What is a delisted stock?

When shares of a listed company are removed from a stock exchange platform and are not available for trading anymore, the process is called delisting.

The firm becomes a private business once the shares are no longer accessible for trade. It is not termed as delisting if a company's shares are accessible on numerous stock exchange platforms and are withdrawn from only one of them. Delisting is the process of removing a company from all stock markets, preventing individuals from investing.

Summary

- Delisting occurs when a listed company cuts off its shares from trading on the stock exchange.

- Delisting happens if the company files for bankruptcy, in case of a merger, non-compliance with listing obligations, or the company decides to be private.

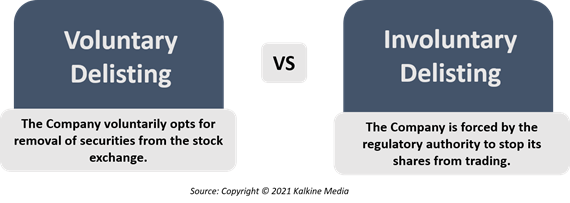

- There are 2 types of delisting - voluntary and involuntary.

- A company can enjoy freedom from complying with various requirements of an exchange by getting delisted.

- However, it can no longer raise funds from the public after getting delisted.

Types of delisting

There are 2 types of delisting that take place in the market.

Voluntary delisting

When a company chooses to delist its securities from a stock market on its own, it is called voluntary delisting. The company compensates stockholders for their shares and delists the full lot of shares from the exchange.

A company becomes a voluntary delisting candidate of its whole structure changes, or in case, if the company has expansion plans. This can happen if the company is purchased by an investor who wants a majority stake in the company.

Another reason of delisting can be if a company finds it difficult to comply with the laws of the exchanges as regulations might hinder the company’s functioning.

Involuntary Delisting

When a company does not want to delist itself but the stock exchange decides to remove a business from the market, it is known as involuntary delisting. This is also used by the regulatory authority to penalise the company.

Involuntary delisting happens when a company does not fulfill minimum standard requirements. The standards may include the company making consistent losses for 3 years, the firm is unable to achieve its minimum share price, financial ratios, or when sales levels are below the minimum.

Frequently Asked Questions (FAQ)-

Why does a company delist its shares?

There can be many reasons behind a company’s decision to delist its stock.

Here are some of the reasons behind the delisting of a stock.

- It wants to go out of business or is on the brink of bankruptcy

- It undergoes a merger

- It wants to turn into a private company

- It fails to maintain share price thresholds.

- It does not comply with the listing requirements of the exchange.

Source: © Lasserdesignen | Megapixl.com

What happens when a company gets delisted?

When a stock gets delisted, the stock is delisted from the exchange it was trading on and the stock trades on over-the-counter market, i.e. through a dealer market.

A delisted stock has little impact on the shares an investor possesses of that company. The share offers the same degree of ownership in the firm as before, and the stock may still be exchanged.

However, delisting comes with a stigma and is usually an indication that a business is insolvent, near-bankrupt, or otherwise unable to fulfill the exchange's minimal financial criteria.

Can a delisted stock again get listed?

Relisting is a process by which a delisted company lists its shares and trade again on the exchange. Different exchanges follow different guidelines for getting a stock relisted and they can vary on the way the company got delisted.

Source: © Maciek905 | Megapixl.com

Though relisting is not common, but there are possibilities of a company going public again through an IPO after undergoing restructuring.

Relisting can be a useful move for those who retained their investment in the shares of that particular company as it provides with an opportunity to recover the investment.

What are the requirements to stay listed?

The conditions for listing differ from one exchange to the next. The most common requirement by exchanges is maintaining specific price thresholds.

Other requirements of major exchanges are connected to market capitalisation, sufficient shareholders' equity, and revenue outputs.

From an accounting standpoint, public companies must pay their yearly listing fees to exchanges on time, as well as cover the considerable legal and regulatory costs involved with listing on an exchange.

What are the pros and cons of a delisted company?

Delisting has its own set of advantages and disadvantages. On one hand, it can provide a failing firm the freedom and flexibility it needs to get back on the rails without the pressure of public scrutiny.

On the other hand, delisting also runs the risk of the firm going further into debt if it doesn't acquire enough private financing or new tactics don't work out for the business.

The company might enjoy some freedom from obeying with several requirements for listed firms like complying with minimum listing criteria, listing expenses and trading cost, publishing annual reports and market risk, after getting delisted.

However, the company can no longer raise capital from public after getting delisted. Further, the company may lose its reputation as customers may lose the trust in its product.

Hence, delisting involves both merits and demerits and both should be considered before any decision is made.

Please wait processing your request...

Please wait processing your request...