What is meant by Amortizing Loan?

Amortized Loan means a debt where the entire repayment is split into instalments over the loan term. These instalments having interest and principal component suffice debt as the whole by the loan maturity date. The Amortization term is the entire loan term- time to pay off the debt. It is usually in months or years. The period of amortization, therefore, varies in length. Shorter amortization periods often mean lesser interest paid, and longer amortization term has a reverse effect.

Summary

- Amortizing the Loan thus means breaking the loan balance into a schedule of repayments utilizing determining factors like the loan amount, loan period and interest rate.

- The Method of instalment computations helps borrower assess future outflows and conclude the amount of financing they can get for any asset purchase or investment.

- Longer loan term result in smaller monthly instalments, and substantial interest costs are split over the loan tern.

Frequently Asked Questions (FAQs)

How are Amortizing loans different?

An Amortized loan has principal payments split across the loan term. It means that in each monthly instalment, the borrower is repaying interest and principal component. During the initial months, a higher percentage of the monthly instalment is towards interest. With time each next disbursement has a greater principal component. This is because upcoming monthly instalments are based on the remaining loan balance. Some common examples of amortizing loans are Automobile finances, Student loans, Personal credits, Fixed-rate mortgage loans, etc.

On the other hand, in an Unamortized loan debtor only makes interest payments during the loan term. The Principal reimbursement takes places in one go at the close of the loan duration. As a result, monthly payments are lower; however, in the future, paying a lump sum amount may difficult to pay for the debtor. In such cases, it becomes essential for the borrower to plan and save for the future outflow. Few common examples of unamortized loans include; Credit cards, Home equity line credit, and Loans that permit negative amortization meaning monthly payments set lower than interest accrual on Loan.

How does an Amortizing Loan work?

In an amortizing type of debt, the amount is split into regular monthly payments. Each month's outflow has a part going toward principal and another toward interest. Amortizing the Loan thus means breaking the loan balance into a schedule of repayments utilizing determining factors like the loan amount, loan period and interest rate.

In Amortizing loan payments, generally in the first few months, interest costs are peaked. It is because the interest component part of each payment is a result of multiplying the current loan balance with interest fee percentage. This way the greater the remaining loan balance, higher is the interest component. With time each ensuing disbursement has a greater principal component. Over time, as the remaining balance decreases, repayment also decreases, more towards the interest.

A debtor can observe the repayment progress of his or her Loan's balance using an amortization table or schedule. Such a schedule is a helpful visual depiction of exactly how each month's payment is split towards loan reduction's interest and a principal component. Source:

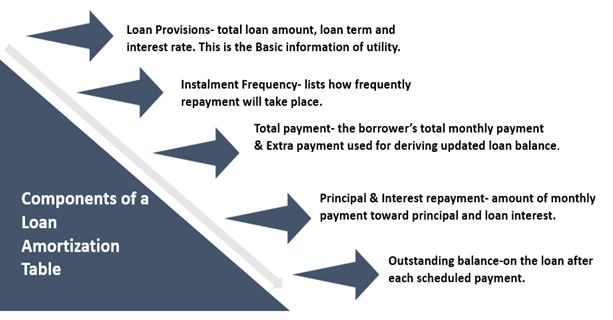

What factors are included in a Loan Amortization Table?

An amortization table lists all the factors used to determine loan amortization. The table estimates what proportion of every monthly disbursement can be attributed to the principal and interest, over the loan term. A borrower can easily construct an amortization schedule. There are also loan amortization templates available that automatically do the calculations. Amortization tables typically include:

Copyright © 2021 Kalkine Media

Creating a loan amortization schedule utilizing the above-listed data helps borrowers compute the total Interest amount they can save by making additional payments if allowed. It also helps them assess the loan payments in future to conclude the amount of financing they can get for any asset purchase or investment.

Borrowers can even know the approximate amount of interest to be paid during a financial year. Often amortizing loans like student loans have a tax-deductible interest. This will definitely help them input tax deductions on the same for advance tax computations.

What is the Formula used to Amortize Loans?

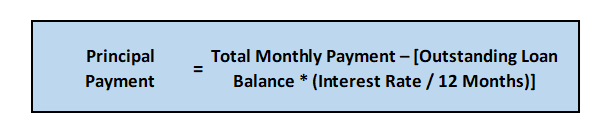

The regular principal outstanding on an amortized debt is computed as:

Copyright © 2021 Kalkine Media

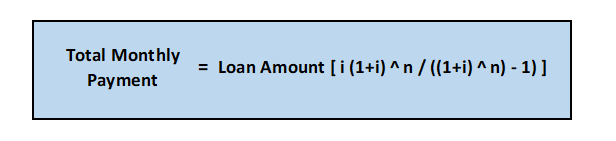

In the above Formula, the total scheduled outflow is pre-specified. Nevertheless, if one wants to compute or equate monthly outflows centered on given aspects, they will have to compute the monthly expense too. The Formula for total monthly payment is:

Copyright © 2021 Kalkine Media

In this,

i = monthly interest – annual rate divided by 12, n = frequency of payments over the loan term, one must multiply the number of years in loan term by 12.

Example

Suppose an amortization table computed for a USD 200,000 student loan with a 10% interest rate amortized over 20 years. These details will be entered into an amortization schedule. The borrower shall thus be liable to pay USD1,930.04 per month. The monthly interest payment would initially be USD19,851.05 in the first month and go down as the Loan's outstanding balance reduces. If the debtor doesn't make any extra payments and pays as per schedule, he/she will pay a total of USD263,210.39 as interest over 240 instalments during the entire term.

What are the Benefits of Amortizing Loans?

Amortizing loans to any borrower -

- Allow to purchase or invest in assets for which there was a lack of funds

- Loan payments do not vary, giving predictability for future monthly expenses.

- The benefits overshadow associated charges in the long run.

- Offers increased earning potential with tax benefits.

- Longer amortization periods result in smaller monthly installments

- Higher interest charges are split over the Loan term.

- Making lump-sum payments decreases the principal, subsequent lowering monthly interest charges.

Please wait processing your request...

Please wait processing your request...