What is meant by Bull Call Spread?

A Bull Call Spread is a strategy in which one purchases one call option and sells another at a higher strike price to help pay for it. A call option is a derivative product and gives the buyer the option to buy the underlying asset at the strike price. In place of the risk taken by the seller of an option, a premium is paid by the option buyer to the option seller. In finance terminology, going long an asset means buying the asset, while going short means selling an asset.

Summary

- A Bull Call Spread is a strategy in which one purchases one call option and sells another at a higher strike price.

- Two options are traded in a bull call spread; one is a long call with a lower strike price and one short call with a higher strike price.

- A Bull Call Spread is a strategy for moderately bullish investors on the market and expects a modest increase in the underlying price.

Frequently Asked Questions (FAQs)

How can the working of Bull Call Spread be Explained?

Two options are traded in a bull call spread, one long call which has a lower strike price and the other a short call which has a higher strike price. The underlying stock and expiration date are the same for both calls. A bull call spread is set up with a net debit or net cost and gains as the price of the underlying stock increases. If the stock price rises above the short call's strike price, profit is restricted, and possible loss is limited if the stock price falls below the long call's strike price (lower strike).

When the price of the underlying stock increases above the short call's strike price at expiration, a bull call spread works best. A Bull Call Spread is a strategy for moderately bullish investors on the market and expect a modest increase in the underlying price. Buying a Call Option and selling a Call Option are two positions taken in this technique. This technique has a low risk and high reward. If the underlying's price falls before expiration, the transaction would be a loss. The overall risk of loss is limited to the amount paid in net premium.

Market Going Up ID 12107943 © Pinonsky | Megapixl.com

If the strike price of a Call is less than or equal to the price of the underlying, a maximum loss occurs. The difference between the two strike prices minus the net premium is the maximum reward. When the price of the underlying increases above the strike price of two Calls, the maximum profit is realised. The benefit is limited to the difference in strike prices less the net premium charged.

(Strike Price of Call 1 - Strike Price of Call 2) - Net Premium Paid = Maximum Profit

Can the concept of Bull Call Spread be illustrated?

Let’s understand the Bull Call Spread concept with the help of an example.

For the purpose of the illustration, let us assume a trader has a bull call spread with a long call at Rs. 180 and short call at Rs.185. The premium on the Rs.180 call is Rs. 3.3 while the premium on the Rs. 185 call is Rs.1.5. Since the trader has gone long on the first call, he pays the premium, while the latter premium is an expense since he has gone short.

Profit And Loss Signpost ID 3862627 © Pryzmat | Megapixl.com

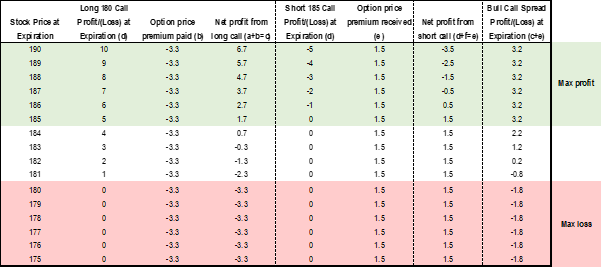

For instance, if the stock price at the time of expiration is Rs.190, the trader can utilise his long call and make a profit of Rs. 10 (Rs.190 – Rs.180). After adjusting for the premium of Rs. 3.3, the trader is left with a profit of Rs. 6.7. However, he will incur a loss of Rs. 5 (Rs. 185 – Rs. 190) on the short call as the counterparty will also execute the trade. After adjusting for income from the call premium of Rs.1.5, the trader will make an effective loss of Rs.3.5. When we add the profits (or losses) from the whole trade, the trader makes a net profit of Rs. 3.2 from the whole transaction. The table below shows the net profit from the spread for expiration prices on the underlying asset ranging from Rs. 175 to Rs.190.

Let’s now look at the other end of the spectrum. Suppose if the expiration price is Rs. 175 on the underlying asset. The trader will not execute his long call as it is profitable for him to buy the stock directly from the market at the current lower price of Rs. 175. However, he still has to pay the call premium. So his effective loss will be Rs. 3.3 from the trade. Similarly, the counterparty on the short call also will not execute the trade since he can purchase the stock from the market at the lower current price. However, the trader will still receive the premium of Rs. 1.5 from the trade, making it profitable for the trader. On the whole transaction, the trader will make a loss of Rs. 1.8 (Rs.1.5 – Rs. 3.3).

As can be seen from the scenarios below, the maximum loss from the transaction is limited to the net premium paid irrespective of how low the price goes, i.e. Rs.1.5 – Rs. 3.3 = Rs. 1.8.

Copyright © 2021 Kalkine Media

On the other hand, the maximum profit from the transaction is capped at Rs. 3.2 irrespective of how high the price goes. As learned earlier, we can compute directly from the formula earlier

(Strike Price of Call 1 - Strike Price of Call 2) - Net Premium Paid = Maximum Profit

(Rs.185-Rs.180)-(Rs.1.8) = Rs.3.2

Please wait processing your request...

Please wait processing your request...