either. However, there is no option of an interest-free grace period in the case of lines of credit.

Regardless of whether the money is borrowed or not, there are annual or monthly fees to avail the facility. Cash can be deposited straight into the bank account from the LOC, allowing the borrower to use the funds with creditors whose payments are due. The funds withdrawn from the LOC may take up to one business day to be deposited into the account.

LOC may be secured or unsecured. When lender gets a secured business line of credit, the lender puts a lien typically on the asset(s). The amount of collateral required varies. In the perspective of a lender, Collateral minimises risk; thus, the borrower has a chance of getting better conditions such as cheaper rates, bigger loan limits, and better terms and conditions.

On the other hand, credit line borrowing is allowed only up to a limit in an unsecured scenario. The borrower will be allowed against the same line of credit again if payments are made on time, and there are no defaults. Since it is unsecured, there is more risk for the lender. As a result, the issuer of LOC may charge a higher interest rate, set lower credit limits or allow lesser time for repayment.

What is a Term Loan?

Businesses may use term loans for financing working capital or investment in equipments, investment in human resources, debt consolidation etc. These loans may be secured or unsecured and are available for both the short term and long term. Any financial institution can approve and distribute a term loan. Over a set period, the given loan amount must be returned in monthly payments like Equated Monthly Instalments (EMIs). Term loans are available with both fixed and adjustable interest rates. A term loan for business purposes typically has a repayment period of one to five years.

What are Letters of Credit?

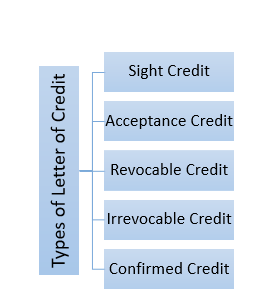

A Letter of Credit (LC) is a document that assures the seller that the buyer will pay the seller. It is given by a bank and ensures that the seller is paid on time and in full. If the buyer cannot make such a payment, the bank pays the entire or remaining balance on the buyer's behalf. A letter of credit is a document that is issued in exchange for a promise of securities or cash. Banks generally charge a fee, typically a percentage of the letter of credit's size/amount. Letters of credit may be of various forms.

Copyright © 2021 Kalkine Media

A sign credit form of LOC is payable at the sight/upon presentation of the correct documentation. The bills receivable is accepted upon presentation and finally honoured on their due dates under the acceptance credit type of LOC. A revocable credit is one whose terms and conditions can be changed or cancelled by the issuing bank without giving the beneficiaries any notice. An irrevocable credit is one with terms and conditions that cannot be changed or withdrawn. Only irreversible LC can be confirmed. When a banker other than the issuing bank adds its confirmation to the credit, it is a confirmed LC. The beneficiary's bank would send the paperwork to the confirming banker in the case of confirmed LCs.

What are Swingline loans?

A Swingline loan is a sort of loan that assists the lender in repaying a previous obligation or loan. It's a huge loan, but it's just for a short time (an average of 15 days) and on short notice. These loans have a higher interest rate than regular loans. It might be a stand-alone loan or a line of credit within a company's existing credit facility. The primary goal of this form of loan is to help the borrower manage their cash flow. Swingline loans can be closed by both the borrowers and the lenders.

Please wait processing your request...

Please wait processing your request...