What is the Dark Pool?

The dark pool can be defined as private networks or private platforms that allow professional investors to trade stock on a large-scale basis without revealing too many details. Thus, a dark pool is often regarded as dark pool liquidity or dark liquidity.

Dark pools are precisely opposite to public financial markets as it is a private platform without any attention from the media. The dark pool keeps the data private about the stock until the trade is executed. It is a favourable medium for the investors such as hedge funds and activist investors during situations when they do not want to reveal their strategy and the position they are taking.

When the Securities and Exchange Commission (SEC) allowed brokers to trade big blocks of shares in the 1980s, dark pools arose. Electronic trading and a 2007 SEC regulation aimed at increasing competition and lowering transaction costs have sparked an increase in the number of dark pools. Because dark pools are generally hosted within a huge corporation, they can demand cheaper fees than exchanges.

Summary

- A dark pool is a private market mainly used by institutional investors to sell off their stocks without revealing many details about them.

- A dark pool uses two methods of trading- high-frequency trade and algorithmic trade method that can process the sale of large chunks of stocks within the blink of an eye.

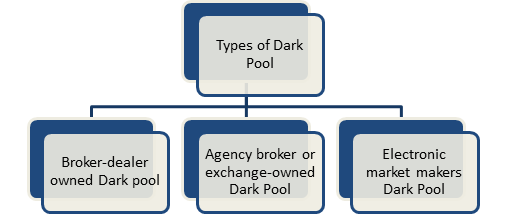

- There are mainly three categories of a dark pool- broker-dealer owned a dark pool, agency broker or exchange owned dark pool and electronic market makers dark pool.

Frequently Asked Questions (FAQ)

How does Dark Pool work?

As digital transactions are getting popular these days, the stock exchanges are purely put up in a digital form nowadays. As a result, we can find there is a steep growth in the number of dark pools these days. Another reason for the dark pool to be popular is its lower fees. As dark pools are private markets, it allows the investors to sell off their stock or securities with a minimum charge. Therefore, a dark pool is the most suitable market for institutional investors, who are performing block trades during the time of a huge investment.

For example: Let us assume that company A and company B both are institutional investors. Company A wants to sell a stock and does not want to reveal its privacy. Hence, company A sells off the stock to company B through the dark pool in such a situation.

Image source: © Michaeldb | Megapixl.com

What are the types of Dark Pools?

- Broker-dealer owned Dark Pool

The broker-dealer-owned dark pool is the dark pool developed by broker-dealers for their clients and some of their proprietary traders. Some of the popular broker-dealer owned dark pools are: CrossFinder by Credit Sussie, Sigma X by Goldman Sachs, MS Pool by Morgan Stanley, Citi-Match by Citibank, etc. The unique feature of broker-dealer owned dark pools is that they derive their prices from the trade flow. As a result, they offer the feature of price discovery to their clients.

Image source: Copyright © 2021 Kalkine Media

- Agency broker or exchange-owned Dark Pool

The agency broker or exchange owned dark pools act as agencies rather than the principal. Some of the famous agency brokers or exchange-owned dark pools are Instinet Liquidnet and IGT Posit. There is price discovery for clients available in this type of dark pool. However, the prices are still derived from the flow of trades, for instance, the midpoint of National Best Bid and Offer.

- Electronic market makers Dark Pool

Independent operators like Getco and Knight mainly develop electronic market makers dark pools. This type of dark pool operates as an independent platform with its own set of rules and guidelines.

What is Dark Pool High-frequency Trade?

Initially, dark pools were only famous among institutional investors who would prefer to keep their strategies private. However, today the dark pool has gained more popularity in the current time, allowing High-Frequency Trading (HFT) and algorithmic trading to the users that are executed without any human touch. The computer program processes massive stock trade through the dark pool within a blink of an eye, faster than any other investor.

The dark pool aims to fulfil the demand of the small exchanges that further helps to meet the demands of liquidity requirements.

What are the advantages of a Dark Pool?

Private trading facility

The privacy policy of the dark pool enables the investors to keep their strategies as secrets that won't come out to the outer world, especially to its competitors. For example, in the public market, the prices might cause an impact on people, whereas, in a dark pool, it can easily be prevented due to its privacy policies.

Avoid price devaluation

The dark pool enables the investors to break down a huge stock into smaller portions and sell them before their prices get devalued.

Source: © Artistashmita | Megapixl.coms

Increased market efficiency and liquidity

The high-frequency trade and other algorithmic trade happening in the dark pool have proven to increase market efficiency and liquidity. Thus, unlike the public market, where liquidity could dry up very quickly, in the dark pool HFT method has shown to increase both the market efficiency and liquidity.

What are the limitations of the dark pool?

Lack of transparency

As the dark pool is a private platform for stock sales, the details of the stocks are kept confidential until the execution of the sale happens. The dark pool operates its trading with very little or negligible insights as compared to any public market. It is often viewed as a limitation of the dark pool by the investors to buy the stocks.

Unfair advantages

The dark pool is also viewed as a medium where some investors receive unfair advantages. Especially in high-frequency trade, many investors gain an unfair advantage that others do not get. Unfair and unethical trade practices on the dark pool are also kept hidden.

Please wait processing your request...

Please wait processing your request...