Define Australian Real Estate Investment Trusts (or AREITs) & its fundamentals

AREITs (Australian real estate investment trusts) give an individual opportunity to invest in property assets of Australia. An individual can invest in assets that would have been otherwise out of reach like large-scale commercial properties, which is a major advantage of AREITs. The Australian property market is expensive and competitive but through AREITs the investors are able to get a slice of the property pie without making huge down payment. Therefore, the investors looking to diversify their portfolio into property may invest through A-REITs and may receive a regular and consistent income stream in the form of distributions or dividends.

Read: How Should An Investor Diversify A Portfolio?

A-REITs can build wealth of an individual in two ways. First, the investor will get the exposure to the real estate assets that the trust owns and will also receive capital growth and the rental income, a source of passive income.

The fund managers of AREITs make the selection of the investment properties and will oversee all its administration, improvements required, maintenance of the properties and rental.

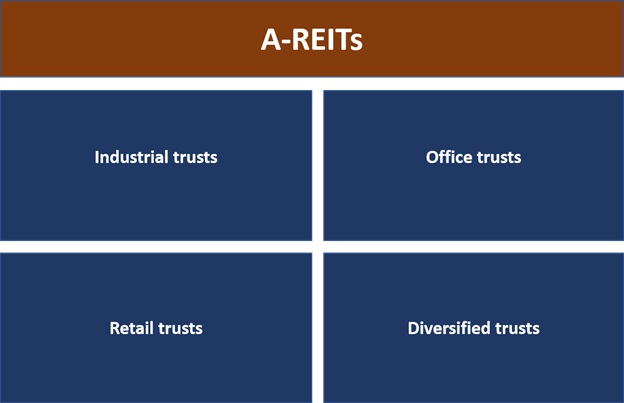

Each A-REITs have their own set of characteristics & features. The fund manager selects the properties that are diversified across regions, how much are the lease tenure and tenant types. Some A-REITs specialise in specific sectors, like an Industrial trusts makes their investments in warehouses, factories, and industrial parks, Office trusts undertake investments in medium- to large- scale office buildings in and around major cities, hotel and leisure trusts invest in hotels, cinemas and theme parks, Retail trusts invest in shopping centres and similar assets, and diversified trusts generally invests in a combinations of industrial, offices, hotels and retail property. AREITs may have assets in commercial buildings, apartments, resorts, facilities and even mortgages or loans.

A News from an Office REIT: Centuria Office REIT Secures Additional Seven-Year Debt Facility

AREITs gets their income mainly from rent, where rents are quoted on a dollar per square metre basis. There’s difference between rents from residents & commercial leases. Residential rents are well regulated but in case of commercial leases there are differing types of rentals or leases. AREITs purchase buildings as going concerns and where there are already tenants, while some AREITs also develop the properties.

Read: Centuria Metropolitan to Acquire Office Assets; Announces Dividend

Further, AREITs in their portfolio can hold either domestic or international property assets. Outside of Australia, the main countries in which AREITs hold assets and the investors can have the exposure are the United States, New Zealand, and the United Kingdom.

Net tangible assets (NTA) reflects the underlying properties in an AREITs and is considered as an important measure of the true value of an AREITs.

How many REITs are there in Australia?

As there are 38 REITs listed on the ASX All Ordinaries Index in which the investors can invest. They have a total market cap of over $100 billion.

Meanwhile, AREITs are generally gets listed on the Australian Securities Exchange (ASX) in the form of listed investment company (LIC). These listed AREITs on the ASX have to abide with the rules & regulations set out by the ASX.

Whether real estate investment trusts are good investment? What are the benefits?

It’s been analyzed that AREITs have posted good returns on the back of high, steady dividend income and long-term capital appreciation. The investors looking for diversifying their portfolio consider this as they have relatively low correlation when compared to other risky assets.

Read: Inevitable Gains: ASX 200 Property listing stocks and Bounce in Property Space

Therefore, AREITs help in reducing overall portfolio risk and enhancing the returns. Further, investing in AREITs is considered to be safe and proven form of creating wealth. An individual can achieve a good return on investment with approximately 30% of all Australian residents rent their residents, therefore the continuous demand for rental will remain across the country.

Let’s list out the benefits or advantages of investing in AREITs.

1) Stability of getting decent returns: The AREITs have posted the good growth. The country has posted more than 16 consecutive years of positive economic growth, which means the averaging 3.7 percent pa. This also reflects that the Australian economy is quite resilient, able to combat situations even there are wars, disasters, recessions, bush fires and other such crises. This makes Australian real estate investment a safe one. In addition, great number of individuals employed is in Australia, which makes it easier to rent. There are lots of other advantages for owning rental properties in Australia as an individual may have access to tenants that pay their rent on time, which, in turn, helps the individual’s wallet.

Writeup on property stocks: 6 Property Space Stocks to Look At - LLC, DHG, REA, BKW, JHX, BLD

2) Easy Availability of Financing: In Australia, an individual can obtain financing easily, as the banks or financial institutions readily lend money for residential properties than any other forms of investment class. These banks or financial institutions may lend up at as high as 95 percent of the requirements. Further, overall interest rates are also low.

Good Read: Breaking Down Monetary Policy Instrument- Interest Rate

On the other hand, the general financing pattern for AREITs is to finance real estate acquisitions through unsecured credit and then refinance the debt with common or preferred stock offerings or senior notes and subordinated debentures because they lack the ability to retain much cash (95% of income must be distributed to shareholders).

Read: Centuria Industrial REIT Announces Equity Raising

3) Favorable Australian Tax System to Real Estate Investors: The Australian tax laws are friendly to an individual who wants to invest in real estate. Like, the law permits an individual to write off investment expenses against taxes, which will lower the tax bill and offsets shortfall between the rental income and holding costs, either in part or in full. This makes the act of investing in real estate more attractive for Australians who are not necessarily affluent.

Tax reforms: Additional Tax Reforms Would Revive Growth – Economists

4) Superannuation Funds: In Australia, the investors have the option of investing into superannuation funds (which are retirement funds), called super funds for short. Although this money has been around for a long time, and the recent changes in Australian borrowing laws has made this option more feasible for property owners. Meanwhile, there is a capital gains tax on a sale of property. However, if an individual at or above age of 60 years, the tax is zero. According to the new rules, the investors are also allowed to renovate properties that are held in the fund.

More on Super funds: Confused About Superannuation or Super Funds? This Guide Will Help You

5) Government Incentives: Other advantage of investing in AREITs is that the government offers rewards for such investment by giving grants. For example, the First Home Owners Grant. However, the grant monies are different among the states, but it can be in range anywhere from $7,000 in Tasmania to 15,000 in New South Wales and other places as well.

Good Read: Is it a Big Smile for Home Builders with $25,000 Grants: Unboxing the Government’s Offering

6)Liquidity: The AREITs are traded on the stock market, an investor can buy or sell them during trading hours. This makes AREITs a highly liquid asset, primarily when compared to traditional real estate investing. AREITs make a diversified investment option as they offer exposure to different parts of the property market. Further, the investor gets access to lots of Australia’s highest quality properties across the retail, office, industrial and residential sectors and more etc. held through property stocks listed on the ASX.

More on property stocks: Top Australian Property Stocks Listed On ASX

Meanwhile, some AREITs adopt hybrid structures called ‘stapled securities’ funds. These stapled securities AREITs offer an individual to have an exposure to a funds management or a property development company, as well as a real estate portfolio. A share in a stapled securities fund comprises of one trust unit and one share in the funds management company. These securities are ‘stapled’ and therefore cannot be traded in a separate way. The AREITs holds the portfolio of assets, while the related company carries out the fund’s management functions or manages any development requirements. On the other hand, the investment in stapled securities may have tax implications for an individual.

Please wait processing your request...

Please wait processing your request...