What is an escrow and how is it different from an escrow account?

An escrow refers to an agreement under which, a third party gains legal rights to hold a large sum of money or property till the time a particular condition is met. On the contrary, an escrow account is an account used to manage a mortgage borrower’s annual tax and insurance costs.

This term is essential when dealing with real estate and mortgages. When two parties enter an agreement, a neutral third party may be asked to hold an asset or money “in escrow” until the agreement comes to an end or a condition is met.

An escrow agent is assigned when the contract is signed and is given legal rights to hold onto underlying property, paperwork, or money.

How does an escrow work?

The third party assigned as an escrow agent must be neutral towards the agreement, making it neither a buyer nor a seller in the transaction. The third party must be a secured entity and should ensure the safety of the assets or goods left with it.

In any type of transactions, buyers and sellers would both have their apprehensions before going forward with the deal. The buyer must be given the right to inspect the underlying goods or an asset he/she wants to buy. Similarly, the seller might need a guarantee that he/she will get paid in full or that they can move to other transactions, if need be.

Thus, the role of a mediator becomes extremely important in such a scenario. An escrow agent can act as a mediator and a regulating body by ensuring that the transaction takes place from both ends.

Once the agreement is in place, an escrow agent must:

- Collect assets from the seller and keep them secure to be given to the buyer upon payment.

- Disburse funds collected from the buyer to the seller.

Once both legs of the transaction are finished, the escrow is closed.

This shows that the escrow agent performs the herculean task of dealing with the goods and capital of other parties, which requires them to be trustworthy neutral agents. Buyers and sellers should be wise in selecting the proper escrow agent to ensure that he/she does not flee with their assets.

The escrow agent also has much to gain from such a transaction between other parties. Agents charge escrow fees to hold onto these assets. In addition to this, an “earnest money” is also charged, which must be paid by the buyer. The fee is usually a small percentage of the total transaction amount. This mandates the seller to take his/her property off the market and leave it with the escrow agent. Hence, the deal reaches its penultimate stage.

How does an escrow account work?

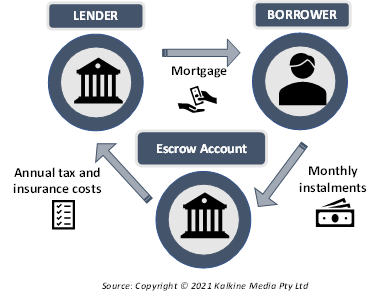

The work of escrow accounts is distinguished from that of an escrow agent. Escrow accounts are used to manage the payments of mortgage holders. Borrowers of home loans and property loans may be asked to maintain an escrow account to pay the property taxes and homeowner’s insurance premiums diligently.

An escrow account ensures timely payment of such taxes. These payments are to be made on annual basis. However, having an escrow account, a lender is asked to make monthly installments towards the final annual payment. This ensures that the final payment is made on time.

What is the role of escrow in a mortgage?

Under a mortgage, an escrow can be used to mediate between a buyer a seller. Banks may also sometimes play the role of an escrow agent in case of a mortgage. The bank is entrusted with fulfilling the duty of a mediator between the borrower and the seller of the house.

The bank must ensure that all mortgage payments are made on time and in the case of foreclosure, the bank would undergo huge losses.

Here, the “earnest money” is roughly 2-3% of the total sale value of the house. However, upon completion of the payments, this earnest money is put into the down payment for the house and the closing costs. Thus, the escrow account is a neutral place, where the money can be held till the transaction is complete.

What are the duties of an escrow agent?

- The escrow agent holds certain responsibilities towards the buyer as well as the seller in the agreement. The escrow agent’s responsibilities towards the buyer include collecting earnest money and obtaining the proof of loan approval from the borrower.

- Similarly, the escrow agent’s responsibility towards the seller includes obtaining access to the property to conduct inspections, making sure that proper repairs and renovations are carried out and obtaining rights to conduct a title search. A title search involves a full-length research into the public records available for the property in question. This ensures a series of checks ensuring that the seller is the rightful owner of the property.

Other than banks, attorneys can also be escrow agents in the case of a mortgage. Escrow agents may sometimes also be tasked with making payments to parties other than the buyer and the seller. These include distributions to real estate agents, prepaid mortgage interest to the lender, providing the recording fees to the county office of records, as well as the paying the fees of the escrow agent.

Who pays the escrow fees?

The escrow fee is the service fee charged by the escrow agent for facilitating the transaction between the buyer and the seller. This fee can be paid fully by the seller, or fully by the buyer or partially by both. Most escrow agents allow different options of payments. While some agents may allow only complete payments, some others may allow the buyer and seller to split.

However, in case of cancellation of the order or delivery failure, the escrow fee must be paid by the buyer from the funds given to the escrow agent as “earnest money”. Any original shipping fee made by the buyer would also be taken out from the existing funds with the escrow.

What is the example of a transaction with an escrow agent?

Consider a homebuyer approaching a seller with an offer. If the seller accepts the offer, the payment procedure can be initiated. The very first step would be the homebuyer paying the “earnest money” to the escrow agent as a surety that he/she is willing to buy the house and has the capital to carry out the transaction.

As the seller finalises property paperwork, the buyer sets his/her arrangement with the lender. Thus, lender can now get directly in touch with the escrow account for future payments. The escrow then ensures that the payment is passed on to the seller of the house.

Consequently, the title is transferred to the buyer via the escrow. The escrow charges a fee for conducting this transfer of ownership as well as transfer of funds.

How is an escrow account beneficial to the buyer and the seller?

Opening an escrow account is a fast-track way of ensuring that mortgage-related transactions are conducted smoothly without any default on either the borrower’s part or the lender’s part.

- For the borrower, an escrow account helps ensure that his funds are not mismanaged. Consider the case when a sale agreement does not work out between two parties, but a deposit has already been made to the seller.

In such a case, it is possible that the seller refuses to give back the payment or delays the return process. Thus, an escrow account can save the buyer from such a hassle as it would oversee managing the payment and can easily return the deposit as stated in the agreement.

- An escrow account can be equally beneficial to a lender as well. Lenders have much on the line when it comes to giving out a mortgage. Firstly, any delay in the payment of the taxes could lead to the property being seized by the tax authority. In such a scenario the lender could face huge losses. Similarly, in the case of insurance coverage lapse, the lender could face huge costs.

An escrow account would help protect the lender in both these tricky situations. A pre-existing fund enables the lender to make timely payments, including insurance fees and taxes.

Additionally, homeowners can also benefit from an escrow account. A systematic set of monthly payments throughout the year ensures that by the year end there are appropriate funds to pay for taxes as well as insurance.

The logistics attached to paying these bills are also eliminated as the escrow account directly makes these additional payments to the appropriate authorities. So, homeowners need not take note of due dates as well.

What are the disadvantages of having an escrow account?

One important thing to note in the case of escrow mortgage payments is that the monthly payments charged to the buyer are rough estimates. This means that in totality, the buyer may end up paying an amount that is higher than the total mortgage payment. On the contrary, the buyer may also end up paying less than the total mortgage payment which can cost the escrow agent additional amount of money.

Estimates might also turn out to be incorrect as taxes and insurance costs may change over time. Any excess funds that may be left in the escrow account would be returned. On the contrary, if there is a shortage of funds, the buyer can be asked to pay more at the last minute.

Additionally, online escrow accounts can charge higher escrow fees than offline accounts.

What is online escrow?

Escrow services can also be used in making purchases other than in real estate or property sector. The online retail sector can pose various challenges to buyer as the identity of the seller may not always be truthfully available. Also, there are many dishonest sellers that trade on online websites, making it a risky marketplace.

An escrow service can provide more than just a pool of funds for both buyers and sellers. In online retail, an escrow service would take vital information regarding the sale and would facilitate the transaction between the two parties. Once the information is laid out to the escrow agent, the buyer and seller can continue the transaction as they had promised to do.

The buyer would pass on funds to the escrow agent, which would only be processed over to the seller once the goods are sent to the buyer. However, if the goods never arrive then the funds with the escrow agent can be handed back to the buyer with the transaction being nulled.

On the contrary, if the mistake is on the part of the buyer, who wrongfully claims that he did not receive the goods, then the escrow agent can investigate the same.

Please wait processing your request...

Please wait processing your request...