What is meant by the term dividend stripping?

Dividend stripping refers to a short term trading strategy wherein investors purchase the shares of a company just after the company has announced a dividend. However, the shareholder will sell the share very soon. Dividend stripping is often practised for gaining tax advantage, although some countries have covered this loophole in their tax laws.

Summary

- Dividend stripping refers to a short term trading strategy wherein investors purchase the shares of a company just after the company has announced a dividend.

- For dividend stripping, the purchase must be made before the ex-dividend date.

- Dividends are paid only as per the records generated on the record date.

Frequently Asked Questions (FAQs)

How does the process of dividend stripping work?

Often shareholders and investors in mutual funds receive dividends on their investments. These dividends are free from taxes, but if there is a long term capital gain, there may be a tax that applies on the gains above a certain threshold. Therefore, shareholders use the method of dividend stripping to avail highest tax benefit possible.

An example

Often when dividends are about to be declared, a hype gets created, driving share prices up. At this time, it is purchased for dividend stripping. The share price falls back to normal levels once the hype fades out. This is the time when the investors sell it off. As a result, they enjoy two-fold benefits. One is that they would have earned tax-free income and can also claim a capital loss to receive a reduction in the total income.

© Mailos | Megapixl.com

Suppose a company ABC Limited announces its dividend payment date as 31 December and the dividend amount $2 per share. Mr A purchases the shares of ABC Limited on 24 December is before the record date when the market price of the share is $20. Mr A purchases 100 shares at this price and pays $2000. On the 31 December Mr A receives $200 in the form of dividends. Once the dividends have been paid Mr A sells off the shares on the 30 January when the share prices have declined to you $15. On selling the shares, Mr A only gets $1500. Thus, Mr A enjoys a total benefit of 500+200= $700, which is the sum of the capital loss and the dividend income.

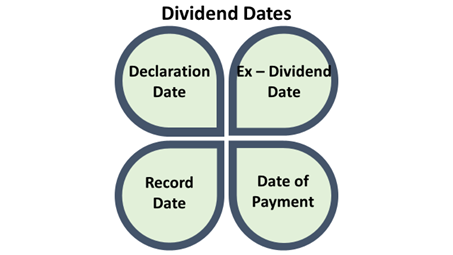

What are the key dividend dates?

The important dividend dates are as follows-

Copyright © 2021 Kalkine Media

The day when the company declares that it will pay a dividend is called the declaration date. It may also be called the announcement date. The ex-dividend date is the date after which the buyer would not be entitled to receive the dividend. The record date is after the ex-dividend date. On record date, it is decided which shareholder will be paid dividends. The payment date is the date when finally, the dividend is transferred to the entitled shareholder.

What is the record date?

The record date is used as a cut off to determine the eligibility of shareholders to receive dividends. Since share trading is an active process and there is a continuous change in shareholders in the stock market, this cut-off date becomes very significant. Therefore, on the record date, the company freezes the database of the shareholder as of the ex-date. It is as per this database that dividends are actually paid on the date of payment.

What is the importance of ex-dividend date for dividend stripping?

Ex-dividend date, also known as the ex-date, is the day on or before which investors must buy the shares to receive the announced dividend. Any company first chooses the record date, and then the ex-dividend date is decided based on stock exchange rules. If any share is bought after the ex-dividend date, the dividend will go to the sellers, not the new shareholder. Thus, from the sellers’ perspective, if they want to reap the benefits of the dividend, they must hold on to the share until the ex-dividend date.

© Rummess | Megapixl.com

Record date and ex-date as per the ASX

The record date is 5 pm on the day the company freezes its database to decide which shareholders would get dividends. All changes to registrations are closed on this date.

The ex-dividend date is a business day ahead of the record date of the company. Any share purchase on or after the ex-date disallows the benefit of the dividend; it instead goes to the seller even if the seller may not be the shareholder anymore. As a result, it is a general trend that share values soar around the ex-date and decline soon after.

What is meant by the term cum dividend?

The shares of a company are said to be cum dividend before it is paid but declared.

Please wait processing your request...

Please wait processing your request...