What is Carriage and Insurance Paid To?

The term Carriage and Insurance Paid To (CIP) is used to define any transportation mode wherein a seller bears the cost of freight as well as insurance cost to deliver goods to a carrier or any other person designated by the seller at an agreed upon destination/location. In this kind of arrangement, as soon as the delivered goods reach the designated person or the carrier, the risk of damage or loss to the goods shifts from the seller to the buyer. This means that the seller is not liable to share the risk involved in this transfer of goods after they are accepted by a seller-appointed party at a specified location.

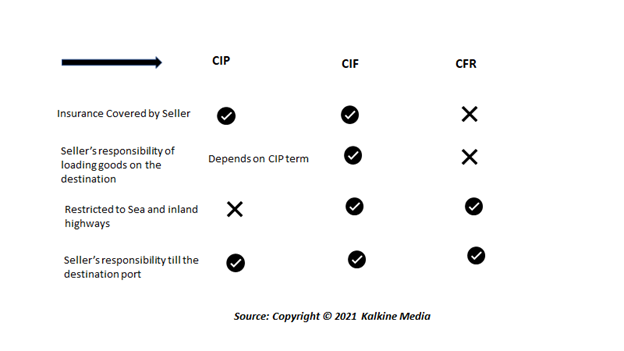

Though we can compare CIP with Cost, Insurance, and Freight (CIF), but the duo is different. In CIP, while in transit, the seller is bound to insure goods for 110 percent of value of the goods. Furthermore, in a situation when the buyer asks for additional insurance, the seller must arrange such extra coverage. Other than CIF, CIP is one of the two Incoterms 2020 rules that tell us as to which of the parties must purchase insurance.

According to the Incoterms 2020 rules, published by the International Chamber of Commerce (ICC), Carriage and Insurance Paid can be used for any mode of transportation.

Summary

- CIP is used to define any transportation mode wherein a seller bears the cost of freight as well as insurance cost to deliver goods to a carrier or any other person designated by the seller at an agreed upon destination/location.

- Under CIP, while in transit, the seller is obliged to insure the goods for 110 percent of the invoice value.

- CIP can be used for any mode of transportation, and it is one of the 11 incoterms published by ICC which receives universal acceptance in international trade.

Frequently Asked Questions (FAQs)

How does CIP work?

In CIP, the seller is responsible for the freight and insurance cost to deliver the goods to any person designated by the seller at an agreed upon location. Once the goods are received by the shipping carrier, the transfer of risk takes place. This means that the risk of damage/loss to the goods shifts to the buyer as soon as they are received by the carrier or appointed person. Under CIP, the freight charges include -- transportation cost for any accepted mode of transport, like road, rail, sea, inland waterway, or air.

Say for instance: Apple in United States wants to ship apple mobile phones to India. As per the CIP, Apple is responsible for all freight costs and minimum insurance coverage to deliver the IPhones to the carrier or designated person at an agreed-upon destination. Once the shipment is delivered to the carrier or appointed person, Apple's (the seller) obligation is complete, and this is the point where the entire responsibility and the risk lies with the buyer.

Image Source: © Bankrx | Megapixl.com

Can a buyer ask for additional insurance coverage in CIP?

It is worth mentioning that under CIP, the seller is only bound to pay for a minimum amount of freight and insurance coverage for the shipment of goods. However, there can be situations when the buyer might ask for additional insurance. It is safe for a buyer seeking an extra coverage in order to protect the shipment from possible risks. If this is not done, then the buying party will be at a loss in case the shipment is damaged due to any untoward incident which is not covered under the minimal insurance cover offered by the seller. In such circumstances, the purchaser of the goods can request the seller for an additional insurance coverage. Depending on the bargaining power of the buyer it is possible that the seller agrees to increase the limit of the insurance coverage, which was set initially.

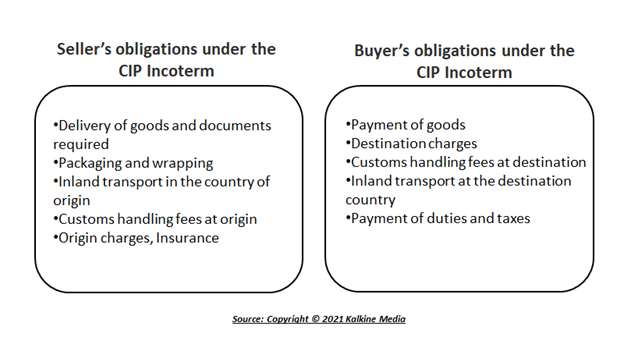

Discuss the seller's and buyer’s obligation under the CIP incoterm?

What is Cost, Insurance and Freight?

Cost, Insurance and Freight or CIF refers to the expense which is paid by a seller during the transportation of a buyer’s order to cover the freight and insurance cost in addition with other costs. Here, the seller bears the cost of any damage caused to the product, till the time the goods are completely loaded on a transport ship. Once the goods are loaded, the responsibility for all other costs lies with the buyer and not seller. Prior to this, the seller bears the cost of all the paper works involved in the delivery process. Furthermore, the seller also bears the expense if any custom duty is levied on the product.

What is Cost and Freight?

Cost and Freight or CFR is mostly used in overseas trade contracts. CFR applies to the cargo transportation via inland waterways or seas, wherein, the seller makes all the arrangements for the transportation of goods to a specified port and facilitates the required documents for a buyer to obtain the goods from the carrier. Under CFR, the seller does not hold the responsibility to provide any marine insurance coverage to the buyer in case there is a loss or damage to the ship during the transportation of goods. It is an agreement or contract, whereby, the buyer and seller reach a consensus to include cost and freight in their transaction.

What is the difference between the CIF, CIP and CFR?

What are the responsibilities of the seller under CIP?

Under CIP, the seller must bear the costs for maintenance of the goods in the warehouse, transportation cost from warehouse to the first port, depot charges, freight forwarder’s charges / air freight charges / ocean freight charges (depending on medium of transportation) and insurance charges.

- Freight terms: In CIP, the seller has a lot of work to be completed before the goods reach the target port. This involves--- inland transit (from warehouse to the first port) and Carriage from the first port to the next port.

- Custom clearance: As per the CIP, both the seller and buyer have an equal role when it comes to custom clearance. Thus, here, the exporter looks after the export proceedings and facilitates all required documents, while the buyer or importer gives his nod for the proof provided by the seller and takes care of the import customs.

- Insurance: In a CIP transaction, the seller provides the insurance coverage. Besides, he also pays for the cost involved in the licensing and security permits. Furthermore, in a situation when the buyer asks for additional insurance, the seller must arrange such extra coverage.

Please wait processing your request...

Please wait processing your request...