What is Credit Valuation Adjustment?

Credit valuation adjustment (CVA) is the market worth of counterparty credit hazard, which happens when a borrower in an arrangement neglects to meet his monetary commitments. It is utilised to quantify the distinction between the actual portfolio return, considering the chance of counterparty default, and the risk-free portfolio return.

Copyright © 2021 Kalkine Media

Understanding Credit Valuation Adjustment

The credit valuation adjustment (CVA) distinguishes the risk-free portfolio and the actual portfolio that considers the chance of a counterparty's default. All in all, CVA is the market worth of counterparty credit hazard. This cost relies upon counterparty acknowledge spreads just as available danger factors that drive subsidiaries' qualities and, along these lines, exposure.

A credit valuation change considers market hazard factors and counterparty credit spreads, distinguishing between two obligations of comparable development yet extraordinary credit quality. The credit value is a valuation that decides the chance of default and is a factor that can affect credit valuation change. If that are some unwanted issues, this can likewise contrarily affect the valuation change as there is a more prominent probability of default over the long run.

The CVA has acquired new conspicuousness and has become a hotly debated issue among monetary firms worldwide, yet it has received little consideration from the academic culture. As shown by the Basel Committee, industry models are not adequately evolved to compute the CVA. In reality, banks’ current most famous methodology isn't just misrepresented, yet in addition improper in principle. That exhibits that counterparty credit hazard is yet a juvenile examination region that needs more investigation and disclosure.

The CVA is an action completed by both money and an exchanging work area in the Front Office in perspective on driving venture banks. Level 1 banks either produce counterparty EPE and ENE (anticipated positive/harmful exposure) under the responsibility of the CVA team. While a CVA stage depends on an estimation of the risk exposure, the necessities of a functioning CVA work area vary from those of a Risk Control desk, and it isn't surprising to see organisations utilise various frameworks for risk mitigation on one hand and CVA evaluation on the other.

The idea of credit risk spreads, which incorporates credit valuation change, was created because of the expanded number of country and corporate defaults and monetary aftermaths. Lately, there have been sovereign substance defaults, like Argentina in 2001 and Russia in 1998. Simultaneously, a high number of giant organisations imploded previously, during, and after the monetary emergency of 2007/08, including the Dotcom crash, Lehman Brothers, and Enron. At first, research in credit hazard zeroed in on the recognisable proof of such a danger. In particular, the attention was on counterparty credit hazard, which alludes to the threat that a counterparty may default on its monetary commitments.

Before the 2008 monetary emergency, market members treated huge subsidiary counterparties as too huge to fall flat and never thought of their counterparty credit hazard. The danger was frequently disregarded because of the excellent FICO assessment of counterparties and the small size of subsidiary openings. The supposition was that the counterparties couldn't default on their monetary commitments. During the 2008 financial crisis, the market experienced many corporate breakdowns, including huge subordinate counterparties. Subsequently, market members began joining credit valuation changes while computing the worth of over-the-counter subsidiary instruments.

Copyright © 2021 Kalkine Media

Accounting rules order the consideration of CVA in MTM announcing, which means bank income is dependent upon CVA unpredictability. DVA is likewise acknowledged, and banks that incorporate it, and by doing so, should keep on including it going ahead and add their own acknowledge spread as a wellspring of profit unpredictability. To alleviate CVA instability, just as a fence for defaults and risk, numerous banks purchase CDS assurance on their counterparties. Supporting DVA isn't as direct. Since DVA increments as the bank's credit spread augments, it is comparable to the bank being short on its obligation. Subsequently, supporting includes purchasing the bank's bonds or selling a security on profoundly associated organisations, i.e., different banks, since they can't sell assurance on themselves.

Consider, for instance, fixed-to-float financing cost trades. Enterprises regularly enter these two-sided agreements to deal with their floating cost versus fixed financing cost openings. Loan fee trades are an excellent reciprocal model for a run of the CVA examination; their multi-period incomes driven by loan cost developments make testing valuation draws near:

- There are two essential orders for the valuation strategy: Current Exposure (CE) and Expected Future Exposure (EFE) Strategy. The EFE strategy is viewed as the unique valuation system as it fuses not just the current hazard profile but also the conceivable flip between resource/obligation positions.

- Specifically, the CVA is the summation of the supreme worth of the exposure driven by the loan cost model and the likelihood of default inputs applied at each intermittent future money stream related to the agreement.

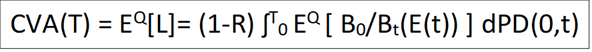

The formula for calculating CVA is

Where:

- T = Maturity period of the most extended transaction

- BT= Future value of one unit of the base currency invested at the current interest rate at T maturity

- R = Fraction of the portfolio value that can be removed in case of default

- T = Time of default

- dPD(0,t) = Risk-Neutral probability of counterparty default (between times 0 and t)

- E(t) = Exposure at time T

Frequently Asked Question’s

What are the different methods of evaluating CVA?

There are various methods to evaluate CVA, which depends on the organisation's character and resource availability to market participants.

- Simple Approach: The method is used to calculate the MTM of any instrument. The calculation is then modified to take account of the counterparty risk by adjusting the spreads.

- Swaption-Type Valuation: The method is a bit more complex and requires in-depth knowledge of derivative instruments and valuations. It uses the credit spread as an estimation against the replacement value of an asset.

- Simulation Modelling: The method involves the simulation of various market factors and risk factors. The evaluation is done considering the multiple outcomes through the simulation. The final profile is created by aggregating the matrix of all the results.

While CVA valuation strategies are very much progressed, they are as not yet normalised and may differ among market members, going from generally effortless to profoundly complex philosophies driven to a great extent by the refinement and assets accessible to the market. Contingent upon the specific market member, CVA can be critical, especially for enormous monetary foundations that are profoundly dynamic in the subsidiary business sectors.

To decide CVA, associations start by evaluating and estimating net counterparty credit exposures. The following stage is then to value the credit hazard of those exposures utilizing the authoritative terms and conditions of the instrument or portfolio and market sources of info, for example, financing costs, foreign trade rates, credit default swap (CDS) spreads, and other applicable factors. Figuring out which CVA valuation technique to embrace is regularly determined by the association's refinement, specialized capacity, and asset imperatives. The most straightforward methodology includes computing the current imprint to-showcase worth of the subordinate and afterward rehashing the estimation by changing the markdown rates, in a limited income structure, by the counterparty's credit spread when the openness is to the counterparty (for example, the subsidiary is in-the-cash or a resource) or one's credit spread if the counterparty is presented to the element (for example the subsidiary is out-of-the-cash or a responsibility). The contrast between the two outcomes is the CVA sum.

A more robust methodology that depends on a swaption type valuation way is to calculate an approx. value of the replacement cost of the derivative using the credit spread determined by the counterparty's risk profile. This methodology requires more complex information on subordinate valuations and admittance to more explicit market information, for example, loan cost unpredictability surfaces.

Further developed methodologies imply simulation of various market hazard factors and hazard factor situations and afterward revaluing every subsidiary utilizing, for instance, a large number of reproduction situations by 100-time steps. The subsequent framework of re-enactments by situation and time steps is then accumulated to produce a standard profile for each netting counterparty. A collateralised expected profile is then inferred by changing each counterparty’s exposure profile to represent the accepting and posting insurance as material.

Some market members consider CVA relating to their exposures to counterparties; however, most participants use a counterbalancing method called Debt Valuation Adjustment (DVA), which is the counterparty's exposure to the market member. CVA and DVA are then equated with figuring respective CVA.

What are the challenges in determining CVA?

Frequently organisations battle with CVA because of framework constraints that are attached to business needs. For instance, substantial monetary foundations with huge subordinate portfolios effectively oversee CVA through a devoted CVA team. These organisations usually have progressed frameworks and analytics alongside the supporting foundation expected to run the administrations, figure anticipated factors, and follow and oversee net collateral by a counterparty insured against the typical exposures.

Organisations that have just a tiny bunch of subordinates would be unable to legitimize a similar significant expense of the innovation, framework, and individuals and will, in a general search for more cheap and efficient options, for example, bookkeeping page models or some outsider electronic arrangements. Processing CVA by spreadsheet techniques is by and large the most un-alluring arrangement, as they will, in general, be profoundly awkward and inclined to manual blunder ordinarily and still require some level of scientific ability to concoct the suspicions for the arrangement. For some associations, this might be the only reasonable choice.

An obstacle for all organisations for calculating CVA is getting the essential market information needed for the estimation. Parameters such as discount curves, credit spread curves, and volatility are generally required for these calculations. The obstacle lies in how frequently this market information isn't promptly accessible in any event for enormous monetary establishments and involves some level of judgment in concocting intermediary information to be utilized to figure CVA. Name-explicit or intermediary CDS spreads are commonly used for credit spreads if accessible. On the other hand, credit spread intermediary estimates, for example, new obligation issuance spreads, are generally utilised where CDS spreads are not promptly accessible. Critical judgment can likewise be needed in figuring out which intermediary measures to pick, especially if, for instance, there are no new proper name-explicit obligation issuances to reference, as well as one need to investigate then obligation issuance spreads for peers.

Usually, outsider market information specialist organizations are expected to provide both the current and verifiable market information needed to evaluate the evaluation. Traditional information sources, such as papers and the web, are deficient and don't provide sufficient recorded information.

Please wait processing your request...

Please wait processing your request...