What is Depression in Economics?

In economics, depression is referred to as a more severe form of the global recession, reflecting a prolonged and major downswing in economic activity. Depression is commonly characterised by widespread unemployment, sharply down industrial production, significant falls or pauses of growth in construction activity, and massive cutbacks in international trade and capital transfers.

The Reserve Bank of Australia (RBA) defines depression as a broader version of recession, both in terms of duration and scale. As per the Central Bank, the scale and duration of depression imply that there are usually adverse economic outcomes that are experienced in several countries across the world.

Unlike any minor business contractions that usually occur in a single country independent of economic cycles in other countries, depressions have generally been worldwide in scope. Consequently, some definitions of depression state it as a terrible recession that stems in one or more economies.

ALSO READ: Recession, and how do we Measure it?

What is the Difference Between Recession and Depression?

The 33rd US President, Harry S. Truman gave a very famous quip - “It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”

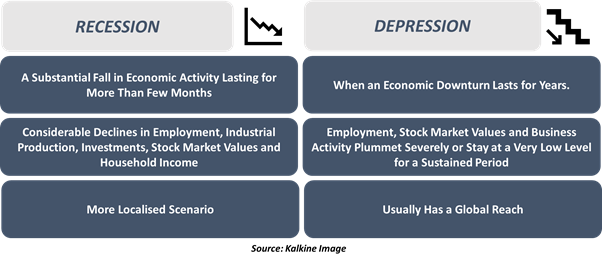

The distinction between recession and depression generally boils down to the duration and depth of an economic downturn. While a recession is commonly defined as a substantial fall in economic activity lasting for more than a few months, a depression is noted when an economic downturn lasts for years.

A recession is usually characterised by considerable declines in employment, industrial production, investments, construction, international trade, stock market values and household income and spending.

On the flip side, the depression is described by a period during which major macroeconomic indicators such as employment level, stock market values and business activity plummet severely or stay at a very low level for a sustained period. In other words, depression is more destructive than a recession, with its effects lasting for decades, as witnessed in the 1930s Great depression.

In addition, the recession is a more localized scenario, while depressions generally have a global reach. Some economists also define depression as a period of output decline for over two years, a fall in output of 10 per cent or larger and a peak in the unemployment rate to about 20 per cent.

Don’t Miss: Bells ringing around a Technical Recession for Economies across the Globe

How Can We Trace Back the Origin of the Great Depression of 1930s?

Fortunately, the world witnessed only one economic depression in modern times, which was the ‘Great Depression of 1930s’ that lasted from 1929 to around 1939.

While the Great Depression sprouted in the United States (US), it caused dramatic falls in output, acute deflation and severe unemployment in almost every country of the globe. Recalled as the worst economic slump in the history of the US and the industrialized world, the event induced around 30 per cent fall in the real GDP and over 24 per cent surge in the unemployment rate of the US.

The severity of this depression became more apparent when it was compared with the US’ next worst recession – the 2008 Global Financial Crisis – during which the nation’s GDP fell by 4.3 per cent, while unemployment rate peaked below 10 per cent.

The economic depression of 1930s also delivered a heavy blow to the Australian economy, with its GDP tumbling by about 10 per cent and the unemployment rate peaking to around 30 per cent in 1932. However, the RBA believes that Australia was less impacted by the Great Depression than some other economies in terms of social and economic consequences.

What were the Key Causes of the 1930s Great Depression?

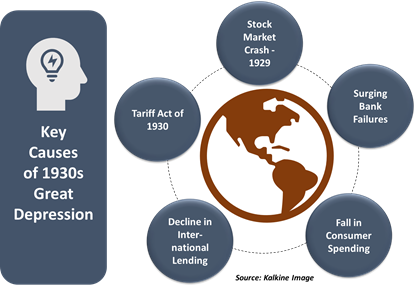

There is no single event that triggers economic depression, while it is an outcome of a multitude of factors, ranging from stock market crashes to deflation. To gain a better understanding, take a look at five key reasons that sowed the seeds of the Great Depression of 1930s:

- 1929 Stock Market Crash: Economists cite the stock market crash of 1929 as one of the primary causes of the Great Depression. Remembered now as the “Black Tuesday”, the stock market downturn occurred on Tuesday, 29th October 1929, wiping off over USD 40 billion dollars of stockholders’ wealth within two months since the market crash.

- Bank Failures: The stock market crash sparked about thousands of bank failures in 1930 amid dwindling confidence in the Wall Street and American banks. With banks going bankrupt, the demand to withdraw money from banks exceptionally increased, stimulating further collapses. Some scholars believe that this problem was further aggravated by the Federal Reserve, which deliberately increased interest rates and reduced money supply to retain the gold standard.

Interesting Read! Can Negative Interest Rates help Economies?

- Deceleration in Consumer Spending: With tight credits, diminished savings and fears of additional economic woes picking up steam, spending by consumers came to a standstill. This resulted in diminished production and a subsequent fall in the demand for labour force. The mounting layoffs further stimulated a ripple effect, triggering an additional plunge in consumer spending and business investment.

- Reduced International Lending: In the late 1920s, higher interest rates induced a sharp decline in lending by American banks to foreign countries, contributing to slowdown effects in some borrower nations like Argentina, Germany and Brazil. These contractionary effects resulted in an economic downturn in these nations even before the onset of Great Depression in the US.

- Smoot Hawley Tariff: In an effort to protect domestic industry, Congress passed the Tariff Act of 1930, termed as Smoot Hawley Tariff, which involved the imposition of a record level of tax rates on a wide array of goods imported by the US. The act prompted retaliation by American trading partners, which further levied tariffs on goods produced by the US, causing a fall in international trade.

In addition to these factors, the drought that arose in the Mississippi Valley during 1930 – the Dust Bowl - is also believed to be a contributing cause of the economic depression.

What are the Warning Signs of an Economic Depression?

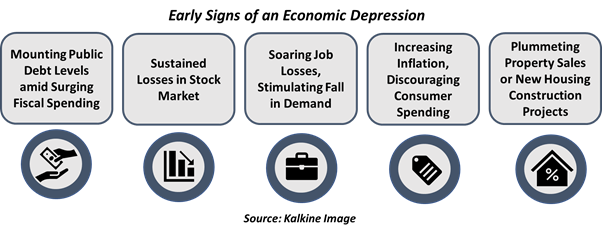

Evidence shows that economic depression exhibits several warning signs over sustained period prior to its arrival! With that said, let us quickly discuss some major threat signs of a looming depression:

- Mounting Public Debt Levels: As soon as a disaster kicks in, the Government intensifies fiscal spending to help the economy stand back on its feet, as evident from the COVID-19 crisis. Consequently, the fiscal deficit and public debt levels surge, potentially resulting in bankruptcies and mass defaults.

- Sustained Losses in Stock Market: The movement in stock prices deserve a closer attention while gauging the economic outlook. A sustained fall in the stock prices appears to be a core indicator of the softer profits likely to be earned by companies. Tumbling stock prices can eat up the savings of average consumers, inducing a decline in consumer spending.

- Growing Unemployment Rate: Soaring unemployment levels witnessed over prolonged periods is one of the leading indicators of an approaching recession or economic depression. Consumers tend to lose their purchasing power if job losses surge, stimulating lower demand for goods and services in the economy.

- Increasing Inflation: While some level of inflation is acceptable, too much inflation discourages consumer spending, triggering a sharp plunge in demand and production. Rising inflation can also provoke the Central Bank to increase interest rates, which can further deter businesses from taking loans and choke economic growth.

- Plunging Property Sales: The property market usually flares better when an economy is in a good spot. So, when property sales or new housing construction projects plummet, it usually indicates deteriorating consumer confidence, raising concerns of economic downturn.

What are Feasible Responses to an Economic Depression?

The magnitude of an economic depression is unprecedented and requires a range of solutions to wade through the crisis. Some of the key measures adopted across the world to deal with an economic depression, include:

- Fiscal Policy: This reflects an increased fiscal spending by the Government and an expanded investment in new infrastructure to create jobs and stimulate consumer demand.

- Monetary Policy: This reflects a reduction in interest rates by the Central Bank to make borrowing cheaper, quantitative easing approach and the use of helicopter money to hand cash to citizens.

- Mortgage Relief: This reflects the support provided by banks to consumers and businesses in terms of mortgage relief to enable them to survive through the crisis.

Please wait processing your request...

Please wait processing your request...