What is backward integration?

Backward integration is a form of vertical integration which involves companies acquiring or creating processes enabling the company to produce its own inputs. These processes are those which the company had previously assigned to other companies up the supply chain.

Complete vertical integration is achieved when a company is involved in all the stages of the production process. This can be achieved by the firm either by mergers and acquisitions with the companies in the supply chain, or by starting its own subsidiary to perform the tasks which had formerly been assigned to these companies.

Copyright © 2021 Kalkine Media Pty Ltd

Backward integration is a form of vertical integration used to make the business more competitive.

What are some examples of vertical integration?

Vertical integration can be better understood with an example.

- Consider an oil refining company like Marathon Petroleum Corporation that depends on another firm for providing it with crude oil. Marathon refinery purchases raw oil from other oil exploration companies and is only engaged in refining the oil and selling it. However, if Marathon were to acquire or merge with these oil exploration companies then it would be called a backward integration for Marathon.

- Consider a restaurant engaged in the production of wheat and potato-based products. The firm usually acquires these products through long-term contracts with farmers or wholesale grocery suppliers. If the firm now decided to start its own plantation growing wheat and potatoes, then it would be a backward integration. Here the firm has chosen to create its own production process without having to merge with or acquire any other company. This gives the firm endless possibilities to change how these inputs are processed. For instance, the firm can choose to opt for organic farming, which it could then advertise to its customers.

How is backward integration different from forward integration?

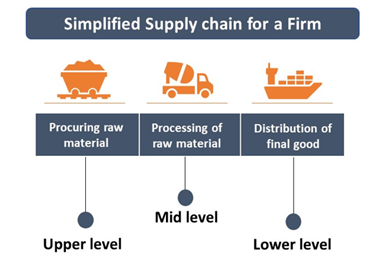

A company’s supply chain refers to the different stages involved in achieving the final good. The processes lying upwards in the chain are the initial stages while the processes lying further down are the final stages including the sale of the product or service.

Backward integration involves integrating those production processes into the company’s operation that lie on the upper side of the supply chain. Whereas forward integration involves the integration of those processes into the firm’s operation that lie on the lower end of the supply chain.

Forward integration involves companies acquiring or merging with those firms that are engaged in the distribution or in the retailing process of the product.

For example, consider a cheese processing company that sells its product to a retailer for resale. If the company decides to set up its own retail chain, or its own digital platform to sell its cheese then it would be forward integration.

What are the advantages of backward integration?

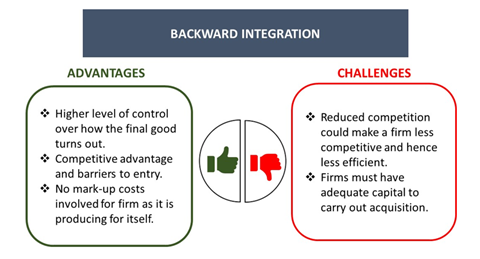

- Higher control: Integrating upper-level supply chain processes into a firm’s operation gives it higher level of control over how the final good turns out. This also allows companies to conduct their supply chain management more efficiently. Thus, there can be higher level of differentiation in the final goods as compared to other competitors. Additionally, the company would have a fixed supply of input when the subsidiary is engaged in raw material production.

- Competitive Advantage and Barriers to Entry: Acquiring a company through backward integration can allow access to exclusivity of the supplier. Other companies may no longer approach the supplier once the firm acquires or merges with it. This adds a competitive advantage to the firm and creates barriers to entry for other companies.

- Cost Cutting: When a raw material producer supplies it to companies lying lower on the supply chain, it would charge a mark-up over the actual cost of production to gain profits. However, if a firm were to become its own input supplier, then there would be no mark-up costs involved for it as it is producing for itself.

What are the challenges with backward integration?

Copyright © 2021 Kalkine Media Pty Ltd

- Lack of competitiveness: Removing competition by acquiring the supplier could sometimes have more adverse effects than benefits. Reduced competition could make a firm less competitive and hence less efficient. This could reduce the innovation in the firm and cause it to produce poorer quality products.

- Financial requirement: To acquire with a full-fledged supplier, firms must have adequate capital. Thus, backward integration can be a huge investment for firms. Many companies may consider debt financing which could end up hurting their balance sheet.

Please wait processing your request...

Please wait processing your request...