What are cash and cash equivalent (CCE)?

Any monetary resource that a corporation can use to run its business is referred to as cash. Cash could be in any form, such as coins, account balance, liquid cash, etc. The concept of cash equivalent can be defined as a component of the balance sheet that determines the cash and other assets available that could be readily converted to cash. The two major criteria for an asset to be considered as a cash equivalent is for the asset to be readily convertible to money, and a maturity time of less than a year. The reason being so, that there is a negligible amount of change in the cash due to the change in the rate of interest or so.

It belongs under the classification belt of 'current assets' in the balance sheet.

Summary:

- Cash is defined as the amount of monetary resource of a company that can be used for business.

- Cash equivalents are referred to as the assets of the company that could be readily converted into cash for utilising in business purposes.

- The different types of cash and cash equivalents are foreign currencies, cash, and cash equivalents.

- Assets that are not considered as cash equivalents are credit collateral and inventories.

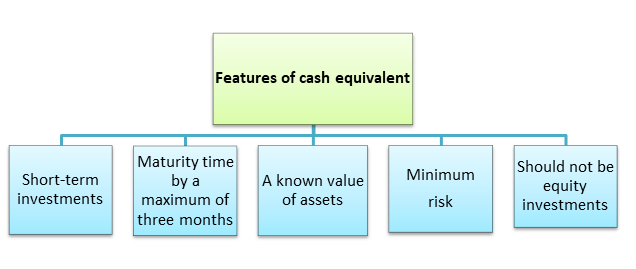

What are the features of cash equivalents?

Not every asset of a company can be considered as cash equivalents. Before deciding if an asset is cash equivalent or not, there are a few things to think about. Let us have a look at the features that a cash equivalent must possess:

- Cash equivalents must be assets that could be readily converted into cash:

Cash equivalents come into use when there is an emergency need for money within a very short notice. Hence, assets that are eligible for getting converted readily and quickly are considered as cash equivalents.

- The convertible amount must be known and accurate:

Apart from being a quickly convertible amount, the value of the asset must also be fixed and accurate. The value of the assets that you have no knowledge about cannot be considered as cash equivalents. This implies that the maturity date of the asset must be close so that the asset's market price is known to the company.

- Minimum risk:

As cash equivalents serve the purpose of emergency need of cash, there must not be too many complications or risk related to it. It should be readily available and quickly convertible in nature. Thus, the assets that have a maximum 12-month maturity time are mostly considered as cash equivalents.

- Assets must not be equity investments:

The assets that fall under the category of equity investments are not considered as cash equivalent resources of the company. However, if the maturity date is within three months or less, they are at times regarded as cash equivalents under some special circumstances.

Image source: © Madartists | Megapixl.com

What are the different types of cash and cash equivalents?

Cash

Cash denotes all the company's monetary resources in the form of currency, including bills, coins, and currency notes. Cash can be readily withdrawn from demand deposits at any time without any prior notice. For instance, let us assume that a demand deposit has got both a checking account and a savings account. The demand account balances are stated in the account statements as cash totals.

Some of the examples of cash are:

- Coins

- Bank drafts

- Cash in checking accounts

- Money orders

- Petty cash

- Cash in savings account

- Currencies

Foreign Currency

Some companies often experience a currency exchange risk when they hold currencies from various foreign countries. The foreign currencies must be converted to the reporting currency while preparing the account statement. The conversion aims to show what if the company did business only with a single currency. The conversion losses that are incurred while converting the currencies are known as 'accumulated other comprehensive income.

Cash Equivalent

Cash equivalents can be explained as the investments or assets of a company that could be readily converted into cash during the time of an emergency. However, not every investment or assets are counted as cash equivalents. There are specific eligibility criteria for the assets to become cash equivalents. These eligibility criteria are already explained above.

Image source: Copyright © 2021 Kalkine Media

For a business, cash and cash equivalents are extremely beneficial. It becomes useful in situations like buying inventories, covering operation expenses and make other investments for the business once they become a part of the company's networking capital, i.e. (current assets - current liabilities). Cash equivalents are also identified as cash backups that are extremely useful during the time of a financial emergency. Lastly, cash equivalents could also be used to fund an acquisition.

Some of the examples of cash equivalents are:

- Treasury bills

- Money market funds

- Marketable securities

- Short-term government bonds.

- Commercial papers

Cash and cash equivalents do not incorporate the following:

- Credit collateral

Some exceptions short-term investments such as treasury bills do not count as cash equivalents. Although treasury bills are short-term investments, yet they are restricted from converting into cash during the time of financial emergency.

- Inventories

One of the most essential features of cash equivalents is that they must be readily converted into cash. However, the inventories that the companies own cannot be converted into cash quickly. Thus, inventories are not counted as cash equivalents.

Please wait processing your request...

Please wait processing your request...