What is debt-to-equity ratio?

Debt-to-equity ratio is a leverage ratio which indicates the level of financial liabilities/debt relative to the equity in the business. The ratio interprets the balance between the primary funding sources of business: debt and equity.

Debt as an asset class is mostly redeemable, baring convertible instruments, and the principal amount is repaid to the lender along with interest payments. As a funding source, debt is an efficient capital for large enterprise, especially for secured debt instruments.

Equity is a non-redeemable instrument that is perpetual, and the holder of equity has ownership in the enterprise as well as voting rights. Since equity is perpetual and non-redeemable, excess use of equity as a funding source will dilute the ownership interest of the business.

Debt-to-equity ratio is widely-used financial analysis ratio, especially used in Fundamental Analysis for companies. Conventional value investors have preferred companies with sustainable debt and high cash flow generative attributes.

It is also used to evaluate the solvency of an enterprise. An enterprise is considered solvent until it is able to honour obligations like interest-payments, principal payments, lease payments, salaries, operating expenses.

For more read: What Is Debt To Equity Ratio?

D/E ratio is calculated by dividing total liabilities by shareholder’s equity. Total liabilities include overall debt obligations of the firm such as line of credit, bank facilities, bonds payable, notes.

Shareholders’ Equity comprises of retained earnings and share capital. It is also expressed as Shareholders’ Equity = Assets – Liabilities. When a company enters liquidation, the equity shareholders of the company are ranked after debt holders to receive any payments.

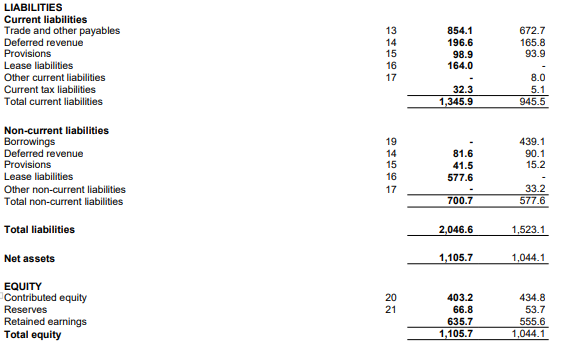

Source: JB Hi-FI Limited AR FY20

In the above example, it can be seen that there are no borrowing in the balance sheet of the firm, but there are lease liabilities, which may include fixed payments. Total equity of the firm is $1.1 billion, which includes equity, reserves and retained earnings.

Total debt: Firms may use different forms of debt like bank facilities, trade facilities, working capital facilities, bonds, notes.

Lease liabilities: Capital lease liabilities are considered as debt. Also called finance lease, they depreciate over time, and interest costs are incurred by a firm.

Equity: It is the value of equity raised by the firm over time since its inception, and it also includes preferred share capital of the firm.

Reserves: Reserves generally includes the amount kept aside by the company to meet their obligations.

Retained earnings: Retained earnings are the funds that were not distributed to the shareholders and are used to fund business like repayment of debt, working capital need etc.

As a leverage ratio, D/E ratio indicates the level of debt used by a company to fund its business operations. Debt as a primary source of funding would mean that a business is highly leveraged, meaning a higher D/E ratio.

When the debt is too high companies go for debt restructuring, for example: Cycliq Group Updates On Debt Restructuring Exercise

When a company deploys less amount of debt to fund its business relative to equity funding, it will have a lower debt-to-ratio or less leverages business. The ratio also shows how much capital has been raised to run the business.

It also shows the ability of the firm to raise further capital for growth. Since businesses and capital needs are idiosyncratic, the ratio also varies across industries depending on the application of capital sources in a firm.

What does debt-to-equity ratio indicate?

A ratio of 0.1 means that the company is utilising a very minimum amount of debt, whereas a ratio of 0.9 means that the business is more tilted towards debt funding. If a firm has a ratio of 2, it means the firm uses $2 of debt for every $1 equity financing.

A lower bound ratio is suitable for companies that are operating under a volatile environment, and risks to going concern are higher. An unpredictable business environment can impact the business’ ability to meet its debt obligations, which may trigger default.

Listen: Implications of sitting on a COVID debt timebomb. Business Insolvency

Business with long-term assets that are not subject to extreme fluctuations in valuations gives room to the organisation to load more debt since lenders are willing to lend against a valuable asset. These businesses mostly include capital intensive business and provide more security to the lender in the event of default.

Whereas some businesses don’t have large asset base and assets are skewed towards inventory, intangibles etc. A higher debt-to-equity ratio, in this case, may not be sustainable since it provides less security to the lenders as well as shareholders.

Why debt-to-equity ratio is important?

It is also used to measure the financial risk of the business. A financial risk means when a company is unable to meet its obligations or repay its liabilities. A high ratio indicates that the probability of default is high along with liquidation.

Since financial risk is high, the investors or lenders will demand a higher rate of return to offset the attached risk, thereby increasing the cost of capital for the firm.

But debt is also a cheaper source of financing with no dilution of interest, and when debt-to-equity is sustainable, the company could be favourably positioned with a lower cost of capital, especially in low interest-rate environment.

Do read: Key World Economies Facing Towering Debt Accumulation: Looking at the Bigger Picture

Moreover, it becomes imperative for management to strike a balance in the capital structure of a firm to generate an adequate return by the firm. A high ratio signals the business could be in financial distress, but a low ratio may mean the business is more reliant on expensive equity funding.

We have seen companies with high debt getting into troubled waters and eventually bankruptcy.

Please wait processing your request...

Please wait processing your request...