What is business?

Before writing about business assets, let us understand the term 'business' first. A business is an organisation that consists of individuals working together to attain shared goals and objectives. A commercial corporation needs to have a mission that reflects what it hopes to accomplish in the future and values that demonstrate the organisation's integrity.

However, a business organisation is an industrial, commercial, or mercantile enterprise that is made up of individuals. A business is a legally recognised entity that sells goods, services, or both to people.

Highlights

- Business assets could be anything of value to the organisation that aids in increasing productivity, efficiency, and profit.

- Non-operating, current, operating, non-current, intangible, and physical assets are the most common categories of assets.

- Intangible assets maybe even more significant and precious to a firm.

Frequently Asked Questions (FAQs)

What are business assets?

Business assets could be anything of value to the organisation that aids in increasing productivity, efficiency, and profit. They are frequently classified as follows:

Intangible assets: This form of asset maybe even more significant and precious to a firm. These assets are more difficult to quantify because they aren't always something that could be felt or touched. It could be the firm logo, slogans, or even the workers' required competence. Intangible assets such as a firm's status and brand recognition could make a firm incredibly valuable.

Tangible assets: This type of asset is typically something that can be touched and seen. It could be computers, vehicles for transportation, office furniture, manufacturing equipment, goods or real estate.

Source: Copyright © 2021 Kalkine Media

If a firm doesn't have the cash flow to pay down its present creditors, it can turn its assets into income. The balance sheet, which may be seen in the annual report, lists and values the corporate resources. They are shown on the balance sheet as items of ownership and are listed at historical cost rather than market pricing.

Moreover, most corporate assets can also be written off, which adds an expense to the income statement as a single substantial expense in the year of purchase. Business assets could also be depreciated, which spreads out an asset's cost over time.

However, assets aid in the survival of the organisation. It is a resource that is monitored and kept by the government, a company, or an individual in the hopes of generating a profit. They could be sold during difficult times, used as collateral during expansion, and contribute to a solid balance sheet. Available cash to patent rights, real estate, and logos are all instances of business assets.

Non-operating, current, operating, non-current, intangible, and physical assets are the most common categories of assets. Therefore, it is crucial to accurately identify and classify assets to ensure a firm's sustainability, particularly its solvency and the dangers that come with it.

Part of successfully running or operating a business is choosing the appropriate assets to manufacture goods or offer services. Therefore, to run and prosper properly, a firm requires the appropriate assets.

The worth of a firm's assets can change and fluctuate over time. Several current tangible assets, like machinery, computers, and automobiles, are prone to age, and some may become outdated.

Source: © Kenjiimages | Megapixl.com

What are the different types of assets, and how do you categorise them?

Current assets

Current assets are those that could be quickly converted into liquid assets within a year. Here are some instances of current assets.

Source: Copyright © 2021 Kalkine Media

Fixed or non-current assets

Non-current assets cannot be quickly transformed into liquid assets. Therefore, it's also known as fixed assets, long-term assets, or hard assets. The following are instances of non-current or fixed assets:

Source: Copyright © 2021 Kalkine Media

Operating assets

Operating assets are necessary for a firm's day-to-day operations and are utilised to earn cash from the firm’s core activities. Here are some instances of operating assets:

Source: Copyright © 2021 Kalkine Media

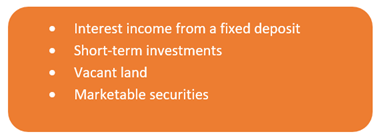

Non-operating assets

Non-operating assets are those that are not necessary for day-to-day business operations but can nevertheless create profit. Non-operating assets include the following:

Source: Copyright © 2021 Kalkine Media

What is the significance of asset classification?

Asset classification is crucial to the organisation's growth. Knowing which assets are current and fixed assets, for instance, is essential in determining a firm's net working capital. In the case of a firm in a high-risk business, knowing which assets are intangible and which are tangible aids in evaluating its risk and solvency.

Determining operating and non-operating assets is critical to understanding the contribution of revenue derived from each asset and determining what percentage of a firm’s income is coming from its core business activities.

Source: © Tforgo | Megapixl.com

What is the significance of depreciation and amortisation in the context of business assets?

By utilising amortisation and depreciation, one may anticipate the amount of income generated by assets at the end of their life cycle and spread out the current value of the assets to give the advantage to the firm over a longer period. Here's how you can leverage depreciation and amortisation to your advantage with business assets:

Depreciation

Depreciation is a term used to define how a firm's assets lose value over time. For example, when tangible non-current assets, like land or equipment, breaks or needs to be replaced, professionals use depreciation to estimate their future value.

Amortisation

Amortisation is how corporations divide the value of current intangible assets that have outlived their useful lives. This could aid enterprises that have taken out loans and assist them in evaluating the income created because of goodwill, patents or copyright privilege like staff morale or consumer satisfaction.

Please wait processing your request...

Please wait processing your request...