What is meant by deflation?

Deflation refers to the fall in prices of goods and services in an economy. Deflation increases the purchasing power of a currency as goods become cheaper than usual. Deflation is the opposite of an inflationary scenario, where prices of goods and services in an economy rise.

Deflation generally indicates a highly productive economy but decreasing prices could also point towards a contraction of demand. Deflation can also lead to a financial crisis as the prices could crash down to unforeseen levels.

To some degree, deflation helps in increasing consumer spending, and it allows domestic consumers to purchase a higher quantity of products for the same price as before. On the contrary, deflation can sometimes be a sign of an impending recession. The speculation of an incoming recession may urge consumers to save more today, which can lead to a further contraction in demand.

What are the causes of deflation?

Two macroeconomic factors can cause deflation:

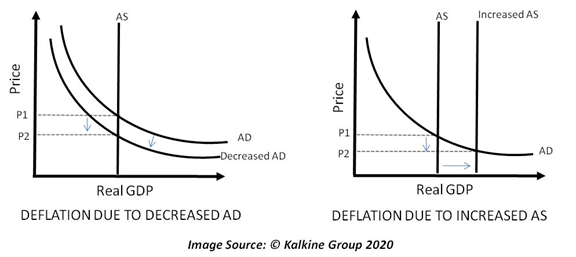

- Decline in Aggregate Demand: Aggregate demand (AD) refers to the total demand for all goods and services in a country. A drop in demand has a direct relation to an increase in prices. As demand falls, there is not enough consumption to meet the supply in the economy.

- Increase in Aggregate Supply: Aggregate supply (AS) refers to the total supply of goods and services available in a country. For the same reason as explained above, when the supply exceeds the demand, the prices decline. On a broader scale, deflation is caused by the disequilibrium in the AD-AS model.

Deflation is the economic state where the money supply in the economy remains the same, but the population and the economy both expand. Therefore, to maintain equilibrium, the amount of cash in an individual’s portfolio decreases. This leads to an overall increase in the value of the currency, unlike in inflation.

Deflation is the scarcity of hard cash in an economy which makes it more valuable to hold.

The scenario of deflation can also occur when the productive efficiency of a nation increases due to better technology. Higher competitiveness levels also lead to firms lowering their prices as they save up on their costs. As prices are lowered, consumers are left with more cash in their portfolio, and thus deflation occurs.

What are the economic impacts of deflation?

Deflation can lead to the following macroeconomic impacts:

- Unemployment: As there is a lack of money in circulation, there is contracted demand. This may lead to producers further cutting down on their costs to save money. Thus, fewer workers are hired, and there are lesser jobs available.

- Debt: Interest rates increase under the scenario of deflation. Therefore, it becomes riskier to borrow as the interest to be paid on borrowings increases. This leads to the situation of debt deflation wherein the real value of debt rises due to deflation.

- Deflationary Spiral: This refers to the scenario where lower prices lead to a further drop in prices. As prices fall, companies try to save up on their costs, leading to lower production. As a result, lower salaries are offered to the employees, and they are not able to spend on consumption. This leads to a further contraction of the economy as the demand falls, which again deflates the price levels.

Is deflation more harmful than inflation?

Inflation leads to an overall increase in the price levels, and thus goods become more expensive, and the value of the domestic currency falls. However, inflation may be beneficial in some cases as it helps reduce the burden of international debt. As the domestic currency loses its value, the foreign debt on a country also declines in real terms.

Unlike inflation, it is hard for consumers to protect themselves from deflation. People can invest and save enough money to ensure that they can combat the scenario of inflation. However, deflation poses a set of challenges for the consumers which are hard to get by and can be explosive at times. It can also put the economy under a liquidity trap, wherein people hoard money instead of investing it.

How can deflation be controlled?

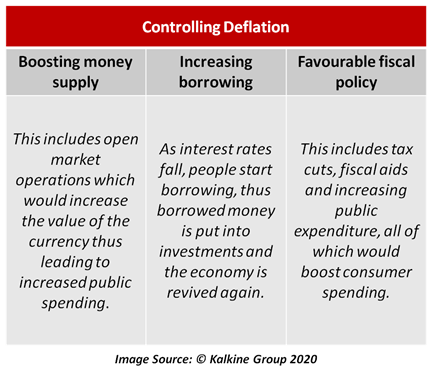

Deflation can be controlled by the government using the following methods:

- Boosting money supply: Increasing the supply of money by buying back bonds through open market operations. This would increase the value of the currency, thus leading to increased public spending.

- Increasing borrowing: This can be done by lowering interest rates through monetary policy. As interest rates fall, people start borrowing, thus borrowed money is put into investments and the economy is revived again.

- Favourable fiscal policy: Along with monetary policy changes, the central bank can also boost public spending by introducing appropriate fiscal measures. This includes tax cuts, fiscal aids and increasing public expenditure.

Is deflation overall a good economic scenario for a country?

Deflation can be more harmful than beneficial for an economy. If a country finds itself locked into a deflationary spiral, it becomes challenging to come out of it. Moreover, increased debt levels caused by deflation are hard to recover from, even with proper debt financing measures taken by the government. Financing debt, in the current period, may lead to increased debt burden in the future.

However, lower level of prices in an economy can also have positive connotations. It can be a sign of an efficient production set up in the economy facilitated by proper utilisation of resources. Economies that offer relatively cheaper goods are deemed to be highly competitive. An example is the computer hardware markets across the world. As new and fast production techniques become accessible across the globe, the price of the final output becomes lower internationally. Thus, there is deflation in the computer hardware markets.

Please wait processing your request...

Please wait processing your request...