What do you mean by aging accounts receivable?

Aging accounts receivable (arranged in a tabular form through an aged receivables report) refers to a periodic report classifying a firm's accounts receivable depending on the duration of the period an invoice has been outstanding. Accounts receiving aging is used as a measurement to determine the financial well-being of the customers of a company. For example, suppose the accounts receivable aging indicates that a company's receivables are collected much later than usual. In that case, this is a cautious sign that business may be slowing down or that the company is resorting to greater credit risk in its sales practices. In addition, accounts receivable aging helps identify the allowance for doubtful accounts.

Summary

- Aging accounts receivable refers to a periodic report classifying a firm's accounts receivable depending on the duration of the period an invoice has been outstanding.

- Aging accounts receivable helps identify the allowance for doubtful accounts.

- Accounts receiving aging is used as a measurement to determine the financial well-being of the customers of a company.

Frequently Asked Questions

How do aging accounts receivable work?

As a management tool, accounts receivable aging can specify that customers are at the risk of default, posing higher credit risks, and can also indicate if the company should continue its business with habitual late payer customers. Accounts receivable aging comprises columns that are often divided into 30-day date groups and reflect total receivables due now and receivables due in the past.

Accounts receivable aging helps calculate the allowance for doubtful accounts. The accounts receivable aging report aids in determining the total amount to be written off when the amount of bad debts is examined for reporting on a company's financial statement.

The most crucial accommodating feature is the aggregation of receivables depending on the length of time the invoice has been outstanding.

A business applies a fixed percentage of default for every date range. Therefore, invoices that have been past due for a more extended period are allocated higher because of the greater default risk and reducing collectability. Besides, the summation of the products from each outstanding date range presents an estimation of the number of uncollectible receivables.

Image Source: © Kevynbj | Megapixl.com

How do companies prepare accounts receivable aging report? Give examples?

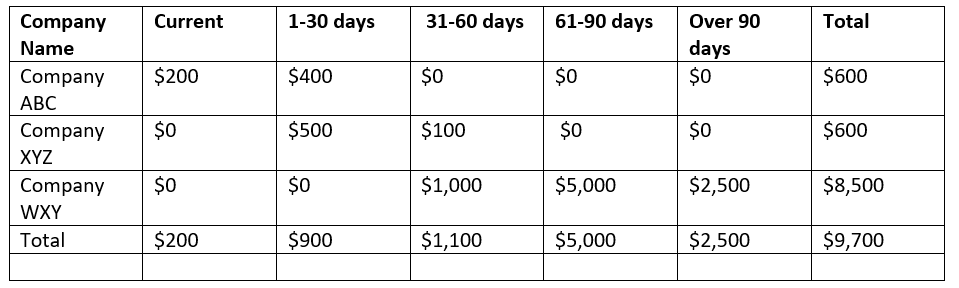

The aged receivables table, which represents accounts receivable aging, provides information on specific receivables based on the amount of time they have been outstanding.

In the table, the column headers include a 30-day interval of time, while the rows indicate the receivables of each customer. The below-mentioned table is an example of an accounts receivable aging report.

The revelations from accounts receivable aging reports can be improved in a variety of ways. First, accounts receivable are the origins of credit extension. For example, suppose a company cannot collect accounts, as depicted, and proved by the accounts receivable aging report. In that case, it can extend business to specific customers on a cash-only basis. Thus, the aging report helps a business in laying out credit.

Businesses can use the information provided by the aging accounts receivable report to create collection letters and send them to customers whose payments are due or delayed for an extended period. In addition, customers can receive the accounts receivable aging report in addition to the month-end statement, giving them a complete picture of outstanding products.

Another example

On April 5, 2020, an XYZ company supplied goods worth $260,000 to another ABC company on a 30-day credit period. As per the term, must pay the payment by May 4, 2020. Let us assume that the purchasing company ABC fails to make the payment when the accounts receivable aging report was created on May 31, 2020. Due to this, this sum is outstanding within 30 days of the due. Therefore, it will be displayed in the column with a window of 0 to 30 days. Now suppose that the seller, which is the XYZ company, does not receive the payment until June 2020. And subsequently, on June 30 of that year, another aging report for accounts receivables was created. At this point, the amount is overdue for over 30 days but less than 60 days from the due date. As a result, it will be displayed in the 31 to 60 days bracket of the aged receivables report.

What are the benefits and shortcomings of aging accounts receivable?

Image Source: © Raywoo | Megapixl.com

Benefits

- Accounts receivable aging helps businesses manage cash flow in advance.

- The accounts receivable aging report can be used to determine the allowance for bad debts.

- The accounts receivable aging report helps top management to decide if they should continue business with a specific customer or not, depending on the outstanding amount.

- With the help of the AR aging report, companies can initiate legal recovery actions against customers for amounts overdue for over two years (i.e., more than 730 days). Though, some businesses also prefer to initiate legal actions after 365 days.

- Companies can charge interest for amounts outstanding for over 60 or 90 days. Besides, aging report simplifies interest calculations.

Limitations

- At times, aging report can give misleading information that the customer's financial health is not good. Disputes between parties can also be the reason for the outstanding amount.

- The accounts receivable report does not give reasons for the delay. As such, the collection officer has to contact individual customers to identify the reasons for the delay.

- The report does not mention the interest to be recovered for excessive delays.

- The report does not provide provisions to be made for doubtful debts.

Please wait processing your request...

Please wait processing your request...