What is earnest money?

Earnest money refers to a sum of money that is paid by the buyer to the seller as a form of reassurance of future payments during the sale of a house. Paying earnest money is also beneficial to the buyer because it gives him leverage to arrange the remaining funds.

Earnest money can be deposited via a direct home deposit, an escrow account or in the form of good faith money.

How does earnest money work?

Earnest money is paid before closing on a house sale. When the seller and buyer come to an agreement on the house sale, the seller must take the house off the market. Earnest money serves the purpose of assuring the seller that the deal would not fall through.

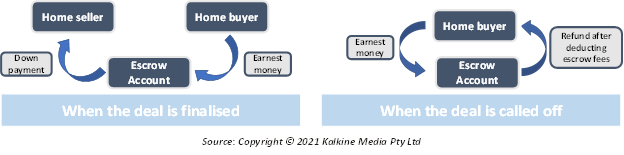

The amount paid as earnest money is usually 1-3% of the total sale value of the house. Most sellers prefer to hold earnest money in an escrow account. In case the deal does not materialize, the money can be given back to the buyer directly from the escrow account. This removes the concerns any buyer may have about whether the money would be returned by the seller or not.

In case the buyer and seller go ahead with the sale, the earnest money becomes a part of the down payment. Thus, the buyer would only pay the remaining amount of the down payment.

However, in case the agreement does not materialize between the buyer and the seller, the earnest money is returned to the buyer after deducting the escrow fees from it. With money locked in on one house, buyers are less likely to close a deal with any other house seller.

How is the amount of earnest money decided upon?

The percentage of the total amount that can be taken as earnest money varies from state to state as policies are different. Additionally, the market scenario is also a major factor affecting the amount of earnest money to be paid.

Under normal conditions, 1-2% of the total sale value can be taken as earnest money. However, if the market does not have a high demand for houses, then the percentage charged as earnest money could be lower around 1%. In markets with high demand, this percentage could be as high as 3%, or even 5%.

To outbid other buyers, one can pay a larger sum of money as earnest money. This would increase the buyer’s chances of securing the property.

Why is earnest money important?

Earnest money may not always be mandated by the seller, but in a highly competitive market earnest money may be necessarily required. Paying the earnest money makes the agreement official. Without earnest money, the deal may not be considered official in many regions.

It is one of the four stages of payment while making a deal on a house. However, in certain instances, even after the payment of the earnest money, the deal may not materialize. Typically, a buying agent should be able to assist the buyer in such a case.

What conditions must be met for earnest money to be refundable?

Earnest money has certain contingencies attached to it for the protection of both the seller and the buyer. Even after the seller has accepted the earnest money deposit, there are certain contingencies that must be met before the deal can be finalized.

These include the following:

- Home inspection contingency: This contingency is placed so that buyers can back out of the agreement in case the there are some faults in the property, and it is in need of repair. However, it is not necessary for the buyer to call off the deal in such a case. He can simply work with the seller to reach a mutual decision rather than scraping away the deal completely.

- Financing Contingency: It might be the case that a buyer had not been approved for a mortgage before making the earnest deposit. Here the financing contingency would protect the buyer. If the mortgage does not get approved even though the earnest money had been paid, then the financing contingency allows the buyer to walk away from the deal along with the refunded earnest money.

- Appraisal Contingency: This protects the buyer in case the property has been overvalued. Here the lender can hire a third-party investigator who can examine whether the property has been priced at a fair value or not. If the value of the house comes out to be higher than the fair value, then the buyer can walk away with a refund. Additionally, this contingency can be used to bring down the price of the sale too.

- Contingency for Selling the Existing home: It is quite possible that contracts are made based on whether the buyer can sell an existing home or not. If the buyer is unable to sell the existing home, then he can walk away with a refund.

These contingencies can be waived by the buyer in case he is sure that the deal would close and there would be no backing off. However, it is important to note that contingencies can provide an extra cushion against adverse circumstances and they might come in handy in certain cases.

What is the difference between earnest money and good faith deposit?

Both terms can be used interchangeably. However, all good faith deposits are not the same as earnest money. A good faith deposit can be made directly to the mortgage lender, while earnest money is usually held in an escrow account.

Both serve the purpose if providing a sense of security about the buyer sticking to the same deal and not going elsewhere. The good faith deposit eventually forms a part of the lending process. However, in case the deal does not materialize, it is possible that the borrower would not get his good faith deposit back.

Please wait processing your request...

Please wait processing your request...