What is a cash dividend?

Cash dividends can be defined as the percentage of profit or recent earnings paid to the shareholders of a company in cash. The funds are transferred through cash, unlike stock dividend or any other form. The management and board of the company decide upon the dividend that is to be paid to the stockholders. They determine if the dividend payment is to be kept the same or to change. Most of the brokers try to convince their clients to reinvest in that company. In fact, long-term investors do reinvest to maximise their profit earning.

Summary

- Cash dividend can be defined as the percentage of profit or revenue paid to the shareholders of a particular company in cash.

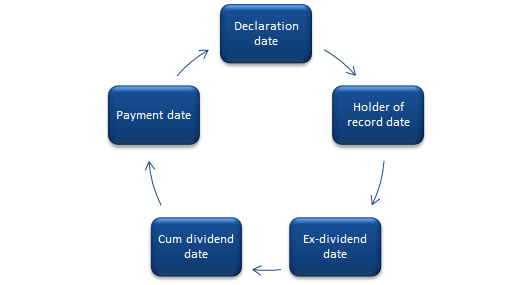

- Some important dates that involve the cash dividend process are declaration date, holder of record date, ex-dividend rate, cum dividend rate, payment date.

- Cash dividends are necessary for a company to draw new investors and persuade the old investors to reinvest.

Frequently Asked Questions (FAQs)

How can we explain cash dividends?

The cash dividend is one of the most common ways of returning the capital to the shareholders in the form of cash payment periodically. It is commonly paid on a quarterly basis. However, some shareholders do get paid monthly, semi-annually, or annually from the company that they invest in.

Image source: © Cammeraydave | Megapixl.com

What are the important dates involving the cash dividend process?

The entire cash dividend process has been broken down into simpler steps by the board of the companies. Below mentioned is some of the important dates involving the entire cash dividend process.

- Declaration date: The management and board declare the approval of the cash dividend payment for all its shareholders.

- Holder of record date: The shareholders who are eligible for receiving the cash dividend is determined on this date, i.e., holder of the record date.

Image source: Copyright © 2021 Kalkine Media

- Ex-dividend date: Usually, the ex-dividend date is two days prior to the holder of the record date. From this date, the company does not pay any dividend to new shareholders.

- Cum dividend date: The time between the ex-dividend date and the payment date is known as the transition period. The dividend has already been announced yet not paid.

- Payment date: The actual date of cash payment when it is paid to the eligible shareholders. The interim payment is due 30 days after the declaration date, and the final payment is due 30 days after the AGM (Annual General Meeting).

How to do accounting for cash dividends?

After declaring the dividends, a company debits all its retained revenue and credits an amount in the liability account in the name of dividends payable. On the day of payment, the company makes a debit account entry of the dividends payable and credits the cash account for the same cash outflow.

Cash dividends, however, have got nothing to do with its income statement. But it does shrink a company's shareholder's equity and cash balance by the same amount. Cash dividends are reported as a valid financial activity in the cash flow statement of the companies.

What is the significance of a cash dividend?

There are multiple reasons why cash dividend is considered important for a business.

- The companies distribute cash dividends as it helps them to balance a particular financial ratio or maintain any cylindrical tendencies of the company.

- Cash dividends also help a company to bring in more investors and focus on reinvesting for their own business growth. As a result of this, the companies at their maturity stage tend to pay out the dividends regularly as compared to the new ones.

- These dividends act as a display to show the market sentiments. The analysts and experts observe the market trends as per the dividends and lay out their conclusions even during an economic downfall.

- Companies do not always distribute dividends in the form of cash. They also distribute stock dividends or give an option to the shareholders to either choose in between cash dividend or stock dividend. The shareholders are also given the option to reinvest as it can effectively help in business growth.

Which companies are eligible for distributing cash dividend?

The companies that have a steady cash flow usually are ideal for distributing cash dividend as their business have surpassed the growing stage and have secured a stable position in the market. Usually, the small business that is still in its growth stage does not distribute its revenues to the shareholders as they need money for their own operational activities.

What is the difference between the cash dividend and the stock dividend?

Cash dividends- Cash dividend refers to the distribution of the recent profit or revenue earnings of the company to the shareholders in the form of cash. This is generally paid quarterly, but sometimes cash dividends are paid annually and semi-annually as well.

Stock dividends- Stock dividend refers to the increase in stock given to the shareholder by the company during the time of the revenue income. The increase in stock depends on the amount of liquid cash available to the company.

Please wait processing your request...

Please wait processing your request...