A baby bond is a small denomination bond that has a face value of less than US$1,000. These bonds are intended to attract ordinary investors who may not have excessive amounts to invest in traditional bonds. Business houses issue baby bonds as corporate bonds. These bonds are sold mainly by municipalities, counties, and states to fund expensive infrastructure projects and capital expenditures.

Examples of corporate issuers of these debt securities are telecom companies, utility companies, investment banks, and business development companies (BDCs) involved in funding small- and medium-sized businesses. Usually, these bonds are issued to attract small or retail investors.

Baby bonds can also be defined as a government policy, wherein every child receives at birth a publicly funded trust account, primarily with more generous funding for lower-income families.

Summary

- The usual maturity range for baby bonds is between 8 to 15 years. However, 50-year bonds are accessible on the market. Baby bonds have a face value below than US$1,000, but it usually varies in values between US$25 and US$500.

- Baby bonds are also frequently floated by state and local governments, such as municipalities and counties.

- Baby bonds are always unsecured and offer a high yield compared to normal bonds because of the callable feature favorable to the issuer.

- A significant amount of baby bonds is furnished as zero-coupon bonds. These bonds do not pay any intermediate interest/coupon payments but just pay the par value (generally US$25) at maturity.

Frequently Asked Questions (FAQs)

Why are baby bonds called unsecured bonds?

Baby bonds are classified as unsecured bonds because neither the issuer nor the borrower pledges any collateral to guarantee interest payments and principal repayments in the event of default.

What is the relationship between change in interest rates and the price of baby bonds?

One important thing to remember is that when the interest rates rise, the price of the baby bond falls. This means that the lower the price of the baby bond, the higher the yield. This simply means that any change in the market interest rate will affect the value of the bond.

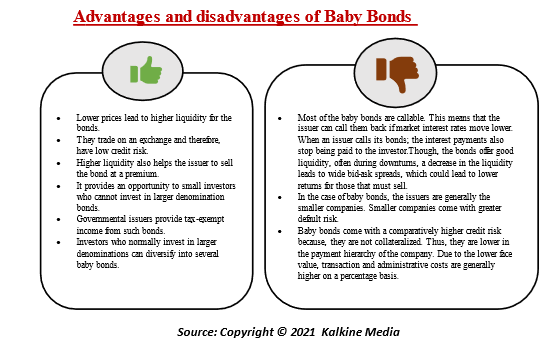

What are the advantages and disadvantages of Baby Bonds?

What is the recent development concerning “baby bonds” in the US?

Congressional Democrats reintroduced a bill in February 2021 to establish US$1,000 ‘baby bonds’ for every American when they are born. The bill was about setting up savings accounts that people cannot touch before they are 18. This was one of several proposals introduced to address growing income inequality and expand the federal government’s child benefits. Under the said bill, anyone born after 31 December 2021 will have “American Opportunity Account” run by the govt with US$1,000 set up for them.

History of Baby bonds

The first Baby Bonds commenced in the US in the year 1935. Years later, a one-time US$5,000 baby bond plan was introduced by former US presidential candidate Hillary Clinton during the 2008 Democratic Party presidential primary elections. However, this plan was later removed from her platform.

Can Baby Bonds End Wealth Inequality?

Researchers studying the baby bonds suggest that the policy would result in wealth distribution to “a more egalitarian position, at least relative to human history.”

Image Source: © calypsoArt | Megapixl.com

Columbia University researchers believe that a baby bond program would not entirely upend the unequal distribution of wealth in America. The top 10% would still own much more than the bottom 90%. It is believed that by raising the lower and median net worth's of Americans, the baby bond initiative could marginally consolidate more wealth in the middle.

A 2019 study out of Columbia University held that a proposal like this would be so effective at closing the racial wealth gap that it would nearly end it among young adults. Besides, a McKinsey report revealed that closing the racial wealth gap in America could grow the country’s economy for everyone by 4 to 6% of the GDP.

What are the types of Baby Bonds one must avoid?

Shipping companies are usually known for being inefficient, over-leveraged, and not very profitable. Several companies in the industry function with losses and are forced to fund activities through debt offerings. Credit Suisse Global Investment Returns Yearbook has rated it as one of the worst-performing stock market sectors of the last 100 years.

How to buy baby bonds?

In the US, baby bonds are also referred to as Saving Bonds.

At present, the two types of saving bonds offered by the US Department of the Treasury are: Series EE bonds and Series I bonds. Series EE bonds are characterized by a fixed interest rate paid during the life of the bond and are guaranteed to at least double in value in two decades. Series I bond earn interest based on the rate of inflation. The Treasury regulates the I bond earnings rate twice a year.

After 2012, savings bonds have been sold only in e-Forms. This means that these bonds can be purchased through an account set up on the TreasuryDirect.gov website. A Treasury Direct account must be linked to a bank checking or savings account, and that account is generally considered the source for money used to buy any savings bonds an investor wants to purchase. Linking savings bond purchases to a bank account avoids the need to pay cash, write a check, or use a credit card to buy bonds.

Please wait processing your request...

Please wait processing your request...