What is the capital account?

Capital account is an element of a country's balance of payments. The capital account records the country's capital transactions with the rest of the world. Purchases and sales of non-financial assets and non-personal assets are examples of these transactions. The Capital account records the transactions that don't affect the production, income and savings.

Summary

- The capital account records the country’s capital transactions with the rest of the world.

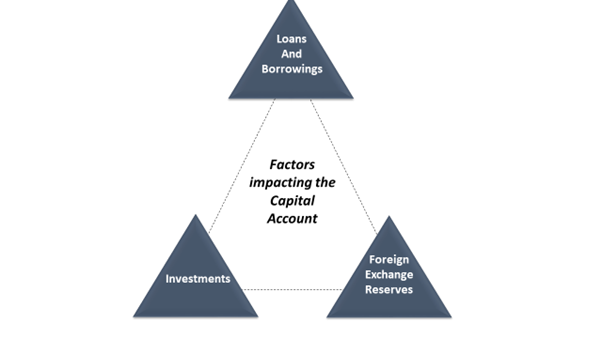

- The inflows and outflows associated with loans and borrowings from the rest of the world, investments in foreign shares and real estate and foreign exchange reserves are recorded in the capital account.

- The balance on the capital account is the net value of the credit and debit of items in the capital account on the Balance on Payments of the country.

Frequently Asked Questions

What is meant by a country’s balance of payments?

A country's balance of payments (BOP) is a systematic account of all of the country's economic dealings with the rest of the world during a given period, usually a year. Both sides of transactions, credit and debit, are included. The BOP should theoretically be zero, indicating that assets (credits) and obligations (debits) are equal. However, this is rarely the case, and the BOP can indicate whether a country has a deficit or a surplus and where the differences are coming from. The balance of payments comprises the current account, capital account and financial account. The current account tracks international trade in goods and services, as well as net income and transfers. The financial account tracks the net change in foreign and domestic asset ownership. The details of the capital account are discussed below.

© Karenr | Megapixl.com

What are some items recorded in the capital account of the Balance of Payments?

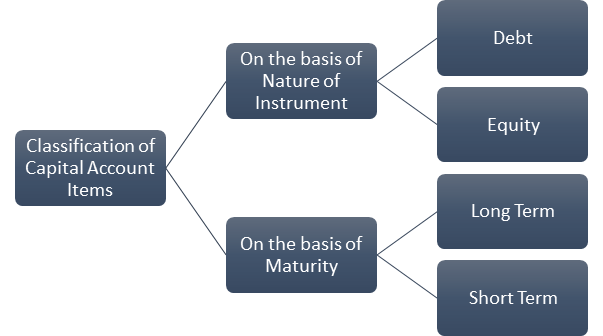

Capital inflows can be classified by instrument (debt or equity) and maturity in the Capital Account (short or long term). Foreign investment, loans, and banking capital are the main components of the capital account. Non-debt liabilities are represented by foreign investment, including foreign direct investment (FDI) and Portfolio Investment by Foreign Institutional Investors (FIIs). American Depository Receipts/Global Depository Receipts (ADRs/GDRs) are non-debt liabilities. ADRs are a type of equity security designed to make foreign investment more accessible to American investors. ADRs are issued by a bank or broker in the United States. A global depositary receipt (GDR) is a bank certificate for shares in a foreign company issued in multiple countries. Debt liabilities include external assistance, external commercial borrowings, trade credit and banking capital (inclusive of NRI deposits).

It is interesting to note that international investment serves as a conduit for governments to acquire access to foreign currency. Foreign direct investment (FDI) and foreign institutional investment (FII) are two types of FDI (FII). Foreign direct investment is a medium- to long-term investment that incorporates direct production activities. Foreign institutional investment, on the other hand, is primarily a short-term investment in financial markets. Because of its short duration, FII can have bidirectional causality with other local financial markets such as money markets, stock markets, and foreign currency markets.

Copyright © 2021 Kalkine Media

What are the various transactions impacting the capital account of a country?

The following transactions impact the debit and credit side of the capital account of a country-

- Transactions involving the private sector, government, and other borrowings from overseas- On the positive (credit) side, receipts of such loans and repayments by foreigners are documented.

- Private sector and government financing dealings to foreign countries are recorded in the capital account of the country's balance of payments. Foreign lending and loan repayments are recorded as negative or debit item.

- The rest of the world's investments in domestic companies' shares and real estate- Because they bring in foreign exchange, such investments from overseas are recorded on the positive (credit) side.

- Domestic residents' investments in international stocks and real estate- Such investments in the foreign market are reported as a negative (debit) since they result in a foreign exchange outflow.

- The foreign exchange reserves are the government's financial assets held by the nation’s central bank. BOP account records "change in reserves" The financing item in India's BOP is a change in reserves. As a result, any withdrawal from reserves is recorded on the positive (credit) side, while any addition to these reserves is recorded on the negative (debit) side.

Copyright © 2021 Kalkine Media

What are the possible effects on the capital account balance?

Inflows of forex are recorded on the positive or credit side and outflows on the debit side. The balance on the capital account is the net value of the credit and debit items on the Balance on Payments. Capital account is said to have a surplus when the sum of the credit balance is more than that of the debit items. When outflows exceed the inflows, there is a deficit in the capital account.

What is the financial account?

Under various balance of payments systems, the financial account, also known as part of the capital account, monitors the net change in ownership of national assets. A financial account surplus indicates that foreigners are buying more domestic assets than domestic buyers are buying assets from other countries. When a financial account has a negative balance, we refer to it as a financial account deficit. When domestic buyers purchase more international assets than foreign purchasers buy domestic assets, this occurs.

What some examples of transactions that impact the capital account?

- Country A based company establishing franchises in Country B

- People of country A buying stocks of a company based in country B

- A person resident in Country A taking an insurance policy from an insurance company outside the country

- Company based in Country A may accept deposits by issuing commercial paper to a non-resident or foreign portfolio investor from country B.

- Loans and overdrafts by a person resident in Country A to a person resident in country B

- Remittance outside Country A of capital assets of a person resident in Country B

- Sale and purchase of foreign exchange derivatives in Country A

- Investment in Country A by a person resident in Country B

Please wait processing your request...

Please wait processing your request...