What is Anti-Dumping Duty?

An anti-dumping duty is an import restriction tool that can be imposed on a good to stop its import from a particular country or in a particular product category. This duty can be levied on a country for a specific good when the country is suspected of exporting that good at a cheaper rate than what it is sold for in its local market.

A dumping claim is followed by an anti-dumping investigation. Dumping may negatively impact the domestic producers because they are bound to compete with the lower prices of the imported good. In the wake of growing protectionist sentiments amongst countries, Anti-Dumping duties stand as a powerful tool.

Apart from Anti-Dumping duties, countervailing duties and a few other remedies like safeguards can also be used when a dumping claim is made.

Why is there a need to implement Anti-Dumping duties?

Anti-dumping duties are implemented with the intent of protecting the domestic markets. When a foreign country dumps a good into a domestic country at a cheaper rate, there are high chances of people preferring the imported good rather than domestic produce. This can be harmful in two ways:

- Trade Balance: Increased imports could disrupt the trade balance and can cause a deficit in the Balance of Payments. A BOP deficit can cause the economy to suffer in many ways, including raising the debt With exports remaining at the same level, increased imports are not desirable.

- Competitiveness of domestic producers: Local industries are affected if a cheaper foreign product of similar quality is available in the market. Domestic producers would not be able to sustain if they were to offer such low prices as offered by these foreign producers. Therefore, they are not able to compete with these foreign goods. The government would want to protect domestic producers by imposing an anti-dumping duty on the concerned good.

How are anti-dumping duties levied?

An anti-dumping investigation reveals which areas are affected and which countries are dumping the goods. These goods are then taxed which often pushes their prices to more than double.

The duties levied can be imposed in ad-valorem form (as a percentage of the price of the good), as a specific duty (implemented per unit of quantity) or as a combination of both.

Apart from anti-dumping duties, countervailing measures can also be adopted. These are aimed at offsetting the subsidies given to the foreign producers by their government.

Another measure is the implementation of safeguard measures. These measures are used to protect a specific industry from a sudden influx of imports. These are industry-centric provisions that are permissible by the WTO.

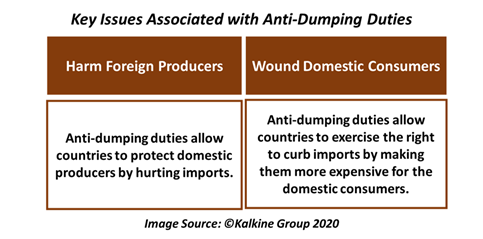

What are the issues associated with Anti-Dumping Duties?

Though anti-dumping duties have a protectionist intent behind them, the World Trade organisation tries to limit the usage of these duties. This is so because there are rising concerns about global trade disputes and their consequences. Some countries might try to take unfair advantage of the benefits offered by anti-dumping duties.

It is quite plausible that a country might try to protect the domestic producers by hurting imports rather than by other reasonable methods. Anti-dumping duties allow countries to exercise the right to curb imports by making them more expensive for domestic consumers.

WTO has always advocated for fair trade policies. Thus, any policy that provides benefits to a country’s domestic producers at the cost of foreign producers’ exports, needs be implemented carefully and with proper regulation.

Apart from hurting foreign producers, anti-dumping duties may also hurt domestic consumers. If the domestic produce is not homogenous or of similar quality as the foreign produce, then the domestic consumer would have no choice but to go for the more expensive foreign good. This would not solve the problem and would be more harmful than beneficial.

Anti-dumping duties move the international trade markets further away from the WTO’s principle of free-market creation.

What are the alternatives to Anti-Dumping duties?

It is safe to say that Anti-dumping Agreements cause variations in the stream of exports and imports between a domestic country and the accused trading partner. However, these variations are subject to change based on the bilateral relationships between the two countries, the level of efficiency of exporting country as well as the accessibility of other countries to the importing market.

However, anti-dumping duties may not drive down competitiveness levels of foreign countries that have an efficient production base. These countries might find another market and start exporting there.

On the domestic front, an anti-dumping duty may not always be enough to offer price competitiveness to home producers. An Anti-Dumping Agreement coupled with a constant push in the efficiency of the domestic produce in terms of technology, cheap labour as well as welcoming FDIs and strong investments in the affected the sector can be a better way to fully utilise the imposed duty.

Please wait processing your request...

Please wait processing your request...