What is burn rate?

The rate at which a company or an organisation is consuming its venture capital to finance its operations before it starts making money is known as burn rate. The burn rate is usually measured in terms of monthly spending or cash outflows.

Summary

- The rate at which a company or an organisation is consuming its venture capital to finance its operations before it starts making money is known as burn rate.

- Burn rate is also known as a net-negative cash flow

- To keep the burn rate in control, before making any purchase, start-up founders must ensure that every dollar is contributing to the company's growth.

Frequently Asked Questions (FAQs)

What is the importance of burn rate?

The word is most commonly applied to a new business attempting to scale up operations and become profitable. Because it shows exactly how long a company has before it runs out of money, the burn rate allows expanding businesses to set realistic timeframes.

Burn rate analysis can be used to determine whether or not a company is self-sustaining. It helps to judge either the need to cut costs or increase revenue.

Accurate and timely information on burn rate helps figure out if there is a need to adjust the current cost-to-income ratio by looking for new fundraising options or decreasing expenses. It also helps to assess if there are additional funds to put back into the business and invest in boosting marketing or improving product development or expanding operations or undertake more research and development activities or increase human resources.

It's challenging to strike a balance between the urge to expand and the need to create a long-term business. The impulse to spend that Venture Capital money and run on a high burn rate is sparked as soon as the money is at hand.

Businesses face a problematic scenario if growth doesn't equal the money being spent. The runway will shrink, investors will be less interested, and companies will require a major revamping of strategies to stay afloat.

How is burn rate calculated?

The burn rate is the rate at which a company's financial reserves are depleted to support overheads. It's also known as a net-negative cash flow measure. For instance, if a company has AU$6,00,000 in cash reserves and burns AU$60,000 each month, the company will run out of cash in ten months.

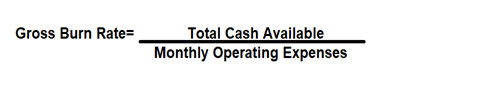

- Gross Burn Rate

The total amount of operating expenses incurred by a corporation each month is known as the gross burn rate.

The gross burn rate shows founders how much money they're spending each month. It's also a financial statistic that all venture capitalists, investors, and board members should be familiar with to evaluate in greater depth and track over time.

This computation considers the monthly financial reports, namely income statement, balance sheet and cash flow statement, which provide a fuller picture of the company's overall financial situation and, as a result, a more accurate estimate of burn.

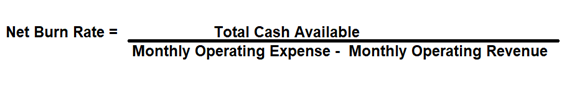

- Net Burn Rate

Net burn is calculated by measuring revenue and income against expenditure and is derived from the profit and loss statement, which gives Net Income's value and that of the Cost of Goods Sold.

How can high burn rates be controlled?

Before making any purchase, start-up founders must ensure that every dollar contributes to the company's growth. For example, a when buying new machinery, company should evaluate the productivity enhancement, it should be sure that there is demand enough to boost production using the latest equipment and that it will not remain idle.

Reduce Business Spending, ID 24248985 © Michaeldb | Megapixl.com

In a crux, the returns on investment or spending must be crystal clear before blocking money there. Start-ups should strictly follow the rule of hiring the right people at the right time. For example, it may not be wise to get on board too many customer service executives because initially, the market base will be lower and will expand only gradually. Companies can also save cost by using co-working spaces instead of spending massive amounts on infrastructure like building and furniture. It is a sustainable decision because the business can still maintain operational efficiency.

Is there an example of a start-up shutting shop because of high burn rate?

Primary Data was a California based visualisation start-up that received close to USD100m funding from Battery Ventures, Lightspeed Venture Partners, Accel, Pelion Venture Partners. The company tried selling the product to Fortune 500 companies, whom it intended to sell but were unwilling to buy the product. The company was aiming to sell mission-critical software. However, its product did not meet the standard requirements of its clients. The management realised that the company had a high burn rate with close to no revenues. To revive the sales, the company launched a new version of the product and acquired companies, but all in vain. Meanwhile, other companies competing in the market were able to gain market shares and consolidate their positions. The investors realised that the business was not sustainable and was burning cash- this led to the decision to shut down.

© Iqoncept | Megapixl.com

Similarly, Pearl Automation was a start-up launched in 2014 by former Apple engineers Bryson Gardner, Joseph Fisher, and Brian Sander. The goal of the trio was to create aftermarket automobile components. The firm received about $50 million in venture funding from Accel, Shasta Ventures, Venrock, and Wellcome Trust and continued to hire workers, many of whom were former Apple employees, until June 2016, when it released its first and only product, the RearVision backup camera. The device was excellent in features and helpful too. However, it was very pricey at US$500 for the entire set-up. In addition, there were also other close substitutes from auto manufacturers in the market. Thus over time, the company shut down.

In both cases, we see that the start-ups kept on spending amounts in anticipation of sales that never actually materialised. Sales revenues were very minimal- this resulted in a higher burn rate because of consistently high expenses clubbed with minimal incomes.

Please wait processing your request...

Please wait processing your request...