What is diversification?

Diversification is a sort of risk-mitigating strategy that is pervasive and is extensively applied in several risk management practices. It attempts to distribute the potential risk to a range of variables, thus allowing to square-off movements of variables in a group.

In this context, we specifically discuss diversification with respect to the investment portfolio. While picking investible assets is a vital activity, the magnitude of returns delivered by a portfolio will also depend on optimal risk management.

Diversification is one of the risk management technique used in portfolio optimisation. The ‘all eggs in a basket’ saying is well known. In investments, it is favourable to have a diversified portfolio, but excess diversification can also have negative outcomes.

Do read: Investing Basics: 5 things to consider in case of a Diversified Portfolio

One should not just enter a new position for the sake of diversification since opening a position could well turn into an unintended risk instead of cover for a downside. Moreover, diversification is good, but excessive could is futile.

Reducing volatility is a prime expectation from diversification. Investors re-position portfolio according to the changing environment, and the process continues on an ongoing basis given the information flow and consequent ramifications on the portfolio constituents.

Managing risk is like a prelude to reap acceptable returns. Diversification forces an investor to take a broader view of the portfolio, and add new positions based on contingency plans for existing large positions. Diversification is primarily undertaken to avoid risk of ruin due to an investment decision going south.

Good read: How Should An Investor Diversify A Portfolio?

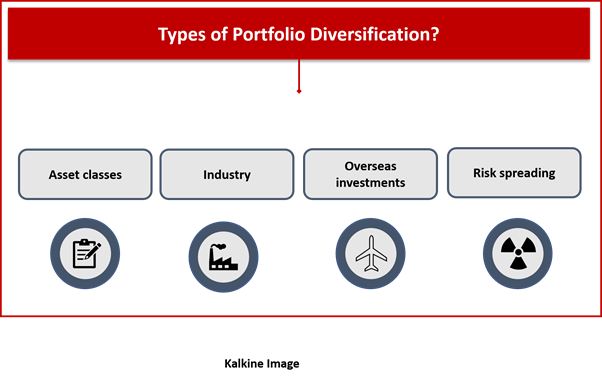

What are the types of portfolio diversification?

Asset classes: A diversification based on asset classes is the most popular way because it involves expanding the portfolio to more than one asset class. An investor with allocations into just equities may look to buy some bonds, ETFs, derivatives etc. As these assets to an extent have diverse risk attributes.

Conservative investors are likely to have notable portfolio allocation to fixed income securities due to lower risk and relatively more chances of full return of capital along with interest payments. Some may want to add ETFs to balance the volatility with an exposure to a basket of securities.

Derivatives also provide considerable opportunities to hedge the risk. Investors should pay considerable attention to derivatives as a small change in the value of derivative could mean much large change in actual money.

Industry: Asset classes are further classified based on the industry. In a business or economic cycle, the performance of various industries could vary from each from other. A diversification based on industry attempts to mitigate risks associated with fluctuations in the output of companies during a business cycle.

Consider the business environment that is on an expansion phase, the investor will likely prefer a business that is sensitive and positively correlated with expansion. The industry highly benefiting from expansion includes financials, consumer discretionary, real estate, information technology, materials and industry.

Similarly, investors prefer defensive sectors like telecommunications, healthcare, consumer staples, and utilities during the recession. Through diversification across industries, investors seek to benefit from an underlying trend in the broader business cycles.

Overseas investments: In a globalised and hyper-connected world. One should open to embrace the developments across jurisdictions, which may provide unique opportunities. Investing in a number of nations will also hedge the currency and political risks among each other.

It is important to have a broader view of your surroundings. Sometimes a widely used product or service around our surroundings belong to a company located outside our jurisdiction.

For instance, Hyundai Motors and Samsung mobile are two very successful businesses, yet many would not know in which stock exchanges have their listed stocks. Similar is a case with YKK, a Japanese company with a dominant market position in zippers (pants, jeans).

Foreign investments can provide much more than just a currency exposure to investors, especially dominating businesses like Samsung, IKEA, Microsoft etc. may prompt an investor to go beyond boundaries.

Risk spreading: Risk associated with individual securities can vary significantly. Investors applying diversification across asset classes, geography and industry are likely to confront the varying scale of associated risks. The understating of beta comes handy.

It is important to have a risk with varying scale spreading across securities. With the greater scale of risks across securities, there is a potential for returns of greater scale and dissimilarity. Although diversification seems favourable for investors, excessive diversification could be risky and cause adverse outcomes.

What are the disadvantages of diversification?

Diversification may look very complex to investors due to the number of securities in a portfolio and changes to allocations of those securities based on information flows and portfolio positioning. For beginner investors, this could mean a lot of complexities.

A diversified portfolio could limit the level of gains one could have had, but it also limits losses as well. Over the short term, diversification may seem like losing money rather making money. However, it helps to reduce overall portfolio risk over the long term.

As a result of several securities, the frequency of trading and re-positioning is higher, which means broking costs are also higher.

Please wait processing your request...

Please wait processing your request...