What is Cash Conversion Cycle (CCC)?

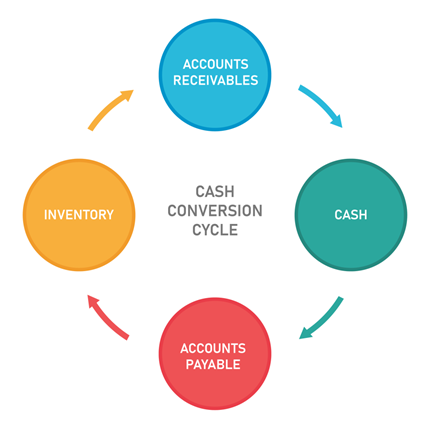

The cash conversion cycle can be defined as a metric that is used to calculate the average time taken for a company to convert its investments in inventory and other sources into cash flow happening through sales. The cash conversion cycle is also commonly known as the net operating cycle. The purpose of the cash conversion cycle is to calculate the number of days it would take a company to earn money from sales and reinvest that for purchasing raw materials for operations.

Image source: © Bakhtiarzein | Megapixl.com

Summary

- The cash conversion cycle can be defined as a metric that is used to calculate the average time taken for a company to convert its investments in inventory and other sources into cash flow happening through sales.

- A lower cash conversion cycle denotes that very little time will be taken by a company to complete its production cycle, sell out the products and bring in cash from the sales.

- The three essential components of the cash conversion cycle are days inventory outstanding (DIO), days sales outstanding (DSO) and days payable outstanding (DPO).

Frequently Asked Questions (FAQ)

How can Cash Conversion Cycle be explained?

The cash conversion cycle is a metric that analyses the average time taken by a company to convert its investments in inventory and other sources to turn into cash. The conversion depends on several factors such as the company's way of investing, whether it is utilising its fund in a correct way or not, the production cycle, demand of the product, the payment mode of the customers and how soon can be payment be deposited to the company's fund, etc.

Image source: © Rummess | Megapixl.com

A lower cash conversion cycle denotes that very little time will be taken by a company to complete its production cycle, sell out the products and bring in cash from the sales. By this, it can be understood that the cash conversion cycle is one of the most crucial elements that determine the efficiency of a company; along with analysing that, it also gives an idea of how much time a company will get to pay its own bill.

What is the formula for calculating the Cash Conversion Cycle?

The formula for calculating the cash conversion cycle is:

Cash conversion cycle = DIO+DSO-DPO

Where:

- DIO is known as Days Inventory Outstanding

- DSO is known as Days Sale Outstanding

- DPO is known as Days Payable Outstanding.

In this formula, DIO and DSO refer to cash inflow, whereas DPO refers to cash outflow. The calculation of a company's cash conversion cycle involves three major steps. The following are the elements from the financial statements that are required to calculate the cash conversion cycle:

- Revenue earned and cost of goods sold.

- Inventory in the beginning as well as at the end of the time period.

- Account receivable and account payable at the beginning as well as at the end of the time period.

- The number of days in the total time period.

What are the components of the cash conversion cycle?

The calculation of the cash conversion cycle might appear a bit complicated initially. However, once you get familiar with all the components of the cash conversion cycle, it will be easier for you to calculate the same. The following are the components of the cash conversion cycle:

- DIO (Days Inventory Outstanding)

Days Inventory Outstanding (DIO) refers to the average number of days required to convert inventories into sales. Days Inventory Outstanding can be calculated by:

DIO = (Average inventory/ cost of goods sold) x 365

DIO is practically the average number of days until the product is held before selling.

Image source: © Pmphoto | Megapixl.com

- DSO (Days Sales Outstanding)

Days Sale Outstanding (DSO) refers to the average number of days required for the company to actually obtain the cash from the customers after selling the product. Days sales outstanding can be calculated by:

DSO= Average accounts receivable / Total credit sales x 365

Practically, DSO is the average number of days needed for a company to receive its payment through sales from the customers.

- DPO (Days Payable Outstanding)

Days payable outstanding or DPO is the average number of days needed for the company to deliver its payables. DPO can be calculated by the following formula:

DPO = Average accounts payable / cost of goods sold x 365

Practically, the Days Payable Outstanding is the time needed by the company to pay its own bills to the suppliers or buy raw materials.

How can the cash conversion cycle be improved?

The less the cash conversion cycle is, the better it is for the overall development of the business. A lower value of the cash conversion cycle indicates that the company requires fewer number of days to procure the money from sales that it has already invested. Therefore, it gives a positive report about the business and its efficiency.

The target of every business is to reduce the cash conversion cycle. Hence, to improve the cash conversion cycle, the company should give extra attention to the three most important elements that determine the CCC: Days Inventory Outstanding (DIO), Days Sale Outstanding (DSO) and Days Payable Outstanding (DPO). Therefore, a company can improve its cash conversion cycle by reducing it by following the three steps:

- By converting inventory to sales faster

- By obtaining payment from customers faster

- By postponing the time of the payments

Please wait processing your request...

Please wait processing your request...