What are convertible bonds?

The bonds which the corporation issues are mainly known as convertible bonds. As the name suggests, convertible bonds can be converted into shares of the same company's stock as per the choice of the bondholder. Thus, convertible bonds possess both equity and debt qualities, and they usually offer more revenue than common stock but not more than corporate bonds.

Just like corporate bonds, convertible bonds do also come along with a specific maturity date. If an investor decides to convert the bonds into equity, the bond will lose its debt properties and possess only equity properties. However, if an investor is not willing to convert the bond, then, in that case, he will receive only the face value of the bonds upon its maturity.

Summary

- Convertible bonds are defined by the bonds that can be readily converted into shares of the same company's stock.

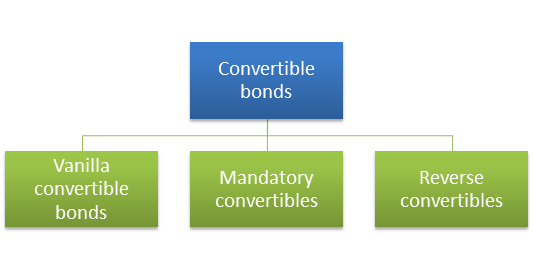

- There are mainly three types of convertible bonds: vanilla convertible bonds, mandatory convertibles, and reverse convertibles.

- Convertible bonds not only help companies to gather capital quickly but also help in reducing tax deductions on interests.

Frequently Asked Questions (FAQ)

Why do companies issue convertible bonds?

It has been observed that companies that lack credit rating and have a high growth potential are the ones to issue convertible bonds. These bonds are said to be more flexible than any other regular bonds.

Image source: © Rummess | Megapixl.com

There are mainly two reasons why companies issue convertible bonds.

- Convertible bonds help to lower the coupon rate on debts.

Investors prefer lower coupon rates on convertible debts than any regular or corporate bond coupon rate. The convertible feature of the bonds allows to lower down the coupon rate on the debts. It is beneficial for the issuer as it helps him to save on interest expenses.

- Convertible bonds help in delaying dilution.

Convertible bonds are also helpful when raising capital through bonds rather than equity as it helps the issuer delay the dilution to its equity holders. At times some companies might experience situations in which it readily offers debt securities in medium terms as the interest expenses are tax-deductible. However, dilution can be manageable as the net income and share prices grow throughout the bond.

What are the different variants of convertible bonds?

The following are the popular types of convertible bonds often referred to investors:

- Vanilla convertible bonds

A vanilla convertible bond is the most popular form of convertible bond currently available in the market. Vanilla bonds allow investors to convert their bonds into a certain number of shares at a predetermined conversion price and the rate at the time of maturity. For example, the vanilla bonds might pay coupons payments during the bond's duration and come with a fixed date of maturity wherein the investor is paid the bond's nominal value.

Image source: Copyright © 2021 Kalkine Media

- Mandatory convertibles

Mandatory convertibles refer to the compulsory bonds for the investors to convert into shares of that specific company where he invests. As an added advantage, mandatory convertibles come with two different convertible prices. The first price will be the price that will delimit the price at which the investor will receive the par value in shares. The second price is supposed to limit an investor to receive above the par value.

- Reverse convertibles

The reverse convertibles commonly refer to the bonds that can be either repurchased in the bond in cash or converted into equities at a predetermined price and rate at the time of maturity.

How can conversion ratio be defined with respect to convertible bonds?

The conversion ratio is also popularly known as conversion premium. The conversion ratio portrays the number of shares that can be converted from a single convertible bond. It can also be represented by the conversion price mentioned in the official statement and the other provisions.

However, investors must remember that the prices of convertible bonds are highly dependent on the underlying share price. Nonetheless, an exception occurs with convertible bonds at the time when the share price goes down substantially. As a result, the investors in that situation receive money higher than their par value during maturity.

Let us study an example of a conversion ratio to understand the concept. Let us assume that the conversion ratio is 30:1 with a par value worth AU$1000. It denotes that one convertible bond can be further converted into 30 shares of the same company.

What are the pros and cons of convertible bonds?

Convertible bonds come with their own set of pros and cons. So let us first look at the pros of convertible bonds.

The following are the pros of convertible bonds:

- Fixed-rate of interest

One of the primary advantages of convertible bonds is that it gives the investors a fixed rate of interest payments. Moreover, investors can also choose to convert the bond into stocks and gain benefits from it.

- Tax benefits

The interest gained from bonds is subjected to tax deductions. However, issuing convertible bonds can save a company from paying heavy tax, which is otherwise not possible in equities.

- Allows delay in stock dilution

Another beneficial feature of convertible bonds is that it lets the issuer cause delay in the stock dilution. As a result, companies can issue convertible bonds to investors to raise capital without immediately diluting the shares.

- Lower interest than regular bonds

Another significant aspect of convertible bonds is that it offers lower interest payments to investors than regular bonds. As a result, a company can raise its capital quickly without investing much in interest payments. On the other hand, investors are okay with lower interest because they can convert their bonds to shares anytime and enjoy its benefits.

Image source: © Convisum | Megapixl.com

The following are the cons of convertible bonds:

- Low coupon rate

One of the major drawbacks of convertible bonds is that they offer low coupon rates. This is because of the feature of a convertible bond being readily able to be converted into shares.

- Risky for investors

Convertible bonds might put investors at risk of loss in certain cases. It is applicable in cases of companies that earn low revenues and is a startup.

- Share dilution cannot be prevented in certain situations.

Exceptions do occur in cases of convertible bonds in certain situations where share dilution cannot be prevented. As a result, share prices and EPS dynamics may get depressed.

Please wait processing your request...

Please wait processing your request...