What is the Bottom line?

The bottom line refers to the income, or net profit of a company. It is the profit or income received by a company after deducting all expenses from its revenue. The bottom line is the net profit given in a company’s income statement during an accounting period.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Understanding Bottom line

In accounting context, the term bottom line defines as the net income of a company. In income statement of a company, net profit is recorded on the bottom after deducting all the expenses from revenue. It shows the profit earned by a company during an accounting period.

To increase bottom line, management of a company try to generate more sales and revenues. It is calculated by using gross revenues; gross revenue is also called as the top line. The triple bottom line concept is introduced for enhancing the profit of a company with its environmental and social responsibility.

Bottom line reflects the efficiency of a company in controlling costs or higher sales. A company can improve its bottom line by more revenues and increasing efficiency. Bottom line refers to the line at the bottom of a company’s income statement that shows the net profit /loss during a specific period.

Frequently Asked Questions (FAQs)

What does the bottom line mean in business?

Profit is the blood of any business. The first and primary motive of any business is having “profit”. The Bottom Line may refer to the outcome of all the activities and the work of the business. It defines as the net income of a company which is recorded in the bottom of a company’s income statement.

Bottom line of any business shows how profitable result a company gives during an accounting period. The management of a company may have focus on improving the bottom line. Improving bottom line indicates that management try to reduce its cost or expenses and increase their sales of business.

For example, a company decides to keep customers with a new strategy and invest its resources into the development of products or services according to that strategy. The company calculates what it received from the investment along with other revenues and deducts all the cost and expenses incurred in the process in the end of the accounting period. These costs may also include interest on debt, taxes, depreciation, operating and administrative costs etc. After paying all the expenses from its revenue, the company has their net earnings that referred as the bottom-line numbers.

How bottom line works as an indicator for a business

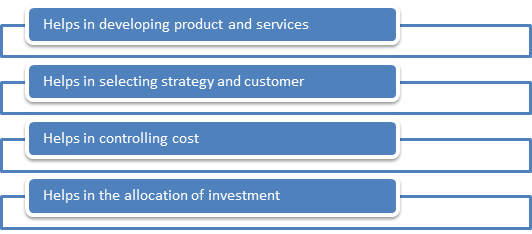

Bottom line shows the net earnings or net profit at the bottom of a company’s income statement. It is the result of an investment made with the motive of earning profit during a specific accounting period. It is an important indicator of a business that shows the overall conditions of a company in its investment in the market. It also helps management of a company as a barometer in investing, selecting strategies, cost control and marketing.

For a company, the bottom-line or figure numbers is one of the components of the scorecard. It helps a company to understand the need of the following factors to have positive and growing profitability. It helps in:

- Developing product and services

- Selecting strategy and customer

- Controlling cost

- Allocation of investment

If the bottom line numbers are low or declining stage, it indicates that one or more of the factors mentioned above should be examined by management of a company. The management of a company depends on the bottom-line numbers.

Source: Copyright © 2021 Kalkine Media Pty Ltd

What are the methods of improving Bottom line?

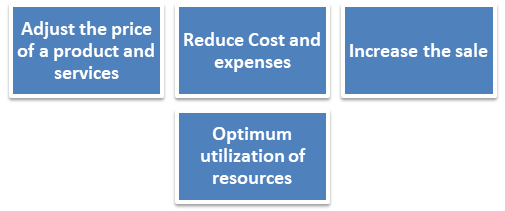

Every business focused on improving its bottom line. These are the following ways which helps a business to get a healthy bottom line.

Source: Copyright © 2021 Kalkine Media Pty Ltd

- Adjust the price of a product and services: if sales of a product or services are not good, management should determine the price again which is fair for both customer and to the business. On the same side, if your sales are good but earning are less, you should increase the price according to the market. While deciding the price always keeps your competitors in your mind.

- Reduce Cost and expenses: To improving bottom line, management of a company should reduce the unnecessary expenses and cut the cost. Sometimes unnecessary expenses and high cost may result low bottom line numbers.

- Increase the sale: An increase in sales may lead improvement in the bottom line numbers. Management of a company may lead increase in sales by reducing the sales return, increasing the production, developing the products/services, and widening the product range.

- Optimum utilisation of resources: A company should utilize its available resources may directly improve the bottom line numbers. It helps the management of a company in increasing the efficiency by reducing the cost.

How can we differentiate Bottom line and Top Line?

Both the terms Bottom line and Topline comes in the income statement of a company. Topline may define the sales of a company and bottom line defines the profit numbers recorded in the company’s income statement.

Top line defines the sales or revenue showed on the top in the company’s income statement. On the other side, Bottom line refers to the net profit showed in the bottom in the company’s income statement. In order to increase the top line, a company needs to increase its gross sales or revenues. It indicates increase in the sales of products and services during a specific accounting period.

Top line and bottom-line numbers may move in opposite direction. It is not necessarily higher sales leads high bottom line, it is possible that the top line increases yet the bottom line decreases because in bottom line attention should be on expenses and cost.

Please wait processing your request...

Please wait processing your request...