What is board of directors?

The board of directors is the governing body of a company and is an important aspect of its operation. It is a set of people chosen to represent shareholders. Every public firm, non-profit organisation, and private business are mandated by law to appoint a board of directors. By driving the broad direction of the business, ensuring that critical decisions are prudent and ethical, appointing leaders and creating policies, boards of directors could assist a firm succeed or fail.

The term "director" refers to anyone who serves on the board of directors. The board oversees safeguarding shareholders' interests, monitoring the organisation or corporation, setting administrative regulations, and making decisions on critical issues that a firm confronts.

Furthermore, the separation of management and ownership are key themes in corporate governance. The shareholders own the corporation, but the management influences the functioning. The board of directors is also required to try to bring the interests of shareholders and managers together. They must also constantly serve in the best interests of the firm.

A board of directors is necessary for all publicly traded corporations. On the other hand, a board of directors is also present in several private firms.

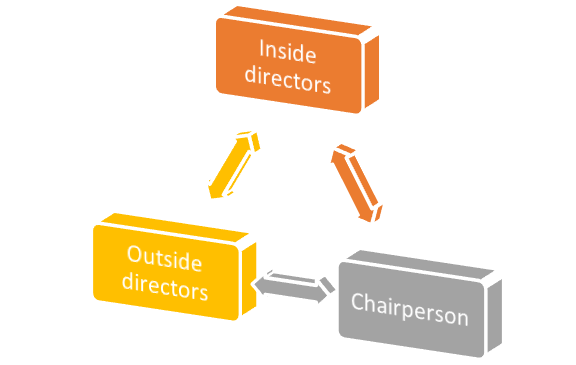

Boards of directors frequently meet many times each year. In addition, board members should be compensated for their contributions. The following are frequently found on a board.

Source: Copyright © 2021 Kalkine Media

Members of the board and company executives, such as the chief executive officer, are called "inside directors". This is because they play a dual role in the organisation, serving as managers and members of the governance body.

Outside directors, however, are not corporate executives. Instead, they are the individuals picked for their competence and knowledge in their respective fields. Furthermore, outside directors have a single function; they are not managers and are thus seen as the board's more objective members. Thus, for example, an outside director or an inside director can serve as chairperson.

Summary

- The board of directors is the governing body of a company and is an important aspect of its operation.

- Every public firm, non-profit organisation, and private business are mandated by law to appoint a board of directors.

- The board oversees safeguarding shareholders' interests, monitoring the organisation or corporation and setting administrative regulations.

Frequently Asked Questions (FAQs)

What is the function of the board of directors in a firm?

Source: © Drudoran | Megapixl.com

They are primarily responsible for acting as a fiduciary on behalf of the corporation's shareholders. A fiduciary is obliged by law and ethics to work in their best interests. They make decisions on issues like:

- Overseeing mergers and acquisitions.

- The company's internal crisis response.

- Implementing stock option policies.

- Establish organisational objectives.

- Assisting executives and their teams.

- Recruiting and firing senior executives.

- Offering the necessary resources.

- Creating a dividend policy and making payments.

- Setting executive compensation.

- Making sure that the firm has well-managed and sufficient resources.

Source: © Miskolin | Megapixl.com

Who are the members of the board?

Chairman: The chairman, often known as a "president" or "chairperson," is the board of directors' acting head. Every board member is deemed a peer, even though the chairman defines the board's direction. The CEO is sometimes the chairman of numerous different boards.

Vice-chairman: The vice-chairman, sometimes termed the "vice president," fills in for the president or chairman when unavailable. They may also be known as "chairman-elect" if the member is anticipated to be the next president or chairman.

Secretary: They take the charge of creating and keeping business records and other essential business documents.

Executive director: They are the inside director who enjoys an executive position within the firm.

Treasurer: The treasurer is liable for the firm's economic health but not for day-to-day operations. They are typically in charge of the audits, annual budget, investments and financial policy.

Celebrity director: They bring famous characteristics like influence, credibility, image, and goodwill to garner the public's attention.

Shadow director: Even though they oversee or directs the firm, they are not identified as a board member.

What different types of boards are there?

An effective board should be tailored to the needs of the firm. Therefore, a few distinct types of boards are listed below.

Collective: A collective board, sometimes known as a "cooperative board," is a group of people who come together to make decisions.

This kind of board is generally seen in medium or small-sized non-profit organisations, where members work on and equally vote on all aspects of the business. Then, they work together to achieve a shared objective and make choices as a group.

Advisory: Its purpose is to offer knowledge, insight, and viewpoint to the organisation's decision-makers, and it's also known as a "council". Members generally cooperate with other boards, like a working or managing board, on other aspects of the company's operations.

Governing: This leads to a corporation operating as the sole entity that acts in the best interests of the shareholders. They give advice and recommendations to the firm's owner, who does not have a seat on the board of directors. They function at a distance from the company, concentrating on the firm's future and the broader issues.

Classified: A classified board of directors, sometimes known as a "staggered board of directors," comprises various types of directors. All directors are elected simultaneously in a normal board of directors, but a staggered board is seen as a defence tactic against a hostile acquisition.

Managing/Executive: The members work together to oversee the firm's long-term and day-to-day operations. They frequently take the position of a CEO, and members work in subcommittees to deal with various elements of the business.

Fundraising: Its primary goal is to promote the organisation by leveraging its members' resources, influence, and connections.

Working: This sort of board has members who are also workers, and it is more common in smaller companies or startups with hardly any resources.

Please wait processing your request...

Please wait processing your request...